Thanks @hanera! I know you aren’t as bullish on Malaysia, but if you happen to see a similar article I would love to see it.

If someone can gain access and provide, I am sure this would be an interesting article…

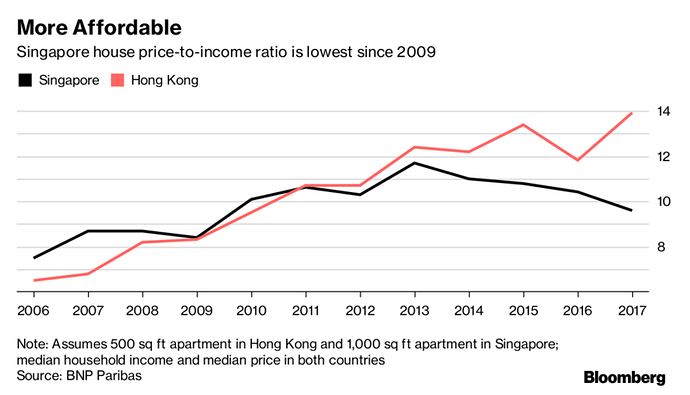

Singapore also ranks better on affordability. The house price-to-income ratio has declined to 10 times from 12 times in the past decade, while in Hong Kong it has climbed to 15 times from about 11 times, Lee said.

Price2income = 10 is considered affordable, so prices in SV has more room to appreciate ![]()

“All asset prices in the world in the next 10 years are going to be priced according to Chinese liquidity,” Lee said. “Especially in markets where the stocks of such assets are small, that’s going to squeeze the asset price very substantially.”

If he is right, prices in SV would appreciate a lot more since there is no good land (undesirable neighborhoods should appreciate faster because plenty of scope to build) to build anymore!

Bay Area has a lot more land than Singapore, if not, tear down the malls and build high rise condos. Is it a good time to buy a condo in Singapore now?

Bay Area has nimbyism but in Singapore, government controls all aspects of housing and all the banks. At present, Singapore government wants stable prices… so no crazy appreciation like here.

Rentals are very soft in Singapore. You would get even lower yield/ cashflow / cap rate than SV. Long term appreciation is not that great. Investors buy new condos (plan only, not fully constructed) and sell them before TOP (where you must pay in full)… usually hold for a couple of months to a year before selling… very profitable game when property is in a bull trend… profits in multiples of initial deposit ![]()

Intersting. I would be interested in buying an unbuilt home, wait for a year or 6 month for it to be built, then sell it immediately after built. This scheme can be low effort and high return model in a housing bull market which we are no doubt in. Which city and state is the best spot to play this?

Is Seattle or Portland a good place to do this?

Just don’t do this in the UK. More often than not these homes never get built and buyers lose their deposits.

What Hanera described would be a market that I wouldn’t be too aggressive about participating in. It’s frothy and indicates a top is on the way.

Im looking at singapore too, lots of condos that are TOP around 2014 in the centre are now selling for lower than what people paid in 2010/2011 when the market was absolutely bullish but rental yield is a meagre 3% (and this is not taking into account maintenance, prop tax etc) However, the govt is restricting foreigners so the demand for such housing has come down.

With rents softening, I still think investing in districts with good schools and close access to MRT (BART equivalent) is good long term, singaporean parents are known to kiasu or extreme tiger parents and will do anything to get their kids in No 1 schools.

Also, It helps that american citizens do not have to pay the additional 15% stamp duty that is imposed on foreigners as a temporary measure to curb property speculation.

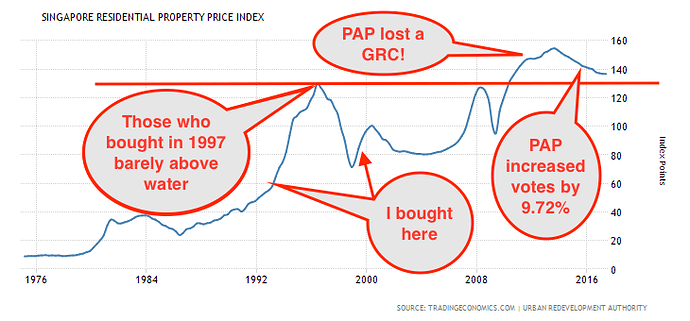

Rent and price have been declining for the last three years. PAP won’t risk property prices to shoot up uncontrollably ![]() My guess is hold prices at this level for 1-2 years to allow rent to stabilize.

My guess is hold prices at this level for 1-2 years to allow rent to stabilize.

Doesn’t seem to be a wealth creating play. Bay Area real estate looks much better. Why bother?

Some of us actually have family over there…

If you have to buy a house, might be a good time because plenty of choices and can buy at your own sweet time. Once it starts to rally, unless you’re as nimble as wuqijun, would be hard to get one because your bid is likely to be too low.

I really want Malaysia to pop as a country but it just ain’t happening…

Sometimes it makes more sense to rent. Looking at that chart, with Lee’s pretty visible hand, I’d think thrice before wading in.

I thought most people live in government housing in SG? Who buy properties there?

Have you investigate Iskandar? The hottest in Malaysia now.