Is 720 the score for a conforming loan? That means home ownership will only ever be about 60% without “subprime”.

Current home ownership rate is 63.6%?

Aren’t mortgages with Credit scores lower than 600 subprime?

I’m not sure the official definition of subprime. I thought 720 is the minimum to get the conforming Fannie/Freddie prime rates. Anything below that and your rates start increasing.

1 Like

I guess the keyword is conforming, which I missed earlier.

According to Tracie, my mortgage contact, she actually said 720 score is B grade. 749 gets preferred.

1 Like

- Past payment history (about 35% of score) The fewer the late payments the better. Recent late payments will have a much greater impact than a very old Bankruptcy with perfect credit since.

Myth - paying off cards with recent late payments will fix things. Payoffs do not affect payment history. - Credit use (about 30% of score) Low balances across several cards is better than the same balance concentrated on a few cards used closer to maximums. Too many cards can bring down the score, but closing accounts can often do more harm than good if the entire profile is not considered. BE CAREFUL WHEN CLOSING ACCOUNTS!

- Length of credit history (15% of score) The longer accounts have been open the better for the score. Opening new accounts and closing seasoned accounts can bring down a score a great deal.

- Types of credit used (10% of score) Finance company accounts score lower than bank or department store accounts.

- Inquiries (10% of score) Multiple inquiries can be a risk if several cards are applied for or other accounts are close to maxed out. Multiple mortgage or car inquiries within a 14 day period are counted as one inquiry.

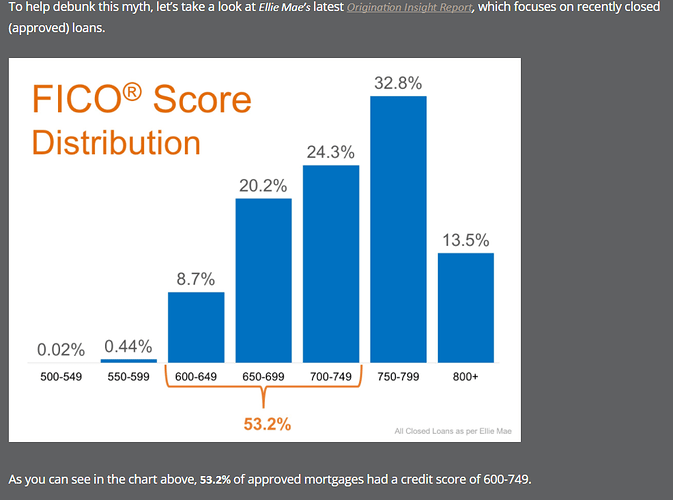

This were the FICO Score Distribution. I hope this will be helpful.

2 Likes