The stock market just surged past a record milestone thanks to the GOP tax bill

Here’s a rundown of how prospects of tax reform are shaping investor decisions for specific sectors:

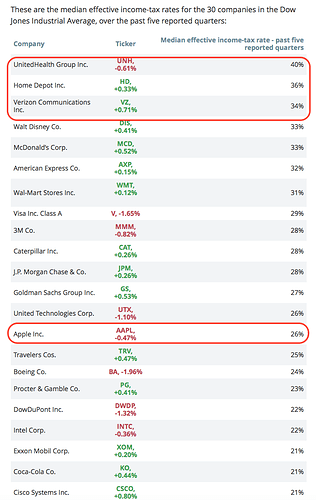

Tech — While the selling in this space on Wednesday may have come as a surprise to some, it makes sense when you consider that the sector has the third-lowest tax rate out of any industry, according to data compiled by S&P Global. That means companies in the group have less to gain from a corporate tax cut, and investors are recognizing that by pulling money and allocating it elsewhere.

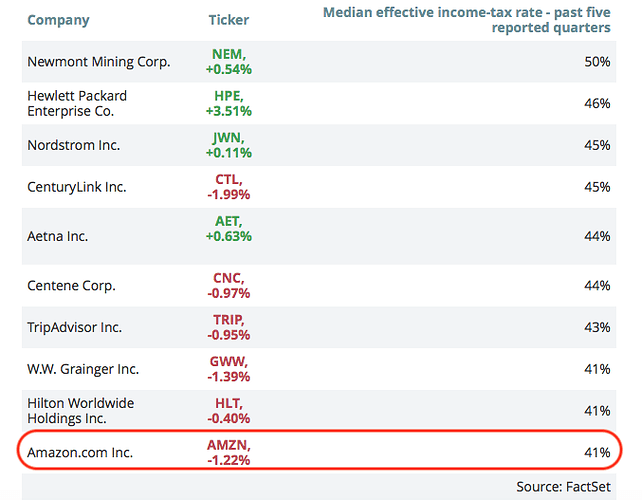

Highly-taxed companies — A Goldman Sachs index of high-tax companies surged 0.9% on Thursday as traders bet that they’ll be helped most by the GOP’s proposed corporate tax cut. Further, on Wednesday, the group’s 1.4% return outperformed a similarly constructed index of lower-taxed corporations by the most since 2008, according to Bloomberg data.

Small-caps — The Russell 2000 index of small-cap stocks rose as much as 0.6% on Wednesday as investors buy exposure in more domestic-focused companies expected to benefit most from the GOP tax plan.

Banks — As stated above, banks had an outstanding day, boosted by optimism that the GOP plan will improve US growth and allow firms to pay lower taxes. They rose another 0.9% on Thursday.

Trump’s tax plan is here — here’s how Wall Street says to trade it