Realities of hyper competitive business environment.

Let me think for a minute………I sign a document that states that I am liable for whatever it conveys. Later on, such document is telling me that the guidelines, instead of moving money to my bank account it goes to the bank account of my attorney.

I think I am an idiot for signing such document.

And this idiot president didn’t even know what he signed because he is marveling how is possible that there are tax incentives to move businesses overseas in the tax cuts, which were taken advantage by GM. ![]()

![]()

![]()

The 2017 tax cut has received pretty bad press, and rightly so. Its proponents made big promises about soaring investment and wages, and also assured everyone that it would pay for itself; none of that has happened.

Yet coverage actually hasn’t been negative enough. The story you mostly read runs something like this: The tax cut has caused corporations to bring some money home, but they’ve used it for stock buybacks rather than to raise wages, and the boost to growth has been modest. That doesn’t sound great, but it’s still better than the reality: No money has, in fact, been brought home, and the tax cut has probably reduced national income. Indeed, at least 90 percent of Americans will end up poorer thanks to that cut.

Let me explain each point in turn.

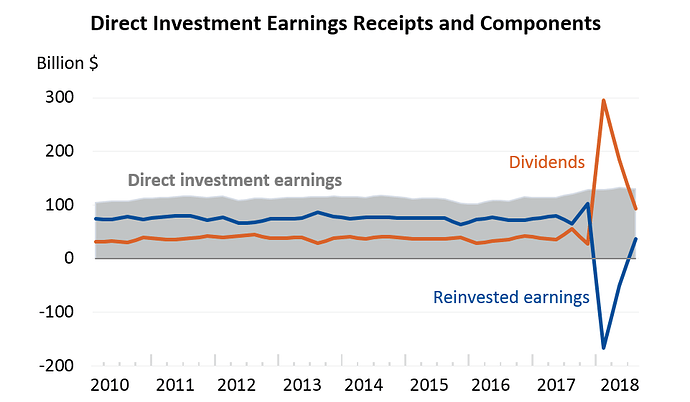

First, when people say that U.S. corporations have “brought money home” they’re referring to dividends overseas subsidiaries have paid to their parent corporations. These did indeed surge briefly in 2018, as the tax law made it advantageous to transfer some assets from the books of those subsidiaries to the home companies; these transactions also showed up as a reduction in the measured stake of the parents in the subsidiaries, i.e., as negative direct investment (Figure 1).

But these transactions are simply rearrangements of companies’ books for tax purposes; they don’t necessarily correspond to anything real. Suppose that Multinational Megacorp USA decides to have its subsidiary, Multinational Mega Ireland, transfer some assets to the home company. This will produce the kind of simultaneous and opposite movement in dividends and direct investment you see in Figure 1. But the company’s overall balance sheet – which always included the assets of MM Ireland – hasn’t changed at all. No real resources have been transferred; MM USA has neither gained nor lost the ability to invest here.

I do not think lot of people, like you, understand the impact of corporate tax cuts, still you enjoy the benefits of it without giving credit to those who worked for it.

It took 10-15 years for AAPL to hoard the cash in Ireland, but tax cut helped them to bring that money in a year.

What we have seen dividends and buybacks are short term effect, almost half trillion repatriated already last year and much more to come in future years. 10%-12% tax paid on those half trillions.

Tax cut will stop hoarding outside appx 250 Billions every year as big businesses like AAPL, AMZN, GOOGLE start holding the cash in USA instead of hoarding at Europe.

If someone appreciates value of health care changes obama made, corporate tax cut is a major change like that.

This has long term healthy impact for USA. Unfortunately, It is people’ shortsighted attitude, that I can not explain further.

Revenues rose 4% in 2018.

Enough said.

If you feel so knowledgeable about this topic, read before saying anything. You are lost here, your expertise is not even 1% of what the author of this piece is. I guarantee you that you would learn by being humble and learn from the experts on the matter. Not me, I am just the messenger and that’s where lies your undeserved response.

This is not about benefiting “me”, there’s something called “we the people”, and unfortunately, corporations are called people too.

Check the name of the author. Then, if doubting, send him an email. He will teach you what is going on.

Paul Krugman

-has been an Opinion columnist since 2000 and is also a Distinguished Professor at the City University of New York Graduate Center. He won the 2008 Nobel Memorial Prize in Economic Sciences for his work on international trade and economic geography. @PaulKrugman

Paul Krugman is a total hack. No credibility whatsoever. He destroyed what little he had with his “Sympathy for the Luddites” piece where he tried to rescue Obama for the stupidity of his “auto-teller” remark.

Stay on topic.

Debate his numbers, go ahead. No spinning to well, he is or he isn’t.

So the tax cut induced some accounting maneuvers, but did nothing to promote capital flows to America.

The tax cut did, however, have one important international effect: We’re now paying more money to foreigners.

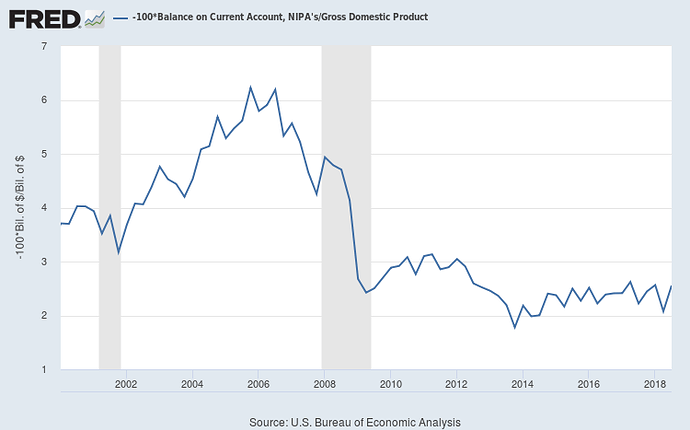

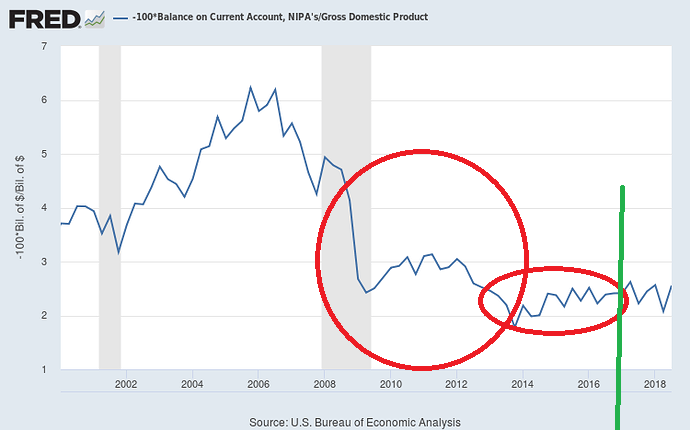

Bear in mind that the one clear, overwhelming result of the tax cut is a big break for corporations: Federal tax receipts on corporate income have plunged (Figure 3). <--------

There they come, the trumpeters in a bunch.

The ignorance of the original article is astounding. How do you take money in Ireland and invest it in the US? You have to move it to the US first. Then they can build a US factory, buy back shares, increase the dividend, and hire US employees. Companies wouldn’t move the money to the US, since they’d get hit with another tax bill for US taxes. Now they get to bring that money to the US, so it gets invested here. Yes, the total money is the same but location, location, location.

The other irony is the left is always saying the US should be more like Europe. Now the US tax code is like Europe’s. European countries don’t tax foreign earnings. Yet they can can’t stop crying about it.

See the Chart Red Circled (obama period), taxes are increased, but tax revenue is decreased.

Adding tax, whether it helped getting tax?

Still companies and individuals need to file taxes and effect of Tax cut 2017 is not completely realized. mostly quarterly estimated filing are there.

Can you, with your wonderful knowledge tell me when the Obama’s economy ended? You know, the fiscal year and so forth? Perhaps then you can move that green mark to the right? ![]()

Share buyback boom remains in overdrive after tax revamp - MarketWatch

“The buyback boom early this year confirms our view that the main use of corporate America’s tax savings will be takeovers and stock buybacks rather than capital investment or hiring,” the company said in a note.

Ahhh…I hadn’t seen this topic. ![]()

![]()

![]()

Now that we get into “explain me this”, the trumpeters are gone. Their only recourse is to “liberals here”, “left there”…![]()

![]()

![]()

Ahhh…they disappeared?

Very strange, 3 people at the same time answered me, then, all the sudden, the 3 are gone!

And the 3 guys always cheer up this administration, it never does anything wrong. Hmmm…

Manch! You better check these 3 guys! Me thinks they are one guy always mobbing me…

Yes, and even Greenspan recently said increasing taxes slows economic activity. We’ve know that since JFK. JFK said he was cutting taxes to stimulate the economy. Some people care about growing the economy, so people have the opportunity to be successful. Other people care about making as many people as possible dependent on the government. The latter has always ended in starvation and revolution.

Go at it.

You guys are so smart, go ahead, dissect it.

I am still waiting on Jil with fixing that graphic

I am still waiting on Jil with fixing that graphic

Waste of time !

Exactly. Those who are shareholders are happy about buybacks and dividend increases. Plus, there was a long list of companies using it to give bonuses, raises, and train employees.

Stay on topic.

Debate his numbers, go ahead. No spinning to well, he is or he isn’t.So the tax cut induced some accounting maneuvers, but did nothing to promote capital flows to America.

The tax cut did, however, have one important international effect: We’re now paying more money to foreigners.

Bear in mind that the one clear, overwhelming result of the tax cut is a big break for corporations: Federal tax receipts on corporate income have plunged (Figure 3). <--------

I could crush this clown in a debate in 10 minutes. His numbers are cherry-picked nonsense to make fallacious arguments. Total revenues are what matters. Those corporate profits get paid out as dividends which are taxed when the individuals holding the shares get them.

Ahhh….I love this!

I got my 3 chupacabras mobbing me!

I wonder why they don’t make an opinion on the illegal maids working for Twhitler? ![]()

![]()

![]()

I could crush this clown in a debate in 10 minutes. His numbers are cherry-picked nonsense to make fallacious arguments. Total revenues are what matters. Those corporate profits get paid out as dividends which are taxed when the individuals holding the shares get them.

There, I think the email address for Krugman is somewhere.

Just ask him “sir, how come we are going into more debt, $1 trillion a year when the liar republicans told me we would be paying our debt ASAP because sooooooooo many tax receipts being produced (which the graphic shows they sunk)?”. ![]()

![]()

![]()

Poor Jil, he couldn’t do what I asked him to do, tell me about when Twhitler’s fiscal year started.

I am on my way to meet 3 clients at the office. Lots of 401Ks being rolled over annuities. See ya! ![]()