His supporters too. ![]()

![]()

![]()

While I still wish we’d to go a system where income below the poverty line is exempt, and tax all income above that at a flat rate (no deductions). Then tax corporations at 2% of revenue. This isn’t bad. The compromise avoids the most objectionable stuff. Hopefully, we start seeing massive amounts of offshore cash coming back to the US.

Standard deduction of $24k for married filing jointly.

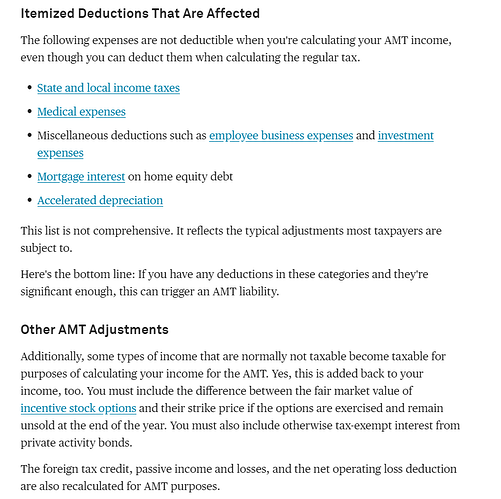

Max deduction for SALT = $10k.

Max mortgage interest deduction = $15k-18k for $750k loan (some recent primary home buyers in SFBA could fall under this category).

Very few of us would incur high medical expenses exceeding 10% of AGI and investment expenses (except wuqijun).

Government at work, for you, only for you.

Don’t forget the amnesiac AG Sessions, who doesn’t remember anything about meeting Russians. “I don’t recall, I don’t remember, I don’t, I can’t”

The turd lied under oath. And he is the AG?

What a shitty country these republicans are turning the US into.

It lists San Jose and San Francisco right in the middle but lists them with a .06 tax rate. The tax for buying is more than double that. So for buyers it is much worse. For owners it depends how long you have owned.

God, will Rubio be one of my heroes who will help vote down the Tax Bill (wait for Jones!!!)???

Funny how Trump’s home town Queens Long Island gets hit the most…

Trump was treated badly in Manhattan. Maybe he wanted a revenge?

He is just white trash from Queens always with a chip on his shoulder

What’s the comparison between pass-through and corporation taxes? With the final version giving 20% pass through income tax free, does it still make sense to incorporate?

I did not see anything about the tax rate for pass through, is it going to be individual rate? If that’s the case, only benefit is that 20% of your pass through income tax free

I think pass through is 23% is tax free and 20 or 21% rate on the rest.

If this is true, pass through is better than corporations. This is a huge tax cut for landlords, isn’t it? Small landlord and realtors can operate as a pass through entity, this is huge for us. Why are realtors against the tax reform? They should congratulate on themselves for this tax cut.

This will encourage more people to be self employed and become a pass through entity instead of a W2 earner. The only drawback is how to find a good health insurance.

Did I miss anything?

Yes, emotional reaction to misinformation…

![]()

![]()

![]()

Do you have to be an LLC or SCorp to qualify for pass through?

Shields and Brooks on GOP tax bill’s economic impact, Doug Jones’ Alabama win