Still want to invest in TSLA?

CEO of Tesla, Inc., celebrated entrepreneurial genius Elon Musk, is a liar, huckster, and moron, who regularly says things so ignorant that I cannot understand how they can come from a human adult, let alone one treated by his fans as a super-genius.

You should always invest in psychopaths like Steve Jobs and Elon Musk. Most successful business people are a-holes. Nice guys like me always finish last.

I am a psychopath yet still not a billionaire, why?

Maybe you directed your psycho energy inwards harming your family instead of outward?

You are too coward. Always making tiny moves that make no difference. Sell all your real estate and stocks. Convert everything into TSLA. Double down by using 100% margin. Go big or go home.

So am I a psychopath or a coward?

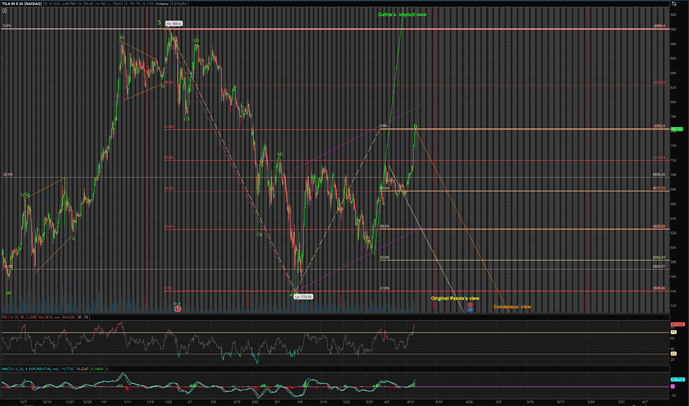

So much bullish news still can’t get above $720. Not a good sign.

Broke above $720, now $730… following the parabolic run of the broad market. $762 is beckoning, and then…

Very good advice for yourself ![]() and @Jil. What is your longest holding period? Mine is since 1997, 24+ years of holding AAPLs. One of the criteria for holding so long is don’t sell even if you suspect share price might tumble 90%… conviction! @wuqijun has conviction. @Zeapelido a little less since he sold 45% (or is it more).

and @Jil. What is your longest holding period? Mine is since 1997, 24+ years of holding AAPLs. One of the criteria for holding so long is don’t sell even if you suspect share price might tumble 90%… conviction! @wuqijun has conviction. @Zeapelido a little less since he sold 45% (or is it more).

1997-2021?

![]()

yeah 45%. I don’t regret it because I wasn’t comfortable with 90% of total net worth being in one stock. And mentally our future retirement is essentially “set” with the money.

And I’m still invested in TSLA with that money via ARK funds but much more diluted.

The other 55% I plan on holding.

Well my real plan is to continue to long-dated covered calls at a variety of OTM strike prices when volatility is high and stock has had a good run up.

If calls end up OTM, I have reduced dependency on TSLA by generating hundreds of thousands in cash. If calls end up ITM, I will sell at prices that I think are fair for the time and I will be comfortable with.

This plan should end up most likely case at least ending up with enough cash / equity to fully cover nice SoCal beach house.

I’m fine with that outcome even if somehow I miss out on further gainz.

You own the future but willing to sell it for a beach house?

You give me an impression that you are working in TSLA. Otherwise, RSUs of your current employment should suffice to buy that beach house.

I mentioned a dozen times, you talk as if you hear it now. You need to improve your memory ![]()

Will select variety of strikes, so will only sell in proportion to how crazy the stock price goes in short term.

Not doing at current levels btw. I’m thinking next one will be around $1200, with a bunch OTM above $2000 probably. Yeah if the price goes above $2000 within a year from when it hits $1200, sure I’ll sell.

That’s like 4m!

And it’s not going straight into a house. Just mortgage and put it into QQQ.

And of course TQQQ on the dips

Interesting to see what people are not comfortable with is precisely what they should have done. The 1% is the 1% for a reason.

You think from tomorrow it’s going to decline?

I mean true to a point. I had high pressure from wife to sell some, even if I didn’t want to.

She still wants to sell more but not going to win that argument.

Also while previously I saw high chance for TSLA to 10x (and it actually did), right now I believe 10x further is much less likely. I model out 3-4x possible in next 5 years. If I thought it would 10x again, I would keep more.

Also, can make top 1% with such mistakes. Top 0.1%, maybe not!