Joseph is a value investor. He is into dividend stocks now.

Wait 2 hrs to be charged ![]()

Except during weekend, pretty empty in Austin.

Below is not for rich millennial techies. Will non-tech guys buy a TSLA car?

I wouldn’t wait 2 minutes to get my car charged. Sorry but environmentalists that are forcing EV down our throats are idiots and will destroy our country. EVs aren’t ready. We are aren’t ready. And the Democrats that force this crap will be hated for all time. There are alternatives. Plug-in Hybrids, Hydrogen. . Forced EV legislation can’t create good science or innovation.

I’m a huge fan of EVs but agree that plug in hybrids are a better way to make the transition. The battery pack from one model S or model X (100 kW) has enough capacity to build 5–6 plug in hybrids that if properly used will do 70% of their mileage on electricity. Given the supply constraints on battery production and raw materials (lithium), focusing on PHEVs would allow more consumers to make the switch sooner.

WFH ![]() Hybrid

Hybrid ![]() Office

Office ![]()

EV ![]() Hybrid

Hybrid ![]() ICE

ICE ![]()

Absolutely, let’s have the legacy OEMs make hybrids to aid this transition. Have them spend billions to make hybrid models that won’t last the decade. When the transition is complete and hybrids are no longer needed, all these OEMs go bankrupt and Tesla the pure EV maker reaps the final benefit of the transition. What a wonderful outcome! Thanks for the suggestion. ![]()

I think hybrid is AWFUL. One of the advantages of EV is lower maintenance costs. Hybrid is really the worst of both. You have higher initial costs and still have ICE maintenance costs. Have a smaller ICE doesn’t really impact maintenance costs.

Hydrogen fuel cell is the real future. Battery EV is the bridge technology.

2% of US cars are EV. To accommodate 50 times that we will need an additional 1.25Ttrillion kwh electrical power production. 10s of thousands of charging stations, dozens of new car manufacturering plants. Probably $15trillion total or more. Where is that money coming from. And how is that new power generation coming along? Pie in the sky liberal government bullshit. No planning just wishing that EV will save us from those evil oil companies. Total hype from Musk fans. Total nonsense from government

And total haterd from the left for the American way of life. So the greenies want us all to live in cramped apartments in miserable cities and walk to work. Not my image of Utopia.

Don’t make sense for sedans / suvs because operating costs of Fuel cell will always be higher, and battery energy density will already be sufficient for 400 mile range soon.

For larger vehicles / planes / boats, hydrogen could make more sense

Hydrogen makes no sense under any circumstance. Continue improvement in EV technology will make hydrogen tech way more costly and infeasible.

People who praise hydrogen here are only being spiteful because they missed the EV boat to wealth. (But it’s not too late if they can change their mind and start investing into Tsla).

The key to wealth is RE. Stocks are for gambling. Not a good bet these days. Imagine if you had sold at $1200. Put the money in munis. Live tax free. Forever. And sleep well at night

ICE maintenance costs vary dramatically. It’s about the design of the engine and quality of materials rather than the size. The beauty of a PHEV is that you’re relying on electric motors for most of the propulsion so even a large vehicle can make great power with a cheap and reliable 4 cylinder. It’s the high performance turbo and supercharged engines with plastic cooling systems (BMW…) that really get you.

I sleep well at night. But I can imaging someone like you who wouldn’t be able to sleep well at night if you had your money in Tesla. It’s because of your misguided foresight, lack of courage, or both. It’s ok. Keep your money in RE and sleep well ![]()

When AAPL was very hot, many genius investors who made tons of money formed all kinds of subscription services, etfs and hedge funds. Many of those are gone. History rhymes. This time TSLA ![]() This guy forms etfs for disruptive businesses, I think is more successful than Cathie.

This guy forms etfs for disruptive businesses, I think is more successful than Cathie.

Btw, if PLTR becomes huge, similar geniuses would be talking about how they get very rich investing in PLTR. Amit is a strong believer in PLTR.

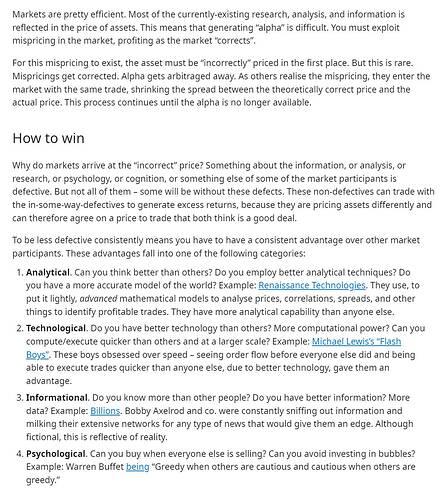

I believed such for many years since 1995 until 2017, almost lost 22 years of growth. However, last 5 years gave me extremely good exposure to stocks, gambling, investment…etc to know what is right and what is wrong.

It is a BIG mistake believing such concept. => Stocks are for gambling !

Truth is stocks are bound to be gambling short term but long term - esp 5+ years of holding, preferably 10, 20, 30 years - is great investment.

Since stocks are volatile by nature, split second we can buy/sell, lot of traders, speculators making it look like gambling. All those gambling are very short term, gamblers wants to run away with money within short duration.

That is not all investment like the way we do in real estate, which naturally takes longer time to trade.

Here you see: You know very well about real estate. Any home comes in your expert areas, you can easily spot whether it is good buy or bad, invest money and be successful.

If we train ourself like the way in real estate, still stocks are good in the long run. Think long term like real estate holding, investors will reap the benefit for life.

For example:

You feel this is negative => 2% of US cars are EV. To accommodate 50 times that we will need an additional 1.25Ttrillion kwh electrical power production.

I see this as positive: If the statement is correct, TSLA being an EV leader (with 2% of EV cars_ has potential to grab lions share ( at 50 times bigger) in next 20 years.

How stocks can grow rich is proved by WQJ’s (he posted openly) investment display. He told me that I was wrong selling TSLA shares and he is right. Market are short term gambling (say TSLA fluctuations between 200 and 275), but market realized the TSLA potential spiked it from $50 to over 700B(holding 3 years such market cap) is an acknowledgement for TSLA’s success position.

BTW: I do not have any position with TSLA, neither I am interested, nor I suggest anyone to buy/sell TSLA. I just want to provide an explanation how stocks are behaving.

Stock behave as irrationally as the people buying them. Winners and losers. Great for bragging rights for few winners. But most investors profits revert to the norm. Should probably stick with index funds . Buying and selling is hard work betting on other peoples dreams. With RE I control my own destiny. Not tied to a maniac like Musk. Look at the wild ride Steve Jobs had. End up loosing it all … dying young. I assume Musk will have a similar fate. Hopefully he picks a worthy successor.

Even index funds fluctuate. If someone has long term look, say beyond five years horizon, index funds always grows.

Simply invest in index funds, DCA every time we have money. Sell only when FED increases rate and buy when FED stops rate hike. This is very simplest idea to grow our money.

I don’t plan on selling my stocks. But I discount their value. Seen too many long downturns. 1929-1952… 1967-1982. 2001-2013…

Maybe my wife will enjoy the gains after I am gone. But we could have another10 year bear market.

“Wealth” based on the value of stock held is an illusion. It’s not real until it’s sold and the cash is collected. Less taxes of course

There is a certain person on this forum that measures his wealth on a daily basis.

TSLA thread becomes a debate about investing in stocks vs RE?