I am laser focused on Bezos’ divorce nowadays. Who would have thought Bezos is just another salty wet man with bad taste on women?

Sell your Amzn!!!

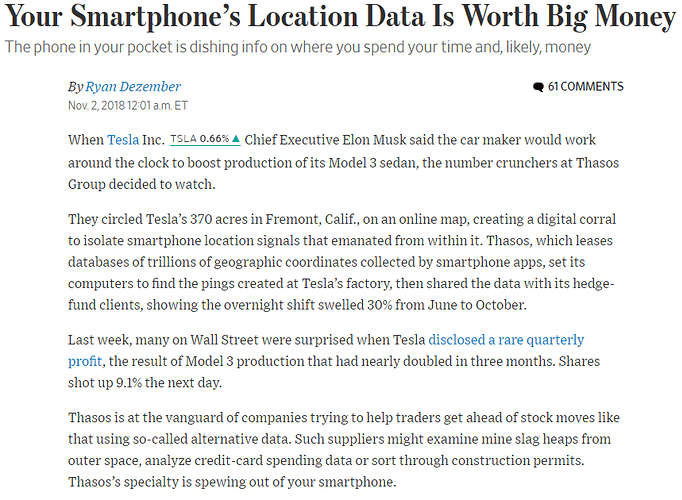

I guess that’s more high tech than when fund mangers would go count cars in a store’s parking lot. It’s the same principle though. This way is actually scaleable though.

They are professional data sharing group started from MIT technology, mainly used by wallstreet. They track sears, target, wmt, tesla etc

Waste of money and tech to track Sears… It has been dead for years.

Sry, can’t help myself!

Now tell us how you feel about JC Penney.

WallStreet bets are involved with multi-millions or billions of money and they need reliable data for such bets. They belong to makers/breakers of the market.

Some orders were canceled by the government. This is from an employee working at Tesla. I had no idea what he was saying but it seems order from somewhere were canceled.

Their solar panels are good I heard.

Tesla Inc. is offering cybersecurity researchers the chance to walk away with an electric Model 3 sedan if they can hack into the car and find vulnerabilities.

Trend Micro Inc.’s spring competition, Pwn2Own Vancouver, invites security researchers to expose flaws in web browsers and corporate software. For the first time this year, the competition has added an automotive category, featuring Tesla’s latest car.

Tesla, which can ship updates to customers via over-the-air software upgrades, launched a “bug bounty” program in 2014 to reward researchers who uncover and report flaws. These are common the technology industry, but rare in the auto business. That’s beginning to change as more vehicles are connected to the internet, leaving them vulnerable to hacking.

“We develop our cars with the highest standards of safety in every respect, and our work with the security research community is invaluable to us,” David Lau, vice president of vehicle software at Tesla, said Monday in a statement.

Source: Subscribe to read | Financial Times

Elon Musk’s Tesla can’t seem to shake its association with marijuana.

In the middle of the market volatility in December, it appeared that Tesla may have snuck another cheeky weed joke into the financial small print of a new debt fundraising.

The electric car company sold a debt security which carried a minimum investment size set at a curious $420,000.

For some investors, it seemed like an echo of when Mr Musk tweeted in August that he had “funding secured” to take Tesla private at $420 per share, an outlandish claim to which many investors’ first reaction was that he must be making a drug reference. The number 420 is a slang term for smoking marijuana.

The furore caused by that tweet led the Securities and Exchange Commission to fine Mr Musk for misleading investors, but not before he was seen smoking pot in an interview for a podcast — something that triggered a new round of criticism.

The December fundraising was via the issue of $840m of auto-lease asset backed securities, bonds backed by payments from Tesla customers who lease rather than buy their vehicles. The eyebrow-raising minimum investment size of $420,000 was for the riskiest tranche of bonds, totalling $40m in all.

According to a Tesla spokesperson, there is an innocent explanation.

First, setting minimum investment sizes, especially for smaller-size tranches, is not unusual, as securitisation analysts will attest.

Second, the $420,000 value was established by the company’s outside counsel on the deal and not by Tesla.

The law firm, Katten Muchin Rosenman, said the figure was derived from tax rules that discourage the lowest-rated securities being issued to a large numbers of investors. If the debt were to be held by more than 100 investors, the securitisation vehicle would be taxed like a corporation. Issuers typically set minimums by dividing the tranche size by 100, or a smaller number to be conservative.

Katten divided the $40m tranche size by 94 and said that it simply rounded up from $416,000 to $420,000.

The ABS deal was the second of its kind completed by Tesla. In the comparable tranche from the previous deal issued in February 2018, the minimum investment size for the lowest tranche was set at $350,000 — rounded up from the $336,000 given by Katten’s formula.

Mr Musk continued to use Twitter to tweak the SEC and other critics last year, keeping questions about his judgment alive and keeping Tesla’s controversies in the public eye.

In that context, it was odd that no one thought a slightly different minimum investment size might avoid raising eyebrows, said one analyst. “It is a weird number to have chosen.”

A good metaphor.

Sounds fishy AF. Lays off 7% of workforce so they can make more cars. OK.

Don’t ever let manch suspects about you, is disastrous…

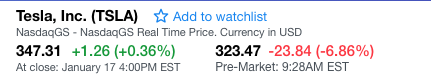

It is even low $316 now, I bought few shares morning !

![]() heed manch, recall he managed to wish AAPL down to $142 from $232.66. I would heed him.

heed manch, recall he managed to wish AAPL down to $142 from $232.66. I would heed him.

The bottom line is Tesla is trying to control the expenses/finances that helps long term.

Contrarian ! I buy when good stock fall steep - catch the knife during bullish peiod ! I bought one 2020 option Jan 17th $320 strike price option now ! ![]()

It is some free money market fear gives me soon.