Pretty good list.

- Not buying a home

- Investing in low yield things

- Marrying someone at a significantly lower income level and having kids, without making an adjustment in lifestyle

Edit: number 3 CAN be done right. For example, I knew a lady who probably made 400K total comp. Her husband made a LOT less, he had a job working with his hands and probably made <50K. They bought a home in Fruitvale. Though they hadn’t had kids yet, it sets them up well to live within their income level. The more common scenario I see is the expectation that they should be able to buy somewhere like Noe.

Two biggest sources of arguments between couples:

- Money

- Kids

Add one more: Not investing or staying away investing is also a mistake.

So the two people that sold their stocks and went to cash said:

- Investing in low-yield things

- Not investing

What does cash in a savings account earn these days?

It is an old one, not current and also cut & Paste from web.

- Not taking care of their body

- Not taking care of their mind

- Not taking care of their soul

Really good ones. How many have you taken care of?

None…

The low income guy should retire and do everything that the high income doesn’t want to do.

High income spouse = Focus on making money. CEO of the household.

Low income spouse = Resigned. Do everything else that CEO doesn’t want/ no time to do. COO & everyone else.

One of them is wise enough not to sell her investment in AMZN, right?

And the other bought house ![]() right?

right?

Thought we are all taking care of the mind and soul by being here? Debating keeps our mind sharp. Having online buddies keep our soul alive.

Yes but it’s too late. We are talking about when we were “young”…

Night is young

Does that include being a sex toy to the high income one?

No need to spell out all the tasks that the other spouse needs to do.

The critical success factor is the inferior one must be willing to be subjugated.

![]()

I think in this scenario the guy likes working! He repairs bicycles and is skilled at it. I do wonder if they would have chosen fruitvale if the roles were reversed. It feels like he didn’t feel comfortable not contributing a good chunk of the mortgage, and that might be a more common feeling for men?

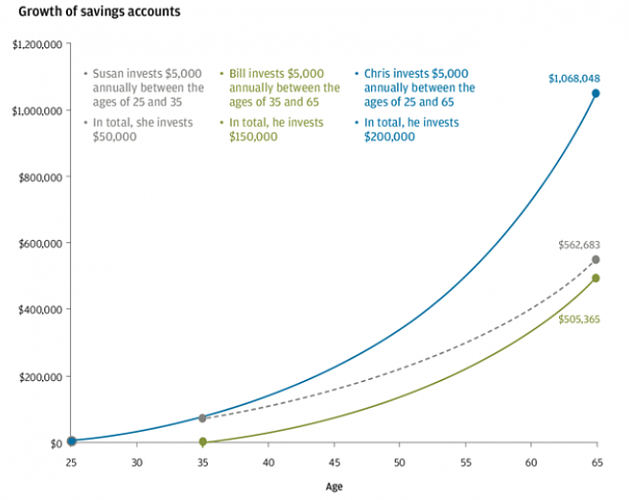

(Only applies to people who don’t have rich parents) - The biggest financial mistake is not to save, hence not build capital to invest that will over the next 30-40 years give great returns.