I think the Real Estate Forum is officially dead… .might want to call it a stock forum…

Even I have been an active seller the last 2 years. Mainly because I turned 70 and will sell most of my properties in the next few years, and buying stocks.

I am the biggest bull on the forum. Now that I have retired from buying it might actually be bullish considering there are 150m Gen y/Z potential buyers and $90 trillion coming from boomers in the next 20 years. Anyway I don’t want to be a property manager anymore and have an active manager. Sick of tenants regulations and the entitlement attitude of the current generation…” we deserve affordable housing free medical free food free education”… Cuba here we come… sorry one only deserves rewards for hard work… nothing more nothing less.

I will keep on here. But I am having more fun fighting the Vacancy Tax and the communists trying to take over South Lake Tahoe. Scott Robbins the progressive councilman has been defeated on every issue. TOT tax, transfer tax, $23 min wage and the Vacancy Tax.

But his crowd has a petition for a ballot measure on a Vacancy tax ten times worst the Oakland version. We will organize and defeat it in November. My good friend David Jenkins is running for city council and will hopefully defeat the communists including Nick Speal and Amelia Richmond.

Congrats on your milestone and glad to hear your future plan, @Elt1!

I am curious how you are transition from REI to Stock in tax efficient way?

NOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOO!!!

Keep it going. Talk about RE…

But as far as I can see no one is on here anymore.

I like DSTs. But wife doesn’t like the fees… Based on the full amount not of the profits.

Agreed, which is why I have taken my toys to Reddit…

Not bad, I am almost hitting 20K karmas in only about a year or so…

Elt1, congratulations. It’s great that you can take it easy and relax.

I have been on, but not participating much. Just holding onto my few rentals and collecting rent.

i am on, I love reading, but don’t have much to add. ![]() you guys are the smartest people i’ve met on the internet.

you guys are the smartest people i’ve met on the internet. ![]()

Congratulations on your milestone!

I have also sold most of my rentals over the last few years. Have been thinking about buying but it’s very tough in the 8% rate environment today.

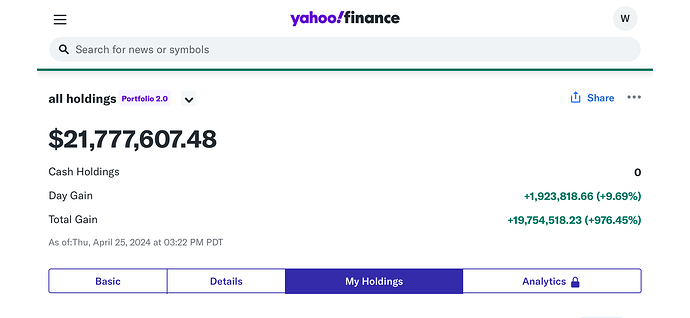

Looking back, I learned a few things from this Forum that have worked out to be life changing, but none of them are related to real estate.

@Terri posted a link a few years back to a video of college consultant talking about some misconceptions on the college admission process. Made complete sense to me and I realized I did not know anything. Should hire a consultant for my kids ASAP.

@hanera and @wuqijun demonstrated in real life the power of extreme buy and hold. Everybody knows the theories but seeing people practice those principles in real life made a big impression on me.

I think it was @Jil who floated the idea of holding leveraged ETF for long term. Always thought it was a bad idea but that changed my mind.

I may have picked these ideas from somewhere else, but maybe I won’t. Hard to put a dollar amount on them. But no matter what I am grateful.

.

Have you do a backtest? UPRO seems ok. What about the highly volatile TQQQ?

Disclosure: I swing trade TQQQ occasionally. Hold S&P index fund, VOO and QQQ for long term (hopefully forever).

Good job. Personally, I hate managing rentals even with a property manager. Recently, I formed a LLC for the Austin rentals and gifted to my sons to manage. I am free ![]()

Didn’t “backtest”. Just looked at the long term chart of TQQQ and such. Extremely volatile but if no black swan event like GFC it outperforms almost everything.

Still thinking though. Have not pulled trigger yet. What’s your read?

.

Since I sold them last year, didn’t re-enter. IMHO, you either trade it or buy it near the bottom of a bear market. Buying now is risky.

Did you fire all your property managers? Your sons are now hands on managing the properties?

Personally I don’t like PM’s. They are too eager to rent out properties and usually do the lowest bare minimum of checking tenant qualities.

.

Same PM. Just change ownership.

Yes, many PMs did what you said. Quite often, we accept a better quality tenants even though they offer a lower rent.

TQQQ is more risky now than at the bottom in 2022. But if my thesis is right, the secular market should still have maybe 4 or 5 years left? When the AI bubble pops around 2028 or 29 the secular bull will die with it.

Most tech names are still way below ATH. Only a few mega names made new highs. Seems to me we still have some ways to go.

I think the real risky time is when we enter a secular bear market like the one from 2001 to 2010. S&P and Nasdaq were basically flat for 10 years. Don’t know what to do then. Sit tight and eat wind for 10 years? Shift to individual names and hope you will find the next Apple and Nvidia? No idea.

Meh. I just held. For most of 2000-2010 the S&P yield was slightly higher than the yield on mm funds and dividends are taxed at a far lower rate. If you have a long time horizon - not too old or generational wealth - I really don’t see the point in trying to time the market. Unless of course you hold one of those triple leveraged funds. Market goes down 30%; lose 90%. Now you need a 333% market gain to break even.

…as for the forum one has to admit that regardless of individual POV and the small size of the place the intellectual quality of the membership far exceeds most other corners of the net. It’s a welcome reprieve from 21st century stupidity. Marketwatch boards used to be interesting. Those went to hell a few years ago.

i was wondering where you had been! ![]()