Herb Wertheim may be the greatest individual investor the world has never heard of, and he has the Fidelity statements to prove it. Leafing through printouts he has brought to a meeting, you can see hundreds of millions of dollars in stocks like Apple and Microsoft, purchased decades ago during their IPOs. An $800 million-plus position in Heico, a $1.8 billion (revenue) airplane-parts manufacturer, dates to 1992. There are dozens of other holdings, ranging from GE and Google to BP and Bank of America. If there’s a common theme to Wertheim’s investing, it’s a preference for industry and technology companies and dividend payers. His financial success—and the fantastic life his portfolio has afforded his family—is a testament to the power of compounding as well as to the resilience of American innovation over the half-century.

Wertheim points to Microsoft, a stock he has held since its IPO in 1986. “I knew a lot about computers and had been involved in building them,” he says. BPI had been using Apple IIe’s, but after Microsoft released its Windows operating system in 1985, Wertheim became convinced it would be a winner. “Only Microsoft had an operating system that could compete with Apple,” he recalls. The Microsoft shares he bought during the IPO, which have been paying dividends since 2003, are now worth more than $160 million. His 1.25 million shares of Apple, some purchased during its 1980 IPO and some when the stock was languishing at $10 in the 1990s, are worth $195 million.

Well he bought the top two market cap at IPO. Super buy n holder ![]()

“My thing is,” Wertheim says as he reflects on his long career, “I wanted to be able to have free time. To me, having time is the most precious thing.”

Agree. Is why I believe in stock investment more than RE especially no flipping and get property managers to manage your rentals.

“You can’t look at what their sales are. You can’t look at anything. What is the future?”

@jil FA is looking at the past ![]()

In order to harvest tax losses in his portfolio, he doubles down on his losers to avoid the IRS’ wash-sale penalties. “If I have a large loss in a stock I like,” he says, “I will purchase more, usually twice to three times the original purchase, and wait the 30 days to sell the original position and book the tax loss.”

His way of loss harvesting differs from @manch who don’t have much faith in any stocks ![]()

After finished reading the article, realize he didn’t invested much in AAPL and MSFT, otherwise he would be in the top 10 richest.

I bought BP years ago. Very happy with the 6% dividends. Buy and hold. Never sell just like RE

His way is very interesting.

May be too risky for you since you’re using high leverage. He mostly uses new cash from dividends.

In addition, must stick to your stipulated position size. We tend to want to keep the increased size when price had rallied hoping for more price appreciation. Make very sure that you have the discipline to sell the original stake once 30 days is up regardless of the market price then.

The biggest takeaway from this story is this: it’s possible for a retail investors to become billionaires.

Obviously he has a successful business that fed him cash to invest. It’s kind of similar to WB’s insurance floats.

If some one crosses, say 20 M or 50M, they will have consulting with CPA, Law firm…etc help.

If it is crossing 200M, they will have set of CPA, law firm, analysts team etc help…etc.

Those team does the research and owner runs a company.

Higher the money, riskier the investment is.

In order to protect, they need to expand the operations with CPA, law firm, analysts and other office staff.

It is not like buying a stock and sleeping forever like mom-and-pop investor.

Exactly. @manch naively think a mom and pop investor can be a billionaire. Is not clear how much cash his business throw out.

1.11 to the power of 62 is 650.

To the power of 40 is 65. It seem he got ton of doughs when he was in late 30s. $2.3B/65 = $35M became $2.3B when invested in S&P index fund. So if he had more than $35M then, he is not outperforming S&P index fund.

Making excuses for your lackluster performance compared to the master?

This is what I am telling analysis, you do it by experience which many books teach !

You learnt this knowledge from books or internet or somewhere else.

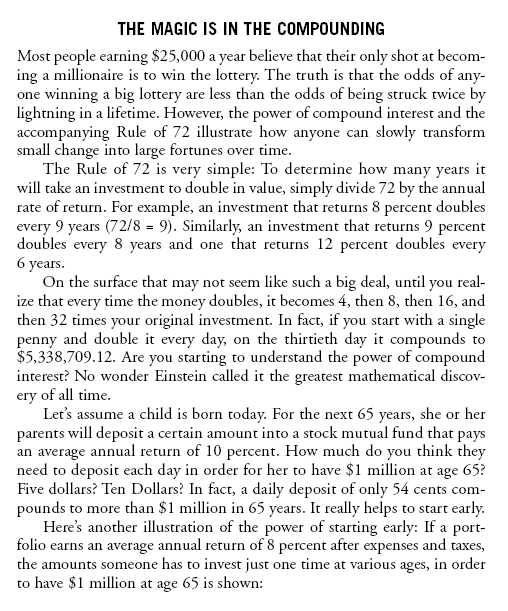

Book “The.Bogleheads.Guide.to.Investing” which I referred give it nicely here

done it since teenager, obvious thing to do!