Market refuses to decline. Keep bouncing back.

Btw, in poor countries, they eat dogs.

Market refuses to decline. Keep bouncing back.

Btw, in poor countries, they eat dogs.

Wednesday will be important. CPI data for July will be released, and two Fed presidents will speak on that day.

| TIME (ET) | REPORT | PERIOD | ACTUAL | MEDIAN FORECAST | PREVIOUS |

|---|---|---|---|---|---|

| WEDNESDAY, AUG. 10 | |||||

| 8:30 am | Consumer price index | July | 0.2% | 1.3% | |

| 8:30 am | Core CPI | July | 0.5% | 0.7% | |

| 8:30 am | CPI (year-over-year) | July | 8.7% | 9.1% | |

| 8:30 am | Core CPI (year-over-year) | July | 6.1% | 5.9% | |

| 10 am | Wholesale inventories (revision) | June | 1.9% | 1.7% | |

| 11 am | Chicago Fed President Charles Evans speaks | ||||

| 2 pm | Minnapolis Fed President Neel Kashkari speaks |

His logic is that the 10y treasury’s PE is over 30 but S&P is only around 20. Stock is so much cheaper and money will flow there as a result.

His justification is not right as he failed to focus fundamentals.

Market is focused on fundamentals moving money from stocks to 10Y.

Apr 2021 onwards, fed reverse repo increased gradually to 2T (most short term money market goes here).

Now, market sees economic issues longer time, and moving to 10y as safe heaven assets now. This is going to invert the yield curve soon.

Such bullish talks, mostly marketing, end up like Cathie wood.

Either bullish or bearish trend , mandatory for investors to be right to make money.

Same old formula, no fight with fed. When they print QE money, market is bullish, when they do QT market is bearish.

![]()

Market is expecting Fed could pause rate hike after the “unusual” large hike in Sep and likely reverse in 2023. Risky to front run this expectation but that is what some traders do.

Yes, this is known and already J powell indicated. FED is pausing after Sep hike, and that may likely end the FED rake hikes for many years. However, yield curve will be inverted that leads a recession.

By all means, my guess, it is exact replica of 2008 downturn (but not real estate downturn ).

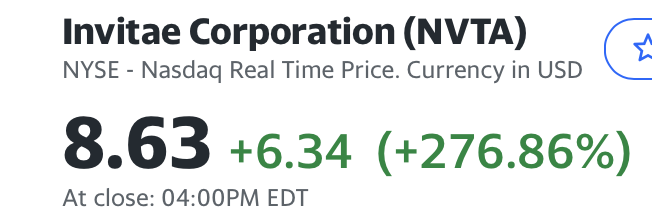

High growth stocks rally 5-10%. Declining CPI is ![]() for growth.

for growth.

Some 15-20% ![]()

![]()

Both Beth’s Elliot Wave boy and Face Ripper’s TA guy are positioning for some short term pullback. Click link below to watch the video.

Cathie Woods is laughing to the bank.

Despite the renewed risk-on sentiment, the current stock rally has been met with a great deal of skepticism.

Who are buying and who are skeptical?

VIX is back below 20. Institutions aren’t buying put protection.

This is some good analysis. Overall, things are bullish.

The wheels are falling off the Chinese economy.

The biggest problem is EU.

.

You manage to jinx the market ![]()

Three stocks in my watch list are green. AAPL , COST ![]() and TSLA. I think COST is a long term hold (>20 years), regrettably I have only a tiny quantity in IRA (long term hold).

and TSLA. I think COST is a long term hold (>20 years), regrettably I have only a tiny quantity in IRA (long term hold).

ACT ![]()