Odd that oil isn’t reacting.

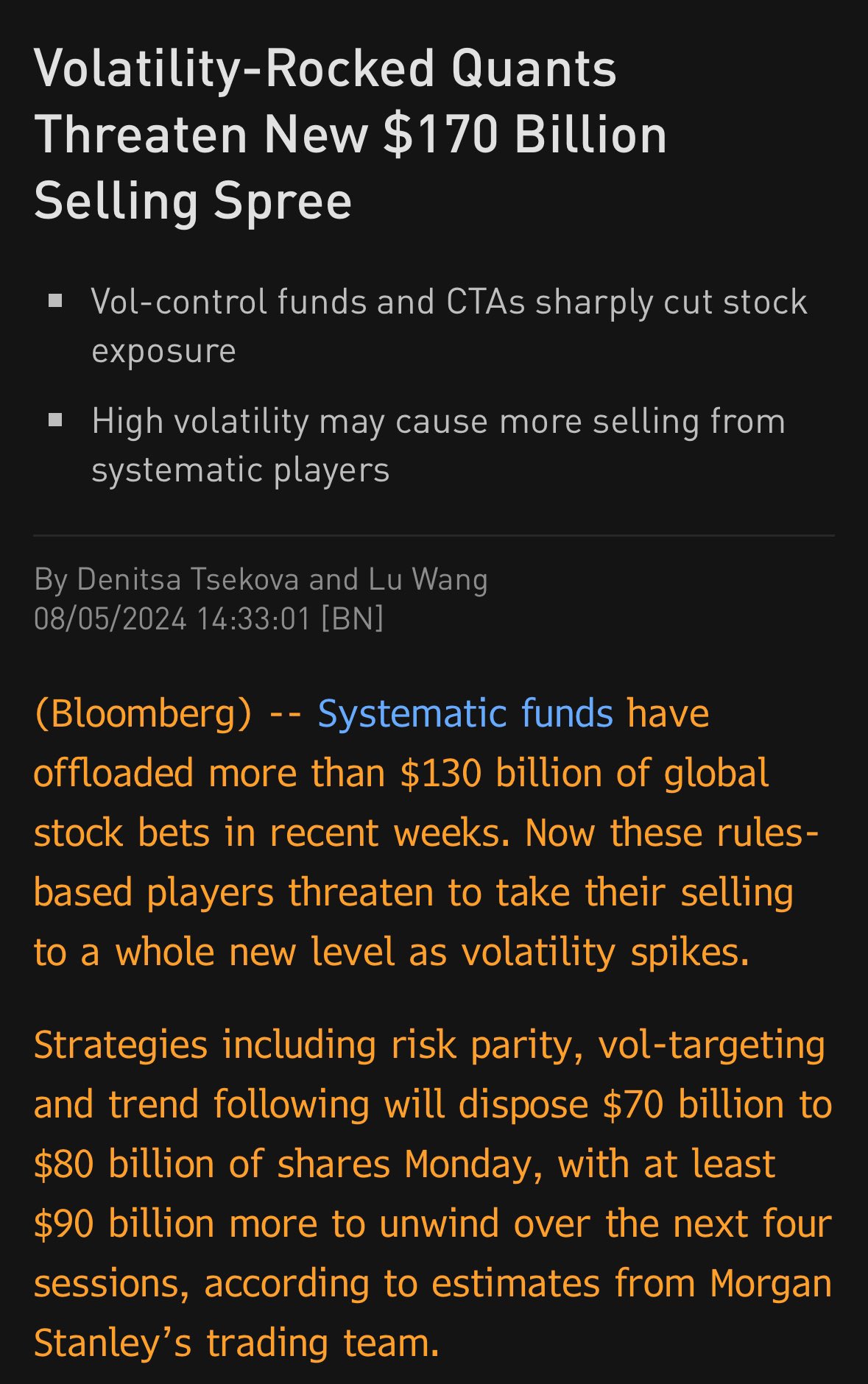

DCB or flash crash?

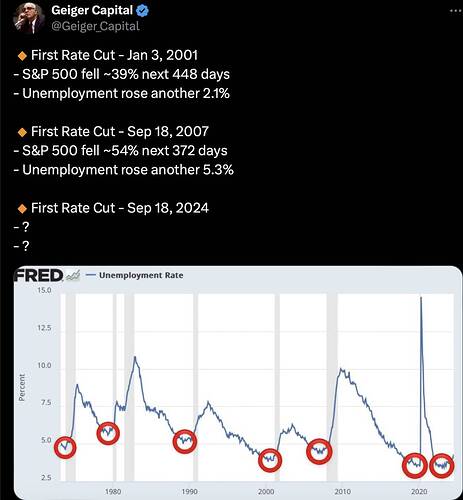

Fed is wise not to cut rate ![]()

S&P P/E is still at nearly 27. Everything has to come up roses to support that.

S&P is in correction (10%-20% from ATH).

ATH 5669.67

LoD 5119.26, 10% decline from ATH

9/11 and the housing/banking crisis.

Still, rate cuts don’t in and of themselves necessarily lift markets. Especially when they’re already priced in and multiples are in nosebleed territory. Buy the rumor, sell the fact?

Global central banks don’t seem to think all is well. They’ve been buying gold like crazy.

It’s reassuring in some regards but also illustrates how much productivity is lost over practices and resource allocations that reduce tax rather than increase profit. It also illustrates how the tax code serves to monopolize the economy.

Just about all resource stocks are getting slammed today whether it’s oil, steel, copper or silver. Not sure why. Nothing specific on MW.

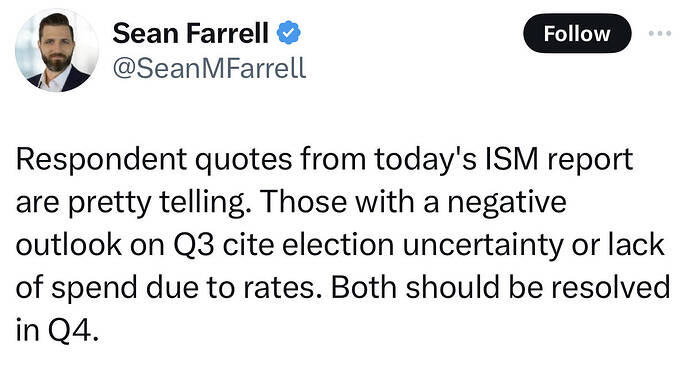

ISM missed this morning. Chance of recession increased.

JPow should have cut months ago. As usual the Fed is always late, in both raising and cutting.