Slaughter.

Correction or start of bear market?

Permabull Tom Lee is always correct in a bull market.

Market shows sign of bearishness… bad news is bad news.

Slaughter.

Correction or start of bear market?

Permabull Tom Lee is always correct in a bull market.

Market shows sign of bearishness… bad news is bad news.

Weak macros will force the Fed’s hand. Bad news should still be good news.

Rate cuts are baked into current valuations. Any serious economic slowdown is not.

I also noticed Europe and Asia did badly today even before the US sold off.

Debbie downer. Stocks tend to do well in election year. Plus the onset of a new rate cut cycle. Just stay in and ride out the volatility.

Definition of correction: 10-20% decline from ATH price.

Definition of consolidation: less than 10% decline in price.

So far, in consolidation.

Futures are ugly and things are falling hard globally this morning. Rates and the dollar are also plunging. Gold and silver are soaring.

Good day to sell puts - sold on SCHW, MDB.

A joke posted on Twitter…

BREAKING: ![]() Emergency press conference by Jerome Powell due to market meltdown.

Emergency press conference by Jerome Powell due to market meltdown. ![]()

To put things in perspective the DOW is higher than it was just 3 months ago.

Bloomberg article is the first time I have heard of SAHM rule. There is another recession indicator called inverted yield curve. When inverted yield curve re-invert, a recession would follow few months later. The re-inversion has not occurred yet.

Good that Kris do his homework and not blindly believe mainstream media… SAHM rule only come out in 2019… wtf…

Adam Khoo also do his homework.

More homework by a Xer…

Why bother thinking about exit when a new rate cut cycle is about to begin?

Don’t fight the Fed.

.

Fed cut rates when data indicates a possible recession is developing.

Fed starts to hike rate, stock market tumbles.

Fed pause rate hikes, stock market rallies.

Fed starts to cut rate, stock market tumbles (reasonable guess?)

Fed pause rate cuts, stock market rallies (good guess?)

We don’t know for sure whether there will be a recession.

But we are fairly certain there will be multiple rate cuts starting next month.

Even if there will be a recession, root cause is because rates are too high. That is something the Fed has complete control over. People have been screaming the Fed should starting cutting months ago. But JPow won’t listen. Now the pressure is mounting for the Fed to cut aggressively.

Remember… Fed has dual mandates… price stability and low unemployment.

These rate cuts is to counter…

If done well, no recession. But we won’t know, even Fed won’t know, obviously…

.

What is meant by price stability?

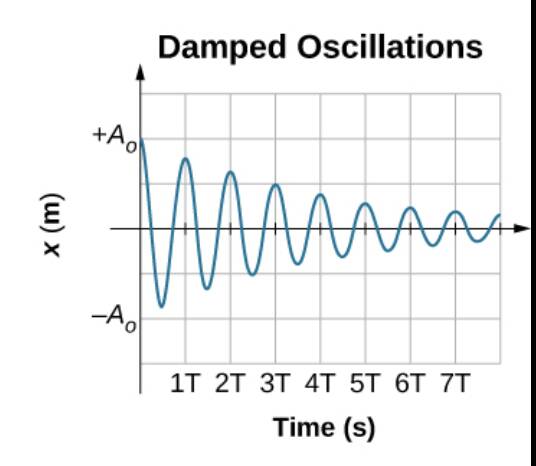

Boom and recession are natural events of business cycle.

If Fed doesn’t intervene, the peak and trough are fairly large.

Goal of Fed is to reduce the amplitude of the peak and trough… technically, we call that damping the oscillation.

The market has been anticipating and front running those rate cuts for months so they may be a nonevent. Especially as inflation has yet to fall to target.

Next year a huge downer will be a hike in the corporate tax rate from 21% to 35% if the Dems win Congress.

Of course the Fed starts cutting is NOT a non event. Just like the Fed starts raising was not a non event in the last cycle. If inflation continues to be weak and employment doesn’t pick up, there is more room for the Fed to cut than market expects right now.

And the liquidity wasn’t even created yet. When it is actually injected into the economy a positive cycle will ensure. Market is forward looking, but it’s not an oracle. Much will depend whether we actually will have a recession or not, and how aggressive the Fed will be in front running it. I don’t think anybody knows how it will unfold yet.

I am not even sure the recent selloff is 100% related to recession fear. There is also a large selloff in Japan because of yen strengthening and the carry trade unwinded. Maybe it’s partly a liquidity crunch from the carry traders?