Trend reversal or bear market rally ?

Random noise

Retail investor sentiment is almost as low as March, 2020. That was a back up the truck moment.

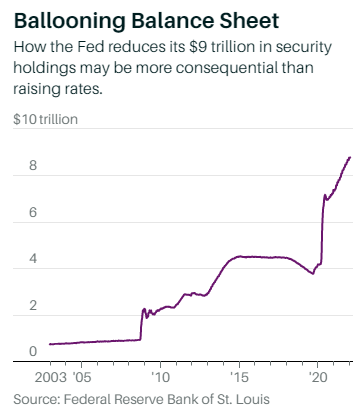

The following graph gives an idea of how fake the economic growth have been for the past decade:

Is it economic growth or money printing?

It’s cool you can repeat the fear mongering. Can you actually explain it or do you just repeat it to make yourself feel better?

What part do you not understand?

You’re deflecting which means you don’t understand.

@erth is our forum’s resident Silicon Valley/Fed cynic or critic.

While all of us bash him, he does make some pertinent points about how Fed has inflated the most recent stock and RE bubble

What most people somehow not understand is that a person can mostly likely survive a fall from 10 feet. But, very unlikely to survive a fall from 200 feet. The economic pain caused by small economic recessions and failures are for easy for society, but creating a major bubble and taking far more severe damage when it burst is fatal.

This theory is used by insurance industry. Take several small risks but do not take one big life threatening risk.

Some things are just not in your control… fear of fall shouldn’t restrict you from climbing… as always balance & awareness are key…

the kind of risk that FED takes gives suffering to entire world. Something like the CA fires do to entire cities and communites (fires that could have been easily controlled when small).

Do you or me or anyone in this forum have any control on what FED does? there is not much you can do worrying about this and need to focus on what we can control… live the life lightly and do your duties seriously and everything will be alright… ![]()

Very correctly stated @spacehopper . We have no control over the Fed, so may as well stop agonizing about their actions be it money printing or raising interest rates

Is it a philosophical question or a fact? In short term you do not control. In long term you do. Purely on short term basis, better understanding of who you are playing with allows you to make well calculated moves. And not to mention the cool you are able to keep.

.

Doesn’t matter it has bottomed or not. Whatever stocks you bought today is likely to be higher at the end of the year. The billion dollar question is which are the ones that can 10x over 5-7 years from today. I have no idea, insist on betting on metaverse ![]() RBLX U MTTR COIN. AV should be very big, so AAPL TSLA, not sure which other companies also on AV… GOOG gave up right?

RBLX U MTTR COIN. AV should be very big, so AAPL TSLA, not sure which other companies also on AV… GOOG gave up right?

Why search so hard for this 10x multiplier? If you are convinced that:

- stocks will go up more than down.

- tech stocks lead the market up.

Then just buy and hold TQQQ. If Nasdaq goes up 3x in next 10-12 years, TQQQ will go up 8x or so.

Notice NFLX has lost all gains since 2020. Any1 bought?

SHOP declined by more than 50% in less than 2 months! Look like it might wipe out all gains since 2020 too. Ditto for DOCU. So much for rock solid e-commerce stocks.