Bill Gross implies an immediate hike to 3.5% in Jul not end of the year.

ASAP! End of the year is not ASAP.

BG is right! I already informed in some thread FED will have next 2 rate hike 0,75% ( July & Aug ) that makes current 1.6% to 3.1%.

BG is telling the same! Asap !!

FED chair said he is front loading rate by raising 0.75 to bring down inflation faster!

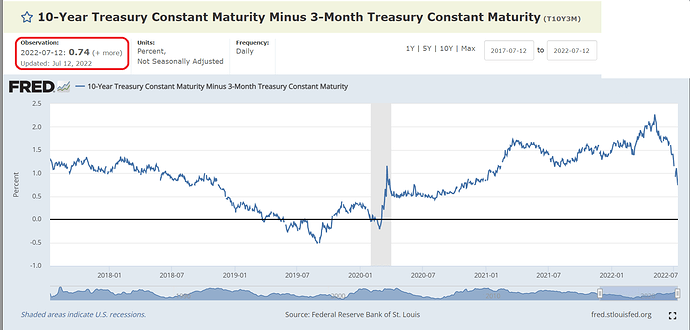

Current Yield curve 0.81% between 10 year and 3 months

My interpretation of what BG means is since he has watched J Powell speech, he felt is too slow. Rather than wait till end of the year, do it in Jul. Hike straight to 3.5% in Jul.

Yeah ! Yeah ! Bill Gross and Bloomberg have supreme power & Accountability over FED and entire Economy as a whole, and they can do it !

I think the GDP data on the 28th could cause a massive swing in the market. If it says we are in a recession, I think the market will rally. It should mean inflation will really start to slowdown, and the fed won’t have to increase rates much more. If GDP is really strong, then the fed might have to get more aggressive which could tank the market.

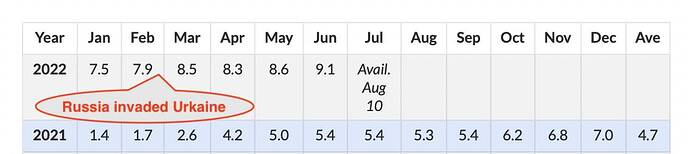

Fed uses Core CPI:

“Excluding volatile food and energy prices, so-called core CPI increased 5.9%, compared with the 5.7% estimate. Core inflation peaked at 6.5% in March and has been nudging down since.”

Wage and rent inflation are the key. Locally rents have peaked for me. Wages seem to be still going up.Cars? I bet RVs are coming down due to gas prices

.

JC might go down in history as the one successfully calling bottom for a very difficult market.

He’s right if Q2 GDP is bad.

I thought he has been calling the bottom for a while now. ![]()

.

?

Below statement…

Jim Cramer is calling a bottom in three popular FAANG names that have been beaten down in 2022.

is not the same as…

28 days ago…

Do Fed listen? I think BG is correct, just jump by 1.25% to 1.75% in Jul.

Inflation is more scary than recession. Inflation affects everybody. Recession affects a smaller group of people.

I think we’ll get 1% now, since the market is pricing for it.

This is what he said in June as per the above link: “The bottom line is they’ve fallen so darn far that I think they’ve become metaphors for a whole host of stocks that are now ready to rally because they’ve got nowhere else to go but up," Cramer said.

Fed with its monstrous rate hike path makes no sense at all. Most of the inflation is due to first supply chain disruption from Covid and then the largest war in Europe since WW2. Doesn’t matter. The Fed is hell bent on destroying the economy.

.

You interpreted as he is saying is market bottom but he didn’t say so. There are some stocks e.g. RBLX and PLTR, which are performing quite well.