Up or down? Many signs that inflation is under control. Will market frontrun Fed’s response or continue to be scared?

Implication of crypto collapse is more impactful than the war and supply chain issues.

![]()

Up or down? Many signs that inflation is under control. Will market frontrun Fed’s response or continue to be scared?

Implication of crypto collapse is more impactful than the war and supply chain issues.

![]()

Recession fear rising, broad market indices such as S&P and Nasdaq are declining, yields of Treasuries are declining yet growth stocks are climbing ![]()

Are people rotating back to growth assuming fed still stop increasing rates or even cut rates? I don’t think they can stop increasing or cut rates until inflation is in check. We need a halt to wage gains for inflation to get back to 2% or lower. Gains were 0.5% in May which is a M/M number. That needs to drop to 0.2% or lower to get inflation under control.

Neck to neck.

Market refuses to decline. Probably for a week or two.

QQQ kissing the 50-day SMA. Let ![]() that it would cross above it. RSI is just above 50.

that it would cross above it. RSI is just above 50.

I am in the camp that we’re already in stagflation. Technically not in recession because of the artificial definition of two quarters of negative GDP. Since GDP is correlated to population size (I suspect is more correlated to size of labor force), with the lower participation of labor, is hard for GDP to grow unless productivity has increased significantly. Lower participation of labor also lead to higher labor cost hence inflation. Total = stagflation. IMHO, the solution is not demand destruction, should be increased productivity. Tech can help ![]() Robotics

Robotics ![]() Process automation

Process automation ![]() AI/ ML

AI/ ML ![]()

I still think we are in a recession. Q2 GDP is going to be negative. The only hope of saving that is if inventory growth allows GDP to have a tiny gain.

The two key events are:

June inflation release on July 13th

Q2 GDP release (advance estimate) on July 28th

There’s so much retail discounting happening. I expect inflation will be 1-2% lower than May. GDP is likely negative, and we are in a recession. The fed will need to keep going with rates to get inflation back below 2%. My hunch is 0.75% at the next meeting then 0.5%. After that, they can relax on further rate hikes.

It’ll be interesting how it all impacts the job market. There’s still FAR more job openings than unemployed. Most companies won’t see much if any revenue decline from the recession. They are so far behind on hiring that layoffs should be minimal. It’s more likely companies will close or just not actively recruit against open positions.

Looking through the definition of economic terms, don’t have a good definition to describe current situation,

Negative GDP (due to lower participation of labor)

Blue chips make good earnings (due to revenge economy + inflation), high growth mixed (due to Fed scared tactics)

Low unemployment (due to revenge economy + lower participation of labor)

High inflation (QE + revenge economy + supply chain issues)

GDP is a country’s measurement.

Individually,

![]()

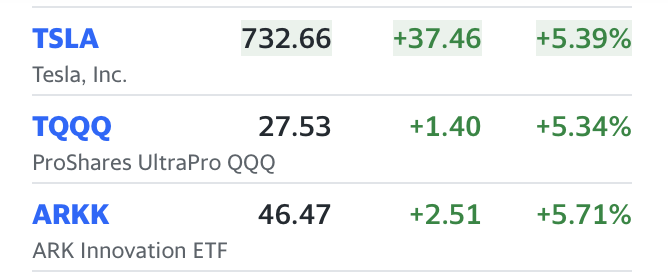

Looking through the charts of stocks I have been monitoring, below are the stocks that didn’t make another low since May,

ARKK ![]()

RBLX

U

TDOC

ZM

CRWD

PLTR

COIN

MQ

SE

TOST

UPST ![]()

Obviously,

AAPL

TSLA

Disappointed,

SHOP

SQ

Just to add more color. Is difficult to employ good suitable SWEs and blue collar workers. GDP is a country’s measurement, negative doesn’t imply hard times for individuals. I think is a case of lower participation of labor (blue collar workers change from 2-3 jobs to 1 job or quit the labor force) and structural issues (certain skillsets are in high demand while certain skillsets are not, so a mismatch).

Good = Passion, energy, drive. Nowadays, many people work for money sake ![]() and not putting effort to get a job done well.

and not putting effort to get a job done well.

I agree. It’s going to blow people’s mind if GDP is negative again with such a hot job market. I’m not sure why people can’t compute GDP will be negative, All the government stimulus spending from last year is gone now. Companies were so far behind on hiring that they still need to add people.

Tom Lee insists that 2nd half would be good. SPX to 5100 ![]()

Two camps’ view on end of bear market,

One: Usual V shape hence looking for a capitulation dive to mark the bottom

Two: Basing or bottoming process where prices bounces up and down for a few months to years

Bill Gross is in the don’t buy the dip camp.

Gross highlighted that the Fed should lift its benchmark lending rate to 3.5% “ASAP” from the current level of 1.75% to bring down inflation.

Why 3.5%? Isn’t neutral rate is 2.5%?

As for equities, they "must contend with future earnings disappointments and are not as cheap as they appear. Don’t buy them just yet,” Gross added.

Not priced in?