Bad news yet market rallies = Go Long

There are trillion of dollars in cash on the sidelines waiting for Fed to U-turn.

Value of US and European IPOs tumbles 90% this year

First-quarter drought extends into second quarter as Ukraine war and volatility deter companies from listing

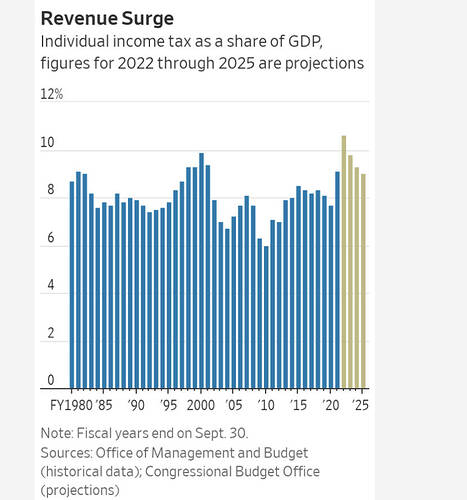

Individual Income Tax Payments on Pace to Reach Record Level

Business owners and investors are paying more, but CBO officials can’t fully explain why tax revenues are hitting high as a share of the economy

Taxes revenue is up because they increased tax rates. Oh wait…

Maybe tax revenues are up because the dollars in which they are paid are down.

I sense market is tired of declining. It wants to go up.

Here my 2 cents:

Lucky: Will buy/DCA VOO and hold for life. Say $500/month on investment

Hard Working : Will buy/DCA AVUV and hold for life. Say $500/month on investment

Smart: Will buy/DCA AVUV and hold for life in ROTH. Say $500/month on investment

The difference between “Lucky & Smart” will be millions after 10 to 15 years.

Here you need to know:

-

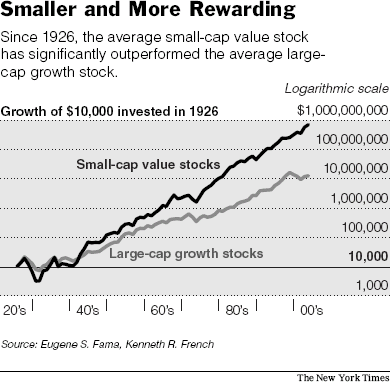

Study in 1992 By Fama and French – Performance of a broadly diversified US stock portfolio relied on 3 primary risks axis to determine its return. 95% accuracy as to what the portfolio would return

-

Market risk or Beta – all portfolios move up or down in relation to the total stock market

-

Percent of small cap in the portfolio by weight – small stocks have higher returns and do not always have correlation to the total stock market

-

Percent of value orientation – value stocks have a higher return than growth and do not correlate with growth stocks

-

Small cap value index has outperformed growth with less standard deviation from 1979-2009

-

Having a 50/50 value/growth index during this time added no return and increased standard deviation

-

Small Cap value along with total stock market is a good choice in your portfolio

Tech’s Decade of Stock-Market Dominance Ends, For Now

Sector’s tumble is worst since 2002; value investors take victory lap

.

Unproven. AVUV is around for 3+ years only. Don’t be so sure.

You just started analysis, that is what I said smart and hard working !

I just compared inception to date, YTD and the ‘23-Mar-2020’, all it exceeded buy & returns.

First time, AVUV is proven with current correction time. AVUV uses some computerized model (or algorithmic models) to pick/rebalance (focusing small value caps).

Lot of information in bogle heads and other blogs. Small Cap Value heads Rejoice !!! - Page 104 - Bogleheads.org

Reddit has many blogs, seeking alpha etc.

Prospectus gives more information.

Fama and French thesis were proven by many research scholars with past data Small-value cap wins !

Last, watch it for many years until satisfied and then invest.

Striking early bird (like the way WQJ bought TSLA or you on AAPL) will give better returns.

Bye…Bye…Bye…now

Boom second half?

People are talking about possible global depression or stagflation. That is to say, the real crisis has yet to come.

In this forum and USA, we worry about stock prices and house prices. In many countries, many might die of starvation because of food shortage, and their economy devastated. WW3, worldwide social unrest, …

Futures are down 400 points

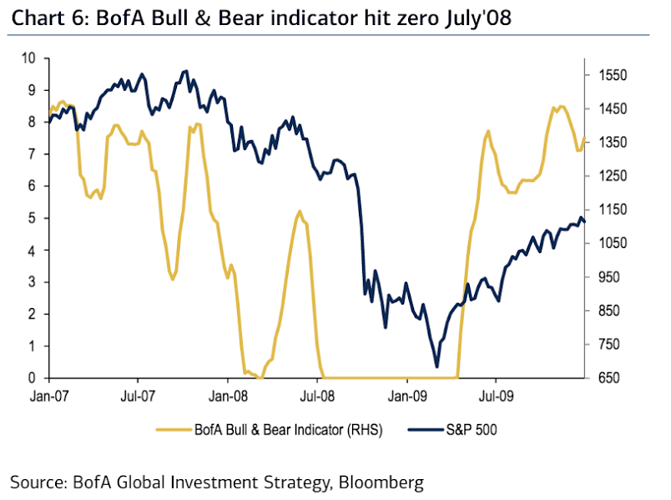

It stayed at zero for almost a year in 2008-2009.

I’m wondering what other levers there are to fight inflation. I don’t think interest rates will make a big enough difference fast enough. Too many people are locked into very low mortgage rates. In many countries, they only do adjustable rate mortgages. That’d really calm inflation fast.

I don’t understand how airlines and hotels claim to be busier than ever. If inflation is really hurting people that badly, airlines and hotels should be some of the first expenses people cut.