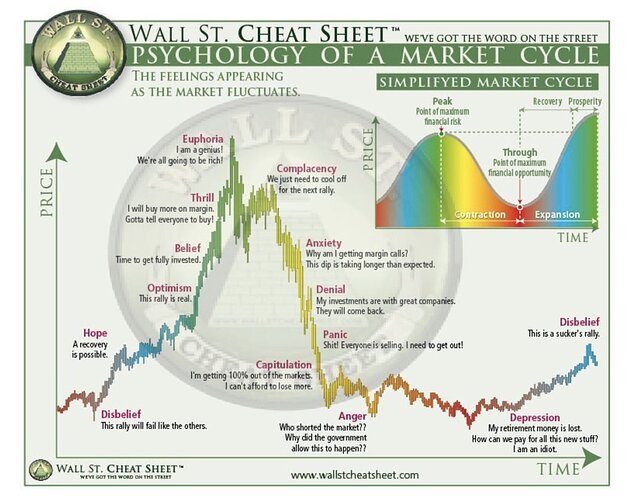

Thought we are in panic to capitulation. Some fin twitters talking as if we are in disbelief… so many talks about current rally is a sucker’s rally.

Sucker’s rally or market QQQ has bottomed in May?

I thought Mar 14 was the bottom. Wrong. What about May 20?

I thought March too. MACD actually turned bullish then but reversed the first week of April. It’s bullish again. Will it hold? That’s the huge question. The signs are that inflation has peaked and is slowing.

This is the first month of the fed reducing its balance sheet. I’m watching bond yields to see the impact.

May job adds were the lowest since the recovery started. That means one of two things:

- Companies are slowing hiring which will cool wage inflation.

- Companies haven’t adjusted salaries to match expectations, and there’s more wage inflation ahead.

Companies are usually very slow to adjust the number of open positions when they slow hiring so watching the number of open positions isn’t a great indicator. Open positions don’t mean the company is actively interviewing for them. Most companies don’t want the stigma of closing roles and giving internal and external people the perception things are slowing.

We recently declined a candidate who was $400k TC and was expecting a jump to $700k TC. I’m not sure why they’d volunteer their current comp when expecting a jump that big. They didn’t have a competing offer at $700k yet either.

Whoa, millennials are aggressive.

FIRE

Shoot your shot ![]()

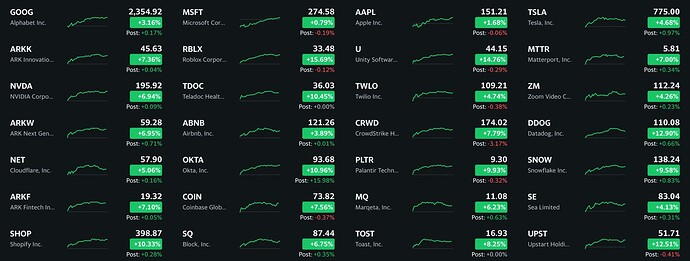

Current bear market is due to Fed raising rates causing multiples contraction. I think market has baked in 7 rate hikes from last hike, if inflation has peaked, Fed might reduce to 2 rate hikes. Other than those with bad earnings, stocks should re-bounce to the appropriate multiples (multiple expansion).

![]() Moving in the right direction. However, QQQ is still below the much watched 40-week EMA. EWT counts five waves from $280.21, cautiously optimistic.

Moving in the right direction. However, QQQ is still below the much watched 40-week EMA. EWT counts five waves from $280.21, cautiously optimistic.

Bonds have priced in fewer hikes. Someone is clearly wrong. The question is who.

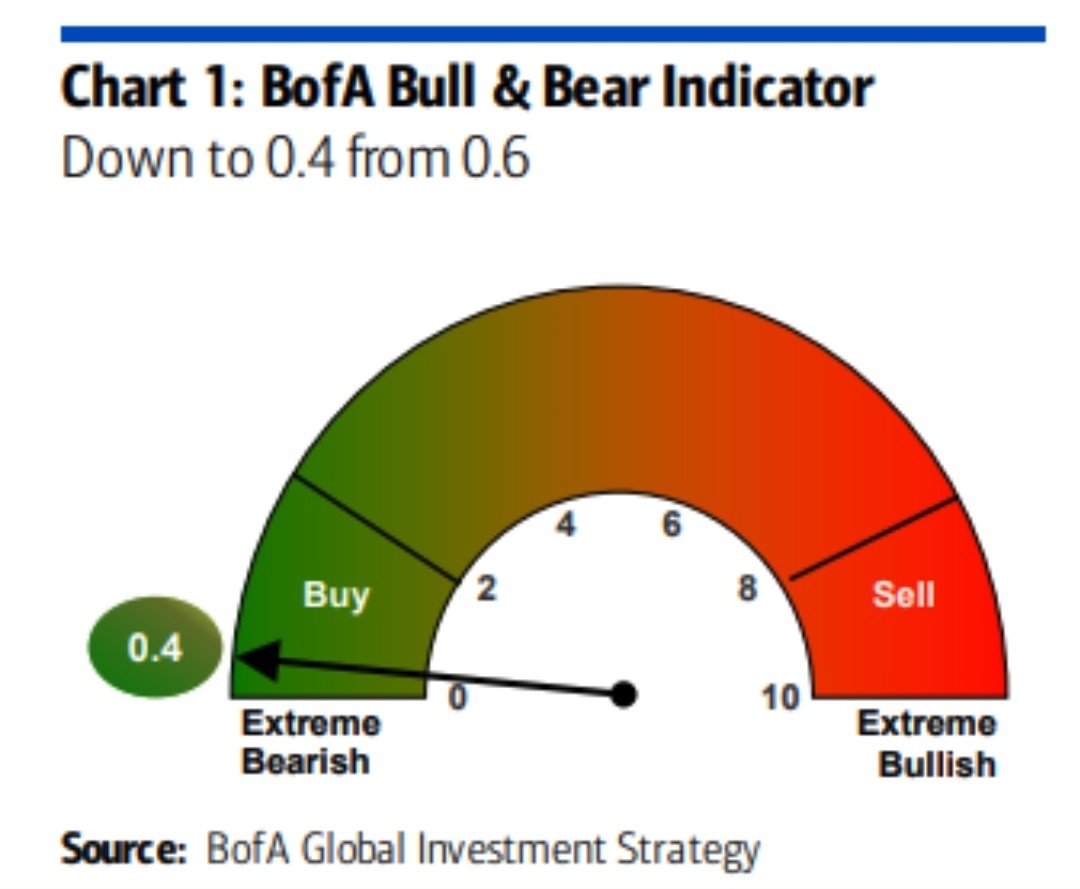

Sentiments are just too far down for whatever economic conditions we are currently in. Investors were even more downbeat a week or two ago than in the depth of Covid low, when the whole world’s economy was about to shut down with no vaccines and no government stimulus, yet. That’s just ridiculous.

If economy had a hard landing the Fed can easily reverse course and cut rates. Two more 50 bps raises are already priced in. We will have ample room to cut if the economy is in trouble.

Do not burn yourself reading daily stock news, sentiments, Twitters, reddits etc.

Why? For example, when market went up yesterday, my partner & I was watching it with our own statistics, finally came to know it is risky to hold further (as potential swing top sets in), sold all to cash.

Remember this: Market goes down today or goes up today was decided minimum 2-3 days ahead (everything well planned/manipulated 2-3 days ahead).

Never believe news/media why that day is down or up, do 10000 feet level economic outlook ( you own analysis).

Market is full of big funds/billionaire manipulators - short term - but in line with economy long term.

Even Bill Gates shorted TSLA, Bill Ackmann, Carl icahn do shorting markets! They do it with software help.

They have money, software and statistics to bring market UP or DOWN with power.

It is extremely hard for retailers consistently win them over many years.

The ways to win:

Be lucky, layman lucky, buy and hold extremely good companies like Hanera’s AAPL or WQ TSLA.

Learn DCF - discounted cash flow - buy latest strong companies based on DCF/Fundamentals. This is the way I found many stocks in the past, Being a traders mind set, hard to buy and hold.

DCF is mandatory to buy and hold new companies. Other than DCF, only luck can play role with blind B&H.

Have algorithm - not at all easy - to support our own decisions.

Finally, if any of these not possible, buy 70%-80% VOO / QQQ / AVUV / VGT and balance cash. Every 5% dip DCA.

There are doubters everywhere, including my judgement. I am as of date 9.5% up YTD (stocks side) with QQQ/TQQQ trading.

Lucky is better than smart and hardworking.

How to be lucky?

The surest way is to invest in S&P index. DCA (preferred) or BTFD if you like to time. Timeframe is hold forever.

So many companies freeze hiring, executives leaving, … will there be a barrage of bankruptcies? Or just companies preparing for hard times? Or just cyclical response to over recruitment and over stock because of euphoric demand/ supply chain constraints.

With Omicron going through the roof everywhere how long until China locks down a major city again?

BTW - OT but scuttlebutt from a family member in the know was that the recent Davos Summit, despite all the precautions and everyone being vaxxed, was a super spreader event. Lots of big whigs left with Covid.

Hasn’t Shanghai been on lockdown for weeks?