Refer to ingenius FinTwitters,

Retail traders are trying to catch the falling knives.

75 bps is just the start though.

Market wants to get over the rate hikes, the faster Fed hits 3.4%, the better. Market now expect Fed to up rate by 0.75 to 1% in Jul. destroy all demand and restart in double quick time. Don’t do a slow death aka softish landing.

What is the point of the fed? They only move after the market has already priced in the move. The market had already decided on 0.75%.

News leaks out “somehow”, i.e. the prediction on MSM @0.75% interest rate increase was very accurate.

It was mostly priced in before the leak. The bond market didn’t move that much this week, and bonds are up today. They didn’t commit to 75 bps at the next meeting.

Wrong. Market expects 0.5 to 0.75% in Jul.

?

Powell said he expects the next meeting to be a 50-75 bps increase. It will depend on the data. Bond yields actually went down today, so the market was closer to expecting 75 bps at the next meeting.

Somewhere I read 1% rate hike means 20%-25% drop in market. If this is true, with the FED is raising, it is alarming to economy.

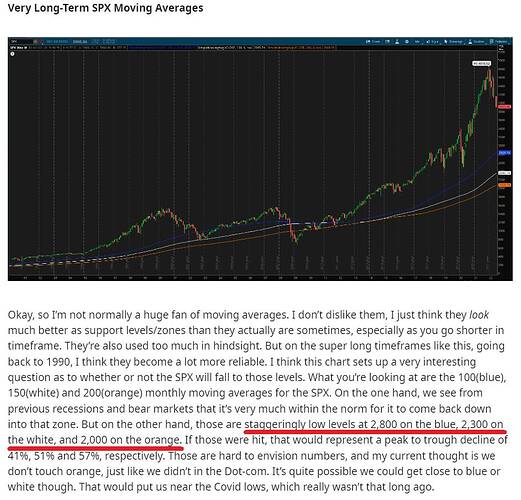

I do not assume everything until now is priced in as QUAD WITCHING will give enough for big Wall Streets to play hard on market.

I’d forgotten about witching…sigh…the next one is June 17th.

That is what Panda was saying last year. May be 1 year too early.

Another day - Why are all stocks down today ? ![]()

.

will the stock market be higher than June 15 on June 18/21 - since witching would be gone by then?

Here you go, Market will be volatile two working days before or three working days after QUAD too.

Jun 18, 21 and 22 are the risky days. Market can make it UP or DOWN - either side change.

QUAD WITCHING creates some technically flaws or opportunities (lowest cost short term puts or spread options) for culprits (shorter) get in and make huge money. They put millions and walk away with billions or loose entire amount !

Among the culprits are well known figures like Bill Ackman, Carl Icahn, why not Bill gates too (shorting TSLA) !

It is hard to predict who does and what they do, how they do.

From an interview of Chanos the short seller that just came out today.

Whenever the market tanks media likes to interview all these “legendary short sellers” and conveniently forget how their performance sucked in normal market conditions. We are seeing tons of scary predictions from them now.

This is what Chanos has to say about Tesla. He said Tesla in this cycle is like Cisco back in the dot com days.

.

TSLA future is in software. Priced in a little of FSD and other software services. Investing TSLA here is to bet that those would be successful. So is either like CSCO or like AMZN.

The opposite is true, see amended quote…