Just because you continually post inaccurate info about the VIX doesn’t make it true. Whatever reddit or zero hedge stuff you’re reading is garbage.

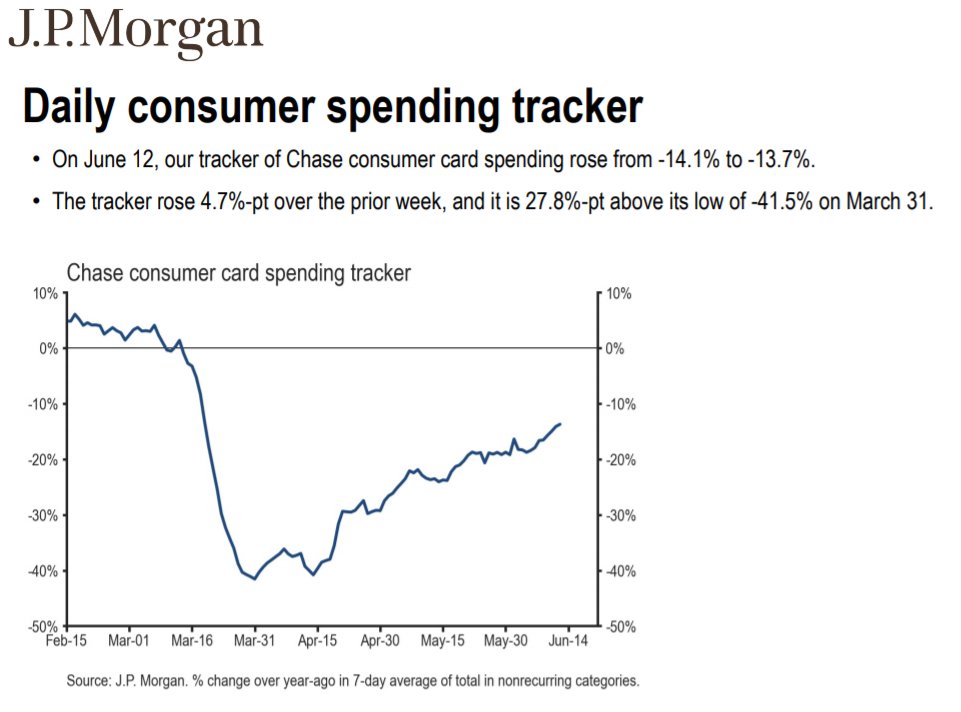

Consumer spending Is having its own V shaped rally. Cc @ww13

Real economy is having a strong rebound, and it’s happening sooner and stronger than most people expected.

Wow, better than I expected.

Still going to be patient. What could I possibly miss out on the upside? If it never comes then it never comes. Going to stop being greedy. Get back to work. Not going to count on being smarter than everyone else because I know that isn’t true.

VIX closed down 2% so the rally is real. Now the market will sky rocket to the moon. The market makers have deemed it so.

FOMO is going to get so bad now.

That’s probably prudent at this stage.

I noted my defensive and natural resources stocks are under performing, left out of the market recovery

This is neither Reddit, nor zero hedge (Your pre-conceived ideas). I expected this kind of answers, that is fine.

VIX is a volatility indicator. If high volatility is good for someone, higher VIX is good. If lower volatility is good for someone, then lower VIX is good. It all depends upon how is one playing with volatility. Some people call VIX fear index, though I do not see why it cannot be called opportunity index, if one knows how to deal with volatility in the market. Higher volatility is generally followed by stock market drop unless volatility begins dropping. But, good traders profit in both bearish and bullish markets. Low volatility means people are pricing the securities nearly same.

It’s a measure of future estimated volatility (based on options prices) not actual volatility. That’s why using VIX to predict market moves is useless. It’s no better than any other human based forecast. If it was such a brilliant forecasting tool, then the market wouldn’t have bottomed when VIX was 80 in March. Between VIX being 80 and the fear/greed index being a 1, it was the ultimate buy signal. It’s just the vast majority we’re too scared to buy. Apparently a bunch of people who use Robinhood weren’t too scared.

I’m honestly shocked Buffet sold airlines at the bottom, since his favorite holding period is forever. Berkshire has tons of cash. They should have doubled or tripled down on them. Maybe he thought he’d get the type deals he got on 2008 which a preferred stock with huge dividends. The fed and congress were much faster to act and acted with far larger moves this time. If he likes boring businesses with cash flow, he should buyout a bunch of gym chains.

Now people that were too scared and missed the bottom are trying to talk themselves out if the fact they missed it. It reminds me of the RE bears in 2013 who were adamant they’d see 2009 prices again.

Good description. Yes, it is implied volatility that is used to price SPX options about a month out is indicated by VIX. I think more than forecasting, all these indicators and price moves are to guide how one should proceed.

Lot of people made bad bets. Carl Icahn lost 2 Billions on Hertz.

With this kind of idea, you are commenting that I do not know. Very good and excellent !

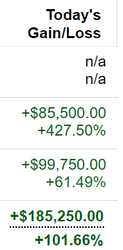

I have been using the VIX ever since I came to know from Dec 2017. Even this dip, we nicely made good money. This is the one time max profit I made this year, feb-mar, but made few times good gains… This is my last update on this, no more update.

Marty died at 70 with $600m. He didn’t forecast his young death. Spend now.

People like him doesn’t believe in passiveness. While trying to intimidate AAPL leadership, he got intimidated by million of retail investors. So he sold out because he can’t actively influence. Has he willing to be just a passive investor, he would more than triple his investment.

![]() you have said this million of time.

you have said this million of time.

2 billion is about 14% of Carl’s net worth. He will make it back. Passive investors (like indexers) make money because Active investors do all the work. If every one is indexing, index funds will go no where.

You misunderstood. I didn’t use those words or concepts.