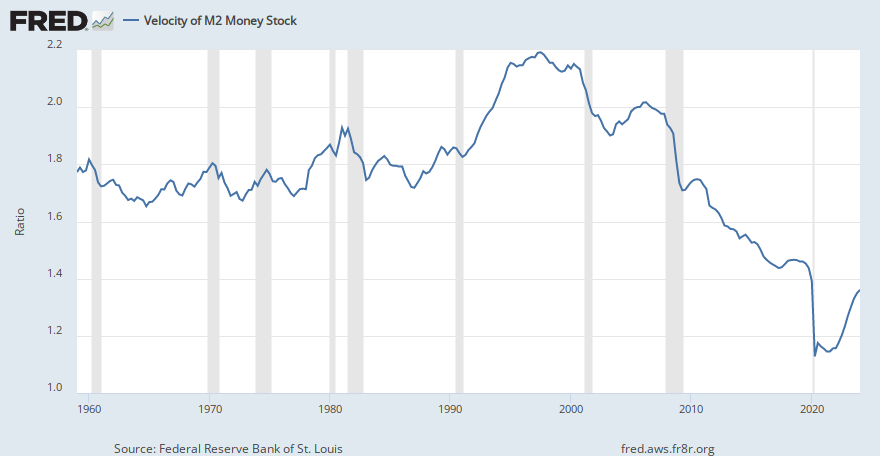

Velocity of M2 Money Stock

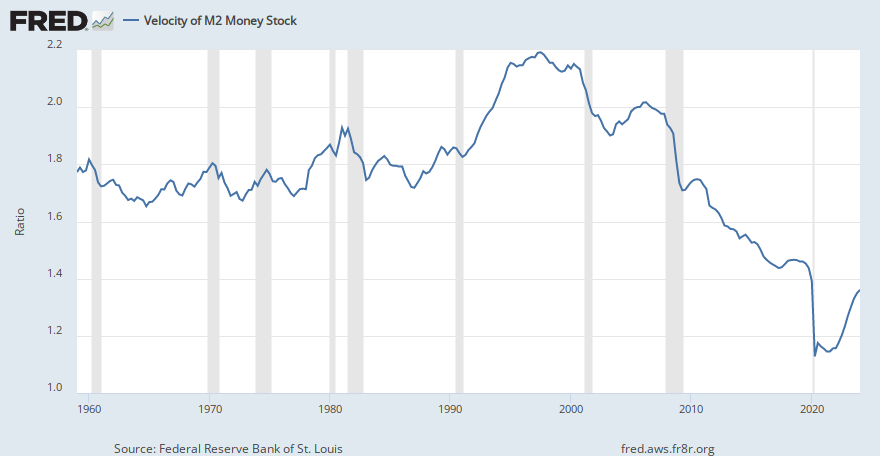

Velocity of M2 Money Stock

.

.

.

Market continues to rocket

The trouble with that is what is the true price of securities when they are priced in dollars and dollars are being printed by the trillions? What is a reasonable yield on the S&P when the yield on cash has been reduced to zero and there’s talk of it going negative?

Velocity of M2 Money Stock

Velocity of money is declining. We can look at the big picture all we want, but that picture gets increasingly complex and more difficult to understand. It’s much cleaner to look at the small decisions being made everyday.

In plain English, the information and the metrics to describe state of economy has been distorted so much that even most informed people have hard time making sense out of it.

‘Cooped-up’ millennial traders have sparked a new pandemic — it won’t end well, warns Princeton economist

https://finance.yahoo.com/m/845cca64-a018-3d3c-9502-162d233606bf/‘cooped-up’-millennial.html

‘La la land?’ The stock market is ‘insanely disconnected’ and due for a ‘reckoning,’ Warren Buffett buff warns

https://finance.yahoo.com/m/5889b0a9-0dc0-3290-9f9a-ba565aad0e7d/‘la-la-land-’-the-stock.html

I am with Warren. Keeping my powder dry. Just put $250k into a vulture fund. The deals may take months to appear, especially in RE.

What happens when the government stops giving away free money. loan forbearance and rent forbearance?

The overall reading for FGI might not read greed, but if you breakdown the components.

Who knows, maybe we will go all the way up to another blowoff top. The climb up for stocks doesn’t look like the bitcoin climb which we can clearly see as greed. It shows that we are still highly prone to tulip mania.

The AdvisorShares Ranger Equity Bear ETF's David Tice is worried the impact of the Federal Reserve's unprecedented policies and speculative investing.

"If the S&P 500 really does surge to 3,400, up 9.1% from these levels, maybe take something off the table," the "Mad Money" host said.

Money managers are getting a bad case of FOMO. Can’t be beaten by day traders, otherwise how can they justify their 2 and 20?

They can’t beat index ETFs and now they can’t beat 30 year old day traders? Why the eff do they even exist? Just crawl back to their holes and weep.

I am with Warren. Keeping my powder dry. Just put $250k into a vulture fund. The deals may take months to appear, especially in RE.

What happens when the government stops giving away free money. loan forbearance and rent forbearance?

On the other hand, what happens if they follow the path of least resistance and never stop giving away free money?

Better have equity and hard assets - not just cash.

I am diversified. But if the Fed keeps going down the path of least resistance the whole economy could be in trouble. The end game is unknown and very risky.

Dalio’s Bridgewater Warns of Possible ‘Lost Decade’ for Stocks

A reversal of the strong growth seen over the years in U.S. corporate profit margins could lead to a “lost decade” for equity investors, Ray Dalio’s Bridgewater Associates warns.

On the other hand, what happens if they follow the path of least resistance and never stop giving away free money?

Hyperinflation and currency (monetary system) breakdown.

The recession is playing out much differently across wealth, race and gender divides. Some are bearing the brunt of the economic contagion, while others hardly feel a thing.