My question to the stock-market subgroup. What went wrong (or right) in last four months. The prevailing thought among (some of the group) was that stock market will tank again (or retest the lows of march 2020) sometime in the July or so. Why did it not happen?

When Coronovirus came into picture Dec-Jan, market has taken some statistics and dropped 30% from peak.

FED & USG intervened, pumped unlimited money, banks/companies are started taking opportunity and reviving their strength.

The original issue remains as is now, extreme unemployment is there between Jan and now, stocks alone riding the wave, but not the economy (2 qtrs dipped).

At some point, stock will correct (I believe, many here do not believe in it) and show exactly in line with economy.

The strange thing is that only tech stocks are making high. There is an upper limit to the earnings of tech stock, but seems no upper limit to what they can be priced. why the excess liquidity created by FED is not going into other sectors?

Good observation, but simple reason.

You have option to buy a home

-

500k price, rent 2500/month

-

750k price, Rent 3000/month

Which one you choose to buy? Very obvious to go $500k home, right? Why?

The return on investment is better…Same in stocks.

a) You have S&P stocks such as airlines, entertainment industry, commercial REITs, Retail industries failed by Coronovirus hit, lay offs and bankruptcy are common.

b) You have nasdaq tech stocks most of them WFH or online or cloud enabled where volume increased, revenue and profit improved.

People choose b) side attractive return on investment than a) side.

These are basic elements of investing.

I have many times mentioned “Valuation books” written by Stephen H. Penman or Aswath Damodaran are best to know how funds choose stocks…Or Intelligence Investor by Benjamin Graham.

As long as earnings of tech stock keeps going up, tech stocks will go up. Market correct when it is over bought situation only.

Gold and silver have gone up even more than stocks. It’s a lack of faith in currency since it’s being created out of thin air and it isn’t backed by anything. As high as valuations are how do you value cash when it’s real yield is negative?

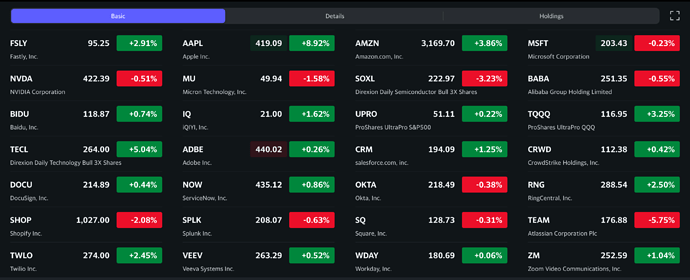

![]()

it is far easier to manipulate tech revenues and profits than other sectors thats why Apple dont disclose Iphone count or Tesla vehicles by market specific. Tesla sold 30K vehicles in China in quarter but where the other 60K vehicles sold. No one knows…

Again Tech stocks need Ad revenue or new business creation to utlilize cloud insfrastructure.

so from where that Ad revenue is coming from when everything is closed?. Just energy industry alone has massive losses.

Not saying people buying power is the same, but when one sector down, it’s opportunities for others. A lot of ads from online deliveries / shoppings, selling you better internet connection, online learning those are replacing ads like travel.

Talking like the orange primate ![]() Apple of all the companies you can quote, won’t cheat on unit sales. There is standard convention and outside auditing. And many analysts checking supply chain. So can be easily verified.

Apple of all the companies you can quote, won’t cheat on unit sales. There is standard convention and outside auditing. And many analysts checking supply chain. So can be easily verified.

Was wondering why market turns so red from green in the morning. Surely worse than profit-taking. Found…

Trump to Order China’s ByteDance to Sell TikTok in U.S.

As TikTok grew more popular, U.S. officials grew more concerned about the potential for the Chinese government to use the app to gain data on U.S. citizens.

What did Fed and CIA do? Collect personal info on citizens and other nations’ citizens? Need a thief to catch a thief.

Potential? Not doing yet.

This is a big subject.

To understand, people have to know how gold standard was followed pre-1973 and what changed after 1973 gold standards are dropped, US $ came into system of currency.

In short, gold goes to peak during recessionary phase as people move it as safe investment when they can not buy bonds (low return) and stocks (possible drops due to economy). Once recession ends, Gold drops, until then it is going up and up.

People move the money where better returns are there.

These are company specific, I do not want to comment as individual users must deep dive on fundamentals about that company (TSLA or AAPL). I am really off of individual stocks.

Why I like Warren Buffet, he is super master/computer of investment !

Famous Quote of Warren buffet “Be Fearful When Others Are Greedy, be greedy when others are fearful”

Remember last week exactly same Thursday and Friday market went down, news paper reported China -USA relationship etc.

You have the same Extreme fear now (Surely worse than profit-taking). Next day market green !

Middle of Wednesday you posted => Mad bull awaken! Folks. Make $ not talk politics.

Mark your statement “Mad bull” ==> next day market dropped.

BTW: This is posted for discussion purpose. No direct or indirect hint, neither stock advice, nor financial advice.

Fear? Look properly. The one that matter.

.

.

.

Btw, realized gain from TQQQ = $15k, about $5k per week for three weeks

USD existed before 1973 ( I think there was typo in what you said). What changed was decoupling of USD and Gold. Nixon did it. Why, pressure of left economists. Same reason FED was created. Without Gold Standards to worry about, FED can print as much money as it likes to save big business in the pretext of helping poor.

20 years ago gold was at about $275 an ounce and the S&P 500 was at about 1500. Look at where the two are today. Gold bugs have reason to celebrate. It’s more than just a temporary blip.

Inflation adjusted gold is still lower than in the 80s. Read what Buffett said about gold.

Market is a complex system with millions of participants. To simplify everything down to one narrative is often just trying to confirm one’s own biases.

You are saved by AAPL, faster than S&P !

Remove your screen shot, better for you, We trust your figure without proof !

Okay, I do not share my proof, but here is what I can say. This July month, S&P went up 4%, Nasdaq went up 5%, but my one investment account (options allowed) went up 30% and another account (options not allowed) went up 16%.

my one investment account (options allowed) went up 30% and another account (options not allowed) went up 16%.

Talking from the June low? About +25% ![]()

you are assuming these business are new to online. it will be very small increment. check yelp.

The scale of destruction in Energy, Aviation, Tourism, education, Telecom, pharma and healthcare (closed hospitals) are on magnitude more than any thing else. even Apple stores were closed for months. with little inventory. they delayed new Iphones. so where is the forward quidence that justify earnings?