I believe market would zigzag up to a new ATH i.e. believe that late Sep low won’t be visited.

NIMBY is not a bad idea to fight mindless densification.

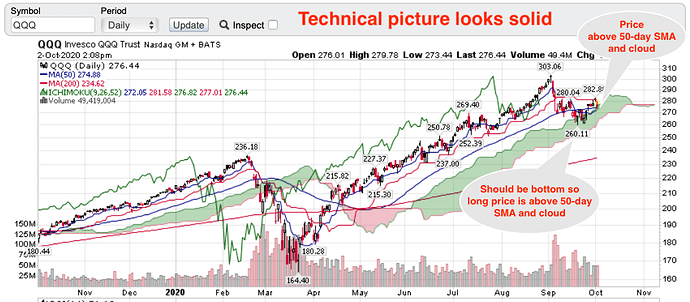

So far, technicals are not damaged.

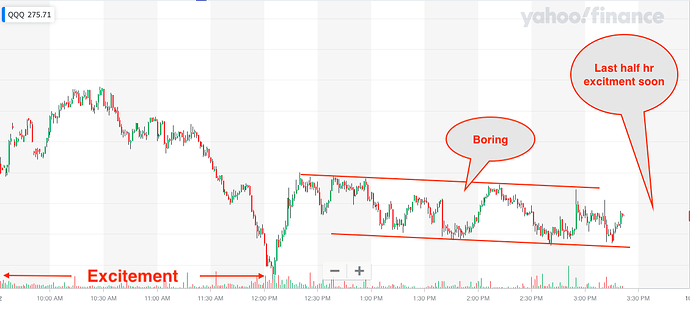

Didn’t long any calls. Probably will if drop to $272-$273.

Apparently, industrial sector is not affected.

S&P index hardly drop.

Just profit-taking in tech stocks?

Blah blah blah. How much market capitalization has been created in the Bay Area over the last 40 years? If I looked at your population trend line in 1995, think about how much value I would have missed out on.

Since you are so smart and have laid out your grand theory, where are you investing right now based on your analysis? Don’t be shy now…

I did not claim any smartness. I just presented the history as it is known. If you find something wrong, you are welcome to present the correction.

The reality was shown since 1900 onwards, every recession. => Means, right from 1900 US Leadership is there after every recession.

Every recession is followed by exceptional growth period. This is what history shows and will continue to do the same.

I remember one guy was discussing in redfin forum that $530k SFH at Fremont was too much at that time (2008-2010), but now you can not see any SFH at that time.

Similarly, $1M homes will be history after 10 years in SFBA.

Typo? time = price?

Luckily he is not in Singapore in early 1980s. $200k is too expensive. Need to pay over $1M for the same house in mid 1990s.

I landed in CU in 2002, SFHs cost about $800k-$900k. Now, $2M can’t get one.

@Jil,

Get any TQQQ or SOXL? In fetal position?

One of the biggest challenge wealthy people face is how to keep the value of their wealth intact. There are several ways wealth can be lost: thieves, government, bad investment decision, or just lost of value in the asset. And one less desirable source of pain is having children who do not know what to do with the wealth. I know a person who lives on SSI but has a millionaire dad who was on big positions in a few companies. The son can get a job. He does good in interviewing but cannot keep a job for more than 6 months. One should be good in earning as well as protecting. I think the amount of understanding and skill required to keep wealth intact is no less that that required to earn it in the first place. That is why everyone cannot be wealthy.

Yesterday, luckily I got the clean signal, purchased huge SQQQ and QQQ 315 puts (yes,315) and sold everything today 60% overall profit, staying away in cash mode. Not buying anything today, waiting for Monday.

Fear of Trump Covid (fuel over fire) may likely extend Monday too, I guess. In addition, I need to wait for one more day for some settlement.

BTW: I may be wrong too, take your own judgement.

Is a clear-cut ending diagonal in EWT. I close all bullish position but didn’t long puts or long SQQQ (my mind somehow is not wired for short ![]() )

)

IMO, still bullish drive (Uptrend) is there. Still holding lot of AAPL, TSLA, RUN, PYPL, TDOC, DOCU, MSFT and SNOW. Initiated some PLTR between $9.02 and $9.20

As per my chart, today is supposed to go down - for a change, but added

heavy fuel by Trump Covid issue.

Normally, when I sell, I do not buy immediately and wait one or two days for some settlement.

BTW: I may be wrong too, take your own judgement.

yup. $1m will be history sooner than later depending how we managed the climate change and how long Fed want to prop up zombie firms of Bayarea. and based on these two conditions local taxes and infrastructure.

Take a drive around North bay first see what people thinking. than look around Oakland and Berkeley hills. It is reverse gear.

Even Belmont-San Carlos had small fire and area was evacuated and alerts were flying around on texts. will any one live such place?

Yes, next up wave is likely powerful. In EWT, completed wave i yesterday, today is wave ii (down), after that is wave iii (up wave, usually powerful i.e. rallies very fast and high).

I think it’s ok to be skeptical of Bay area growth and I am fine reading these contrary opinions. But at the very least one should stay invested somewhere - either in stocks or in RE wherever that is. Holding cash in the current environment doesn’t make sense. Also if you are going to champion Russia or Europe, it would be make more sense to produce specific investment strategies and plans that we can all benefit from.

Here is my stand:

Correct, every recession brings down the price of stocks and real estate as a temporary (2-3 years) phenomena, but not permanent.

For waiters (primary home waiters) or investors, the temp dip is an extra-ordinary opportunity to get in. Losing such low cost opportunity is worth nothing. This is exactly like warren buffet waiting for opportunity. History in 2000 and 2008 showed exactly the same.

There is a permabear or doomsday that SFBA is going to be decimated with elsewhere competition, that I do not agree. Still Silicon valley has upper edge on the technological innovation that benefits this location.

There is no rule that says you have to remain invested all the time, nor you have to invest in something every day. The ultra rich and wealthy people supported the creation of FED and other money printing organizations in the world so that they can control the money supply at the will. They are now falling into the same ditch that they dug for others. Had they (the ultra rich and FED supporters) not killed the CASH, there would be no real need to be looking for investment all the time. You would be only investing when there is a compelling investment opportunity.

I like what you said about maintaining wealth. So I’m curious: what is your strategy for doing that.

Ultimately the value of a dollar decreases over time. So in order to maintain your money, you need to grow your money. How do you think people should grow their money?

You’ve said plenty about Bay Area RE and stocks not being the path forward. What is your strategy?

Bitcoin, duh. Lol.