The point I was trying to make is that you can buy a put only if someone is there selling a put. Once the downward movement of market is confirmed or widely accepted, not many sellers will be around to sell puts.

That’s not how options work. You can always transact because the other party is the market maker who has to sell or buy from you. When share price is volatile, the bid/ask become very wide and the premium of the option would shoot up accordingly. To trade options professionally, one need to know the GREEK of option.

Btw, don’t worry about the market maker, he knows how to hedge. Having said that, there is max cap of worth that each market maker can transact and an overall cap for all market makers. In practice, not relevant to retail investors/ traders, relevant to hedge fund managers managing billions of dollars.

Could they be hedging their position while slowly trying to exit the market?

Being big funds, they do not want to loose money and by default sell slowly so that they max output.

See finviz FB and see how Mark Z sells his share, daily a portion. If he sells all of a sudden, FB will touch $1 in 2-3 days and he can not sell it. He almost sold more than 7 Billions in 2019.

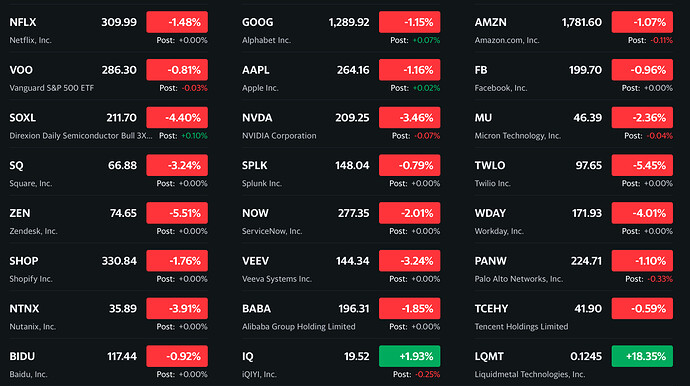

You started with book, good read it, slowly test with hypothetical market, and land with VOO, then test/actual with VOO and other stocks. You need to have comfort in dealing with stocks at least 6 months.

Once mastered stock/etf side, you can think about options as this is very sharp to lose/gain.

Any way, you need to know what is best for you. It is exactly like driving a car from local road to highway, you need to find your own way.

Substitute rich guys = Wall Street

Sun rose from the West

Experts, however, weren’t too concerned about the weakness, citing a largely optimistic macroeconomic picture heading into the end of the year.

Jim Cramer

I’m looking for more reasons for it to go higher other than constant reiterations of analysts…

RBC Capital Markets’ Lori Calvasina

We need to see a bit more of a dip, I think, before you jump in and buy.

Jim Paulsen, chief investment strategist at The Leuthold Group

I think you’ll want to buy on the dips here if we get some weakness

@Jil isn’t concerned. Apparently @manch isn’t concerned since he is happily posting other topics.

However, I was told the crowd is usually wrong ![]()

Wallstreet and most of the media, Analysts, CFA and fund managers are telling retail investors “Stay Course”, “buy and hold”, “do not time the market” and other similar stories.

Wall street makers and big fund managers are using computer power to analyze big data with set of dedicated analysts working on them.

What they are not telling is the hidden hedge action like what Ray Dalio story. Definitely, He knew well ahead and hedged all his stocks with 1 Billion PUTs.

They easily spot the issue and hedge against down fall. It is really hard for individual retail investors to know ahead.

Manufacturing is weak because of Trump’s stupid tariffs. Consumer spending is holding up well still. We will kick Trump’s ass next year and America’s golden decade will officially begin. Fasten your seatbelt.

Do you actually have candidate that can beat Trump? BTW, Bernie and Warren are pro tariffs

Billionaire Bloomberg.

The numbers are for manufacturing within USA and tariffs apply to imports.

How would have manufacturing come out better in the absence of tariffs?

Trade imbalance is a real problem, but tariffs are the wrong medicine. Biden can beat Trump in his sleep.

Because trade war adds uncertainty, and you can’t plan major expenditure with that overhang. The Fed, I think it’s the St Louis one, publishes periodic interviews with businesses and the number one concern for a while now has been the uncertainty.

What happened last time you said something similar? ![]()

Bet on reversion to the mean.

He can’t get minority votes with stop and frisk.

There is not one inspirational Democratic candidate. If the Democrats don’t find another Obama they loose.

There is one. Michelle Obama.

The report that tanked the market this morning. Which reason got cited most often as problem?

WHAT RESPONDENTS ARE SAYING

- “Business level is similar to October.” (Computer & Electronic Products)

- “Chemical industry has been slow globally, but the curve seems to be flattening.” (Chemical Products)

- “Economic uncertainty continues. Our outlook on future business is cautious, yet positive.” (Transportation Equipment)

- “Economy is holding up. Business is staying constant. The same challenges persist — foreign exchange, trade uncertainty and trend changes [for example, sugar reduction].” (Food, Beverage & Tobacco Products)

- “Slowdown in business has us revising our 2020-21 capital spend.” (Petroleum & Coal Products)

- “The order book continues to shrink below our forecast levels. We’re unsure at this point how much of the slowdown is tied to certain events [like the General Motors strike], year-end inventory reductions by customers, or a worsening economy. We don’t expect clarity on this until early 2020, when we expect to either see restocking orders [a good sign] or not [a bad sign].” (Fabricated Metal Products)

- “Demand has stabilized for the last half of [the fourth quarter], and production will be stable for the rest of this year.” (Machinery)

- “Heading into the holiday season, we are seeing the backlog decrease as new orders for 2020 seem lighter than in past years.” (Plastics & Rubber Products)

- “Markets have downshifted further. The continued confusion surrounding China trade has kept export markets on edge. Profits are elusive. Cash-flow planning is paramount. The general economy is slowing down.” (Wood Products)

- “Incoming orders and production have ticked back up. Tariffs are still a question.” (Furniture & Related Products)