If you’re self-employed and make decent money, you could shelter a lot of money with individual 401k.

Then you throw in an IRA and HSA. Mucho dinero in tax-advantaged space.

If you’re self-employed and make decent money, you could shelter a lot of money with individual 401k.

Then you throw in an IRA and HSA. Mucho dinero in tax-advantaged space.

Small caps next to go  ?

?

Some internet companies, in particular, take the further step of reporting adjusted EBITDA, providing a glimpse of their earnings if they didn’t have to account for stock-based compensation. That’s a major expense in Silicon Valley, where equity is such a big recruiting tool and a way to pay founders and top executives.

Also reveal how well founders pay themselves. Even if the companies go insolvent or they got booted, they make a killing e.g. founders of Uber and wework.

So long the traders accept this kind of valuation, is good to go, see who can jump out fast when the tide subside. Nice ![]() game.

game.

Or don’t use an IRA or 401k or HSA at all. Buy and hold an index fund. When you retire the gains will be taxed as long term cap gains - not ordinary income - and in the meantime, save dividends, it grows tax free.

Even though buy/hold may increase the value over a long term, Market is going through cycles and we can take advantage of some trades during the long term using tax advantageous avenue.

Every year, just 3%-5% upside over long term hold will provide huge difference at the end.

I hold some of the stocks, but buy through selling puts (hanera’s suggested) and selling covered call. Last week alone, after getting restricted options in tax advantaged account, I have earned appx 1% using such options. If it is taxable account, they are taxed. In Roth IRA, where small account, I earned 2% last week using covered call. These add additional earnings which are not taxed in tax advantaged account. I can easily earn 5% by making covered call/selling puts.

If the bulk of your investment involves active trading than yes, IRA’s are the way to go.

Companies in January announced just $13.7 billion of repurchases, the slowest opener since 2013.

A discussion of all that's moving the market today including the coronavirus, Morgan Stanley buying e-Trade and more.

Suddenly every @jil worried and started dumping stocks

Suddenly every @jil worried and started dumping stocks

Wrong, yesterday , I nicely sold some stocks, and buying today ! Remember, yesterday I was telling situation was scary and sold some stocks to keep cash that nicely helped me today !

Buffet saying “Be fearful when others are greedy and greedy when others are fearful.”

It was good timing, but I did not expect this much fall today.

Somehow is not low enough for me to buy any.

Guess the difference is not day trading, for position trading, need to be lower.

Do nothing.

Somehow is not low enough for me to buy any.

Guess the difference is not day trading, for position trading, need to be lower.

Do nothing.

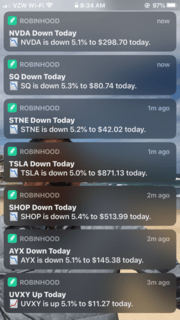

All of these went up, and lot of retail investors would have bought it by FOMO. Now, market makers bring down 5% each to scare them, get their money.

Yesterday, I almost released 20% , and today nicely bought them. It is free money coming out of volatility!

5% warrant a buy. Only two: SOXL - Added. WDAY - None. My GTC purchase price is not triggered.

Options have different tempo to underlying shares. I prefer to buy during low volatility period and sell into high volatility. So today is not a good day or at least in the morning is not good. I would end up buying “expensive” calls. Once the stocks start to recover, IV would drop and calls become “cheaper“ than when price is tumbling - high volatility and wide bid/ask. Occasionally when price tumbles and then recover to about same price the same day, calls become worth more  though price hardly change - IV has increased

though price hardly change - IV has increased

The top-performing sectors in the S&P 500 so far this year are an unlikely pair.

Stock market dives — a 20% plunge in some hot stocks could be next

Maley thinks we could soon get a 15% to 20% correction in red-hot momentum stocks such as Apple, Tesla and Nvidia as the broader market adjusts. “We are getting ripe for a pullback, and those stocks will come down the most,” Maley says.

He plants ![]() toxic

toxic ![]() in readers. 20% is a bear market

in readers. 20% is a bear market ![]()

As of Wednesday, the S&P 500 traded at 19 times 12-month forward earnings, the highest the P/E level has been since May 23, 2002.

What was the interests rate in 2002 and what is the rate now?

What was the interests rate in 2002 and what is the rate now?

I know is higher then. Tell us your academic view of that implication.

https://www.cnn.com/2020/02/21/investing/dow-stock-market-coronavirus/index.html

Other countries think they are A-OK! Slack. If Xi panics and put China economy on ice, you should too.

Added some Brk.B

What was the interests rate in 2002 and what is the rate now?

https://www.macrotrends.net/2015/fed-funds-rate-historical-chart