You are totally not qualified to say this ![]() Bet you didn’t read my past posts. Shockingly accurate. Say it before all these virus or Sander scare. IMHO, all these are just reasons or excuses as you may call it. The main driver is mood or sentiments or psychology or God… whatever you want to call it.

Bet you didn’t read my past posts. Shockingly accurate. Say it before all these virus or Sander scare. IMHO, all these are just reasons or excuses as you may call it. The main driver is mood or sentiments or psychology or God… whatever you want to call it.

Two opposing intent. Trump wants a strong stock market to help him in election, CDC wants to parlay public fears to beef up their infrastructure.

Dow and SPY futures are down 1.3%.

You’re starting to sound like Rush Limbaugh.

I can not prove what I say here, but here is what happening…

Many retail investors are reading scary posts like this, placing sell orders night, which is reflecting in futures !

They are poor retail investors, scared by news/media.

When such scared retail investors are selling, market makers, who sold last Thursday & Friday, are buying at low price…

[edit: I was wrong] crash started. It is beyond my level.

No fundamental analysis, definitely, not DCF computation, can explain above. Is just simple logic, people staying at home have nothing to do so they trade stocks (some play video games and watch videos).

Some stocks re-bounced strongly - some hope.

Grabbed some VOO and VFIAX for my children brokerage. No stocks because they don’t like stock trading. Index fund/ETF suits them well.

Edit:

Examined a few charts, cautiously optimistic that correction might be over.

This was why I thought retracting to October lows was not enough. If the runup from October to January was not based on fundamentals (and at that time we didn’t have the Coronavirus), that level should be used as a benchmark and you should expect at least 10-20% drop from October lows with the drop in productivity due to the virus.

If Oct is the not enough, few months prior is great because most of my stocks bottom in Oct, prior months mean UP UP and Away.

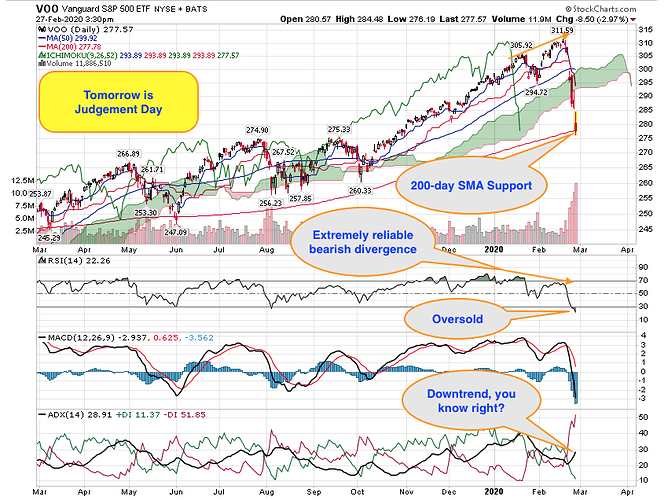

The 200-day is barely holding. Tomorrow could be interesting.

I forgot to peg down some of my GTC REIT orders and got hit this morning. Maybe I’ll buy some BRK.B if it gets back to the 190s

I forgot to peg down some of my GTC REIT orders and got hit this morning. Maybe I’ll buy some BRK.B if it gets back to the 190s

Already bought at $211.

2:30 pm NY time margin call, bottom instead?

Your idol Cramer is buying.

Usually I read after market close. My instinct is to buy after reading your Fear indicator is extreme, @Jil reminded me to look at S&P (re-bounce). Bought VOO, VFIAX, BRK/B, and AAPLs.

But what if the world ends over the weekend??

![]()

![]()

![]()

Then it doesn’t matter. We are already dead. Since I have nothing much to do, added to TWLO, seriously just a dumb move since trading price is not much different from last week. Bought TWLO at $113 last week, now is $111.50.