The Dow Jones Industrial Average tanked nearly 500 points in early afternoon trading Thursday as investors showed concern that the plunge in the 10-year Treasury yield was signaling an economic growth slowdown later this year. Driving that potentially dreaded macroeconomic slowdown would be two factors, traders reasoned. First, the Delta variant of COVID-19 that is sweeping across the world. And two, the Federal Reserve moving to taper its bond purchases before year end.

Generally, strategists don’t believe one rocky session marks the start of a correction (10% pullback) or bear market (20% pullback).

“I’m not kissing off this bull market. I still think it’s a bull market that has further to go,” Johnson says. “It’s not the start of a bear market that’s going to be accompanied by a recession. That just simply is not in the cards.”

When economy is reopening and people are coming back to work, bears worry about runaway inflation.

When Covid comes back and economy seems to be slowing down, bears worry about slow growth.

Seems like bears just trying too hard to look for reasons to be pessimistic.

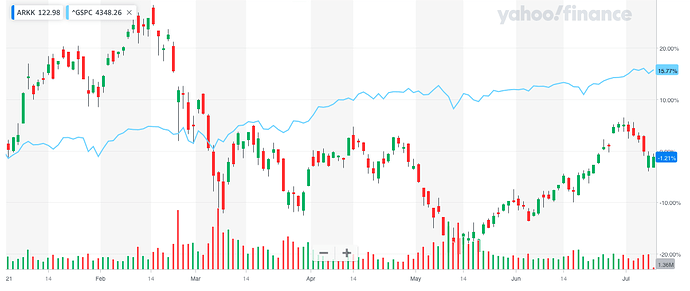

Today Jul 12 is a bad day. Indices are green while nearly all my stocks are RED.

Green ones are AAPL NVDA SQ TWLO DE

ML charges 0.875% p.a. for a loan if you have $100 million stock portfolio?

Ofc startup shouldn’t earn anything. We all know it. These two are clowns. Didn’t they know anything about ROI or watch the TV serial Silicon Valley? Talk to Mark Cuban.

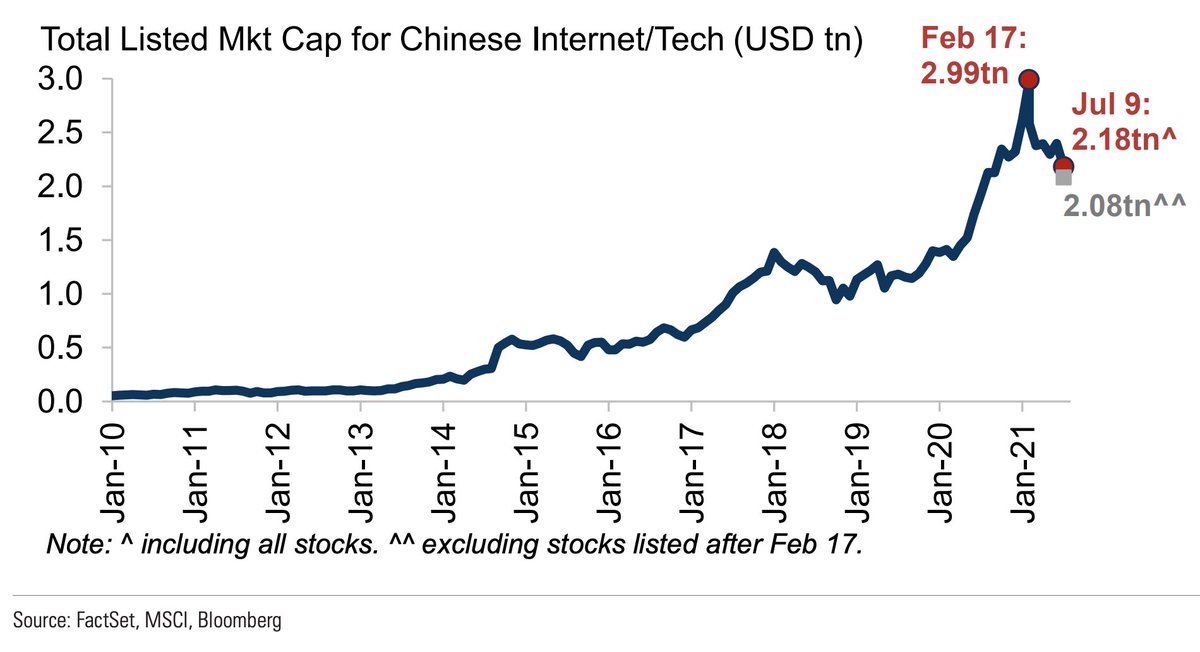

Chairman Xi is busy killing China’s tech industry.

The liberal ideas of tech leaders are driving him mad.

What Deng has built up over 30 years, Xi is more than happy to tear it down.

Bloomberg: China Considers Turning Tutoring Companies Into Non-Profits

“Making the sector non-profit is just as good as eradicating the industry all together,” said Wu Yuefeng, a fund manager at Funding Capital Management (Beijing) Co.

New Oriental Education & Technology Group sank as much as 50% in Hong Kong Friday, while Koolearn Technology Holding Ltd. tumbled 31%.

A good article from Noah. I have seen multiple people inside China made the same argument, so I think that’s really how people of power in China view things. Basically the Chinese government wants “hard tech”, not the fuzzy consumer internet stuff like WeChat and online shopping. In typically command economy fashion they just cut the knees off of Tencent/Alibaba/Didi etc.

But I think they are greatly mistaken. Economy doesn’t work like that. Tencent etc creates massive economic value, and that’s why they are so handsomely rewarded. Cutting them down makes the entire economy poorer, and thus provides less resources for China to spend on hard-tech like semiconductors. Besides, consumer tech companies are the biggest customers of hard-tech companies, providing them the fund to keep developing their wares.