Datadog is difficult for a non-dev to grok. I still don’t fully understand what’s so hot about the company.

![]()

.

Odd that dinosaur companies, AAPL and MSFT, beat the younger companies (AMZN, GOOG, META) in market cap and innovation. The belief in the market is dinosaur companies would be bureaucratic and slow to change, hence would be disrupted. What I see is that they are getting stronger and stronger, and move pretty fast.

Btw, MSFT investors are giving tons of premium for holding 49% of OpenAI. From another perspective, if you want to invest in AI, buy MSFT ![]() in addition to NVDA

in addition to NVDA ![]() ofc.

ofc.

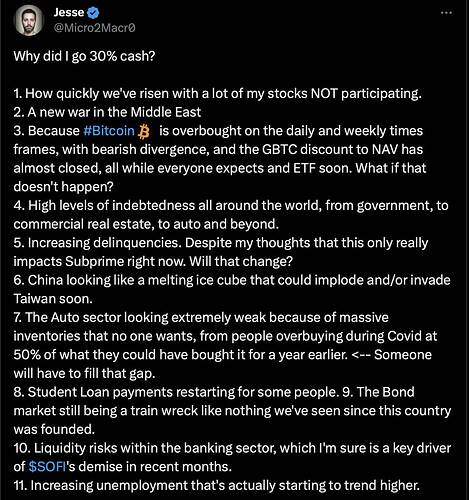

Finally! There’s no way consumers can keep spending at this level. Tapping home equity is expensive. CC debt is at record highs. Student loan payments are resume. Consumers are going to hit their credit limit.

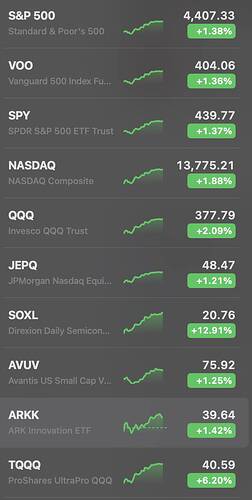

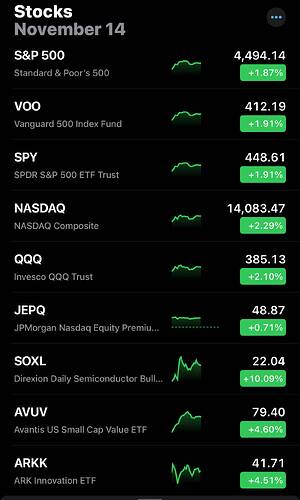

Another good day because of lower than expected CPI due to sharp drop in oil prices

Bitcoin, GBTC and COIN decline for the same reason ie lower than expected CPI.

SoFi has an ETF of the top 50 holdings of their customers:

It gives a good pulse on what stocks younger people are buying. They rebalance it monthly.

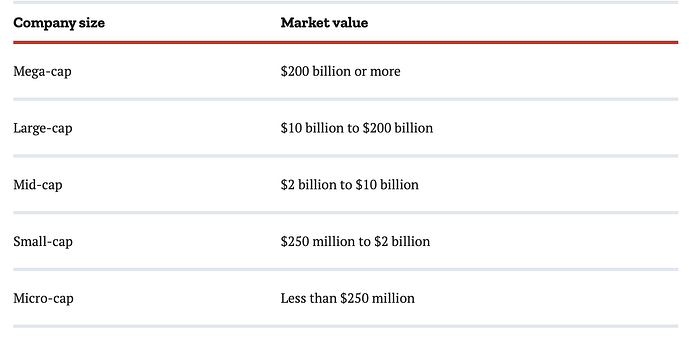

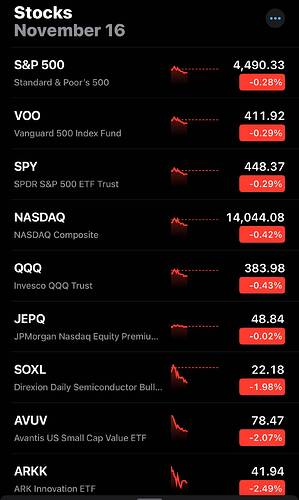

Market again favors mega caps. AAPL GOOG MSFT NVDA are green in the sea of red. These tech companies are clearly more innovative, cash-rich and have strong cash flow. They can capitalize on a booming economy and easily survive a recession. Companies that can only do well in a low interest rate booming economy may not survive a recession.

This is why you’d can’t trust surveys. So much for people spending less this year. There’s a reason most people have under $2k saved for an emergency. No one will say that’s their financial plan in a survey. They don’t stick to the plan though.