Magnificent 7 outperform growth stocks ![]()

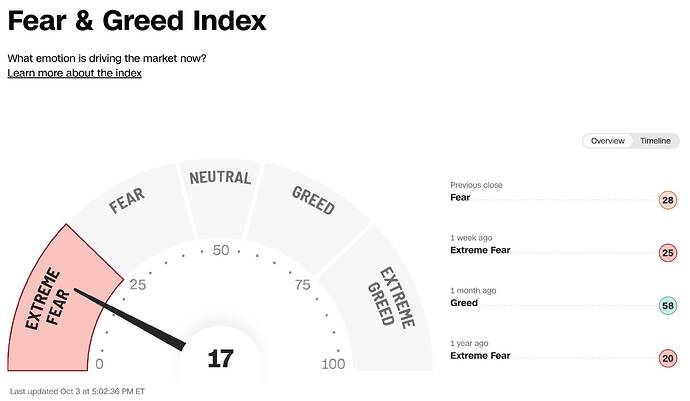

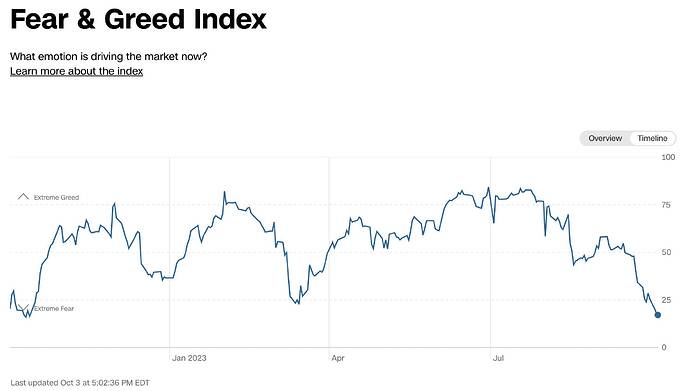

Looks like the 17 reading on F&G 3 days ago caught a local bottom at least? Hope it will hold.

Black swan is about ripped Tom Lee’s face.

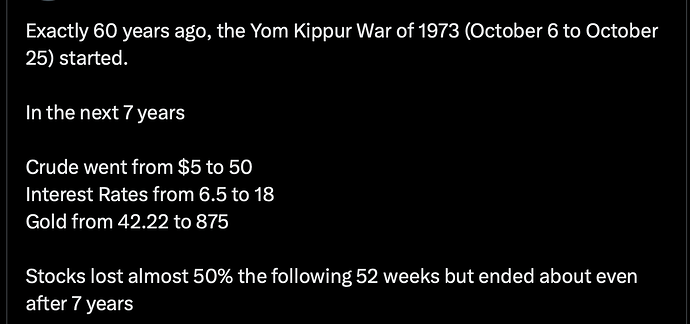

Oil price to $100 per barrel.

Fed hike rate to 6%.

Market crashes 20%.

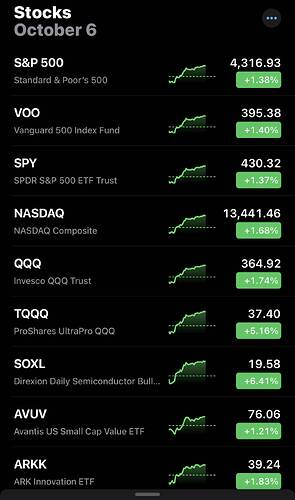

Magnificent 7 ![]() Cybersecurity stocks

Cybersecurity stocks ![]() Rest mixed.

Rest mixed.

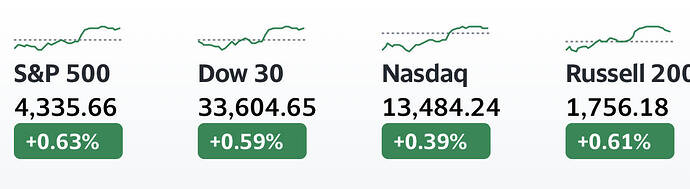

Banks do well. No bull market without banks participating. So this is a good sign for bulls.

Consumers continue to spend at a relentless and unsustainable pace. Ok, I’m a huge contributor to that the this year. ![]()

![]()

![]()

![]()

JPow keeps trying to knock down American consumers but we just keep spending like there’s no tomorrow.

![]()

Tom Lee’s face is ripped today. He is a permabull.

Permabulls like Tom Lee get their faces ripped again.

Oddly USD, Gold and Bitcoin rally. Thought prices of gold is inversely correlated to USD?

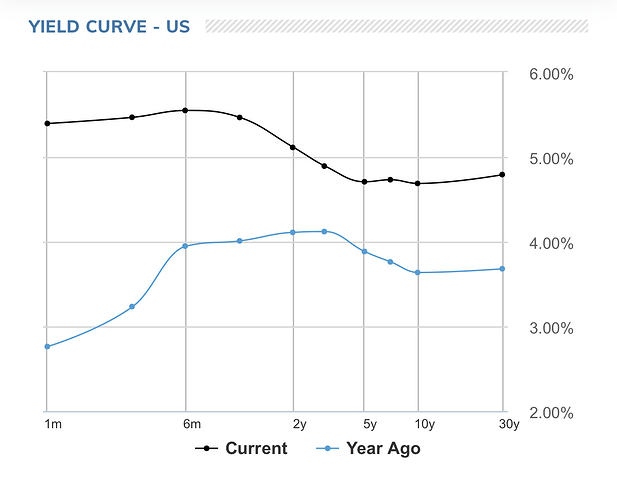

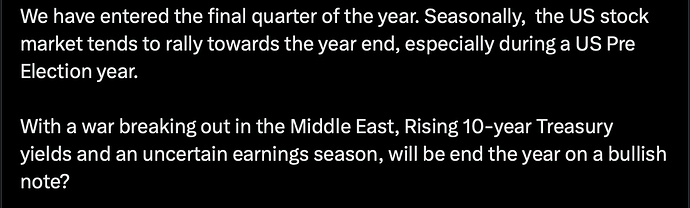

5% on the 10-year Treasury is a key level for Wall Street and is a strong signal that investors may be losing faith that the Fed could cut interest rates in the near future, and pressure equities as a result.

Market is deaf. Fed has already signaled “higher for longer” for many meetings. Pretty obvious no cut in 2024.

I think there is a decent chance we are done with the “higher” part in “higher for longer”. Financial conditions have tightened tremendously with 10-year yield shooting to the moon. Don’t think JPow wants to completely tank the US economy.