The stock market is extremely overvalued. PE ratio of 38 is double the average. It just needs a spark to blow up the bubble created by the FED. Extreme greed has created the birthplace of extreme fear.

The thought here is simple: consider the Feb. $10 puts. GME stock would have to drop by >95% for those puts to be in the money. You’re getting paid ~$0.70, or 7% notional, to sell them. Assuming they expire worthless, that’s a 7% gross and, given they expire in less than a month, an IRR that is so insane I can’t bring myself to put it to paper

Of course, that assumes they expire worthless, and at this point, I’m not ruling anything out for GME. But the board has to be aware that there’s an opportunity to raise an epic amount of money and transform the company (if they don’t, they should get sued for breach of fiduciary duty).

Selling those puts is basically a bet that GME does its fiduciary duty and raises money. Whoever buys those puts is basically buying bankruptcy protection; GME could raise enough money right now to take any potential bankruptcy off the table for the next 100 years. They could raise enough money that they would have enough net cash to cover those strike prices 5 times over.

The moment GME does, the stock probably drops significantly, but the volatility collapses and those puts are worthless.

I have never been a big fan of the stock market. Always thought it was a big casino run by corrupt New Yorkers. The hedge funds are evil. Everyone hates them, even their clients who stupidly pay them 2/20. I hope Congress squashes them along with the 3million idiots on Reddit who are on a Spartacus like revolt. They are basically willing to commit financial suicide to take down the hedge funds.

For all the idiots in the right and left in this ideological war about the economy and politics… think about a real war and what it’s like

in Stalingrad during WW2, the average life expectancy of a Soviet soldier was 24 hours and that of an entire air squadron, one week. For officers it was a slightly higher three days. Most Soviet soldiers died within a day of their arrival at Stalingrad.

The Red Army considered the survival of a tank in a tank-on-tank combat to be under 10 minutes, and most tanks made during the Second World War burned very well regardless of the design precautions.

BTW, they were the winners. The losers were systematically murdered in prison camps.

You can make money in a bull or bear market but pigs get slaughtered at the trough

Pretty informative interview of an investor based in HK. His hedging strategy is simple yet effective.

Two questions.

-

Do we, the public, know about the systemic risks before the financial crisis?

-

Do the ability to short more than 100% of outstanding shares or long calls/ puts leveraging more than 100% of the outstanding shares reveal a systemic risk?

This is not a systemic risk? This type of push or crash prices is not possible in Singapore. It use to be possible resulting in many suicides and bankruptcies, since then Singapore put in many measures to stop such excessively speculation. Do you know Singapore exchange do not offer option trading? For a good reason. I believe Xi wants to prevent such issues too… hence the financial reform and the slow opening of the financial markets. I know you will say not sophisticated, better stable than “sophisticated” and “advanced”.

Short-selling is not banned in Singapore, but SGX already requires investors to mark sell orders as “long” or “short” and publishes both daily and weekly reports on short-selling activity.

SGX intentionally reveals all your cards. Dare you to short excessively.

Possibly yes !

It depends on how we educate ourselves and how realistic we are about current economy.

Take 2008 crisis => My real estate lawyer, who was De-Anza faculty, informed us in the RE financial class during 2006-7 period how economy will collapse with sub-prime loans ! He was perfectly right before Shiller formula was even know public !!

Year 2000 => Just before dot.com crash, My friend was selling his huge holdings in cash and informed everyone - in a birthday party - crisis will sweep this country, sell all your stocks and keep it in cash. He was telling “Cash is the king during uncertain time”. He was right and that was the first time I saw some people are able to make it. Now, this person has appx 50M+ NW and owns two CU homes each valued appx 4M

There are people with knowledge, experience and practical assumptions.

Why you tell forum my canny forecast and net worth? Anyhoo, you make a mistake, those CU SFHs didn’t worth that much.

Silver is next.

Shut down Reddit. Russian bots, millennials. And anti government conspiracy nuts. Who needs Reddit?

Oh boy, my dad has been bullish on silver for YEARS. He’s been telling me to get silver coins, because when everything goes to hell that’ll be how we can buy things. I wonder how much he’s hoarded away.

Interesting stuff:

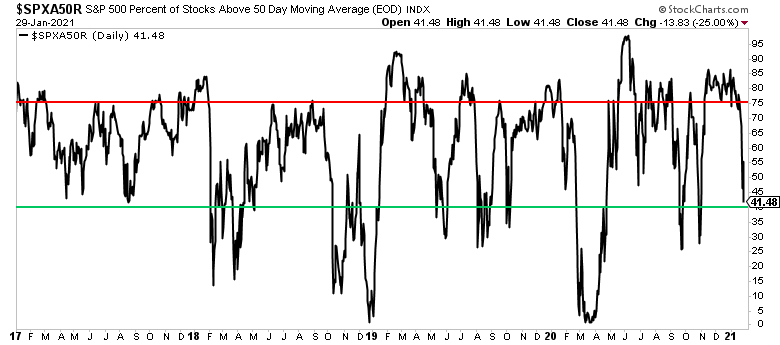

Percentage of S&P 500 stocks trading above 50-day. Wonder what’s the bottom for this cycle. As of now SPY is not even 5% below ATH, but breath is rapidly deteriorating.

Politicians = Hedge Fund Managers  don’t tell anything remotely true.

don’t tell anything remotely true.

Fed also get a cut?

Hinted few days before GME sell put, still holding it. IIRC, one person took similar bet, do not know others.

This is easy money selling puts.

GME Day Circuit breaker hit, Halted Trading !

Why not buy puts now?

Taking profits is perfectly fine, It it goes further up, I may simply regret selling early, but still gained positive.

But buying puts is a future risk and we need to ensure that it 100% correct. Are we sure, it will drop tomorrow?..That is the issue…I avoid buying puts, unless I am 100% confident, keeping cash is safe.

Simple way, buy low, sell high and keep cash (not reverse buying puts).