I doubt it would have that much effect imo. We do need a correction but it’s so bullish short term that I think BDFD will just kick in very quickly.

This guru is not just a correction, is a severe drop.

Kaplan says “a lot of things are going to be dropping by 30% or 40%,” and believes we are in a bear market, so suggests looking at pullbacks between 2000 and 2003 for an idea of what’s ahead.

@Jil algorithm is more accurate than his friend’s stargaze,

…

Semis are GREEN ![]()

Remember these posts (whoever publishes) are being paid indirectly to say so. Such posts on negative market day increases selling ! This was purposefully circulated (after the fact) posts (IMO).

Look at " Critical information for the U.S. trading day" => Creating a sensational story timely to scare the retail investors.

I am not that much 100% right every time. I get burned too. Remember, last time predicted down fall, but failed. I am somewhat better than "Reading the third party news/media to understand market".

All by “Margin of safety” by Klarmann who says never believe anything published in news and see the depth of the issues by our own.

I try to post this always so that people should not be mislead/misread=>

BTW: This is not stock or financial advice (Directly or indirectly). Just posting updates for some discussion purpose. You are on your own whatever you do in stock market.

When it dipped hard this morning, I though it was BTFD moment so I doubled some call positions I had. Let’s see how long this lasts. I might be pushing my luck too much at this point so I’ll be taking profit here and there.

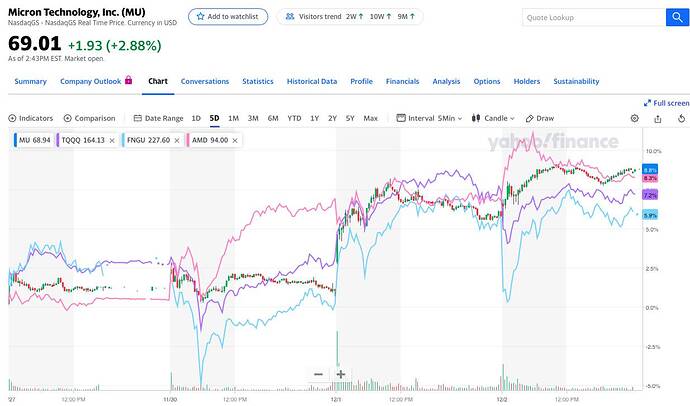

I STC yesterday’s MU calls slightly above $68 and then BTO when slightly below $68, scalping like a day trader. Still holding on  Weekly calls, which have high gamma, need to be nimble

Weekly calls, which have high gamma, need to be nimble

Hmm, you will be burning it (IMO) as real last show starts now (11-1 pm). I sold half of my puts when deep red, and bought some other puts again when S&P was positive.

The market makers are selling in lots. They sell, wait for 1 hour market pick up positive, then resell again in cycles. Otherwise, they can not sell billions into market.

Any way, this is my observation and is not written in concrete, anything can happen any time.

Normally, down day is down-day.

I doubled up AAPL, QQQ calls when nasdaq made a steep decline, closed those an hour later for a nice 30% swing. I have also closed 90% of AMD after almost 2.5x gain as well. I still have QQQ, AAPL, PFE calls and those are running from profit only at this point after 2-4x gains. I’ve been doing mostly 1-3 months out calls so I’m not too worried at this point. I think we go to SPY 380 at least before the year is over. I’ve been also buying a lot of GLD last 2-3 days. Maybe it made a low…who knows! I’m still on BTFD mode and take quick profits.

Yes, in a day, 25%-30% possible if you rightly time it.

The only rule is : Just take the profit when you see profit above 25% !

Well, with options, I take little profit at 50% gain, exit original at 100% and let the rest run until I see obvious weakness. I cut losers usually around 30%.

Also, I haven’t been buying TQQQ as I felt like cloud stocks are taking a beating. Instead, I stick with FNGU which I doubled up this morning as well and likely keep for another 2-3 weeks.

No show today? I only see a flag (a triangle) ![]()

Correct. You see how my guess can go wrong too.

However, market is preparing for a show down. I am better with cash ( right or wrong sold my SQQQ slight profit ).

I sold some puts in morning for profit and holding 50% until I see the results in few days.

I am not comfortable holding stocks except MRNA and BNTX. I have also sold these two stocks covered call in case of price drop.

Let’s it rip ![]()

Looser stock MU is rocketing, up 40%+ over 1 month.

QQQ/ TQQQ and SOXX/SOXL continue to blast upwards with no correction in sight, after a consolidation. Also, instead of rotation, look like a broad-based advance, BULL is not dead but getting stronger.

So many ATHs, QQQ/ TQQQ, SOXX/ SOXL, SE, OKTA, TEAM

All my trading portfolios broke new highs too ![]()

Looks like market going buying spree, after the fact, changed to cash now. Sold SQQQs. This is again false positive.

Now, I have plenty of MRNAs and BNTX going up crazy.

Is correct but SHORT not the long duration decline that you suspected. Perhaps, you need other TA indictators or chart pattern to verify your algorithm ![]() whether it is indicating a short or long decline.

whether it is indicating a short or long decline.

Your MRNAs and BNTXs are not match for ZS, CRWD and OKTA - All obvious stocks to buy - everybody are buying cybersecurity, follow the CROWD. The tradition wisdom no longer holds because of RHers - they buy calls and triple ETFs - somehow have a bullish slant - haven’t think deeply into this effect. So is not just Fed stimulus plan and Biden victory.

Dollar getting slaughtered. It might break 90 soon. For a while this won’t matter but could be a big problem if it continues. In '87 the dollar tumbled all year while the market soared - until shares crashed and central banks the world over had to prop up our currency.

OKTA and ZS are low and then they jumped now, but both MRNA and BNTX have long potential as the world is there market now.

If MRNA is approved by FDA (which I hope soon Dec 19th), the price shots up. They are life saving drugs as of now. BNTX needs -70 centigrade while MRNA needs -4 centigrade to keep the medication. IMO, MRNA is destined to go 100 Billion stock easily.

IMO, MRNA looks to me like next TSLA, long potential for years until Covid is under control.

Yes, I agree on MRNA. It could really shoot up next year. I bet on PFE instead but going into MRNA now.

As for the indexes, we are in the uncharted territory. I don’t think any algo or chart will work. For now, I’m riding btfd and momentum.

Except EWT. Algo is mean-reverting so by definition doesn’t know the degree of extension. How to know would change at 1s, 2s, 3s, 4s… s = sigma

PFE is dividend player and the appreciation is slow. While MRNA is real 10x, which started at $19 last year, have some medication within an year.

If BNTX and MRNA are both approved, I would prefer MRNA as they made a better medicine (for storage and transportation) and long life. BNTX medicine hard to store and transport.

EWT is higher level approximation, unable to code, everything on very vague level (mostly people say after the fact).