You’ve been hoping for that for years now.

Jolly good day. Cloud stocks are still rising ![]()

Obvious ones are rising a lot: FSLY, DOCU, SNOW, SE (@manch did you buy? I thought I can wait ![]() )

)

Algo failed again, market going good.

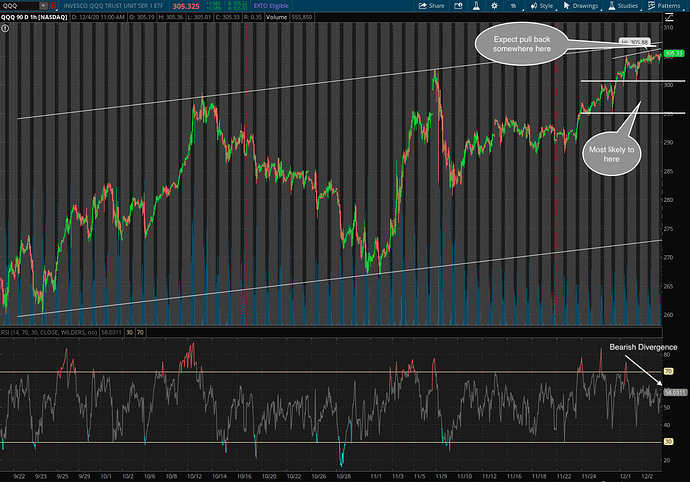

Mostly cloud stocks doing well. QQQ itself is not that great. Expect a pull back soon (consolidation kind). FSLY, SNOW and SE are doing very well.

Not selling TQQQs though.

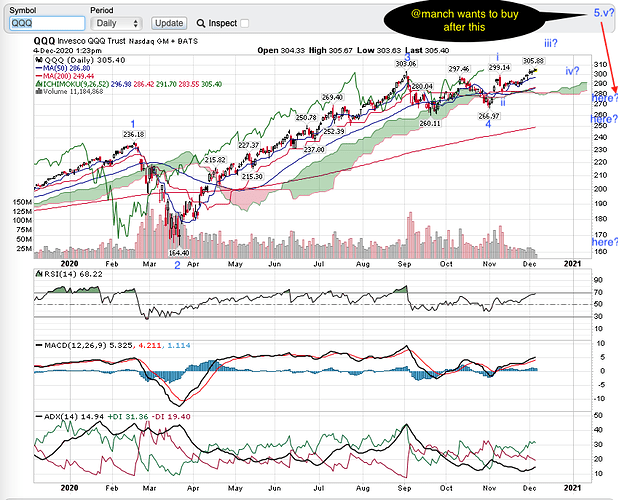

I am still waiting. Have been reading a lot to build up a buy list.

Share your hot list !

My hot list is already posted many times. Recent just few post above.

I am still reading. But I won’t buy until there is reasonable fear in the market. That means I still have some time.

I sold my SNOW and TSLA (not huge positions in each) and rotated into NET (Cloudflare). SNOW lockup for insiders end 12/14 (they can sell up to 25%) and Tesla having cost issues (normal, but I expect some of the euphoria to subside).

might be a bit too early, but this is more my play money - I needed to free up some cash to put into NET.

DDOG is on my list to load up on.

I bought SNOW puts with Feb expiration. Nosebleed valuations reached new heights after earnings - even after Microsoft announced Azure Purview.

Funny. I sold mine today and waiting to buy. Now have to compete with you ![]()

There are some dividend stocks, I bought, no fundamentals done by me except the concept “when stocks dipped too much, they bound to recover After Covid”.

CUK (entertainment)

IVR (Leveraged mortgage/REIT) - this is challenging stock, not easy to decide.

TWO(Mortgage/REIT)

NRZ(REIT)

STWD(REIT)

PK(REIT)

NLY(Mortgage/REIT)

Since they are extremely low, just bought them, to have nice dividend returns.

All are going up slowly, I have not done any research except the concept of buying at low. Planning to hold for long and eternal dividends even though dividends are not assured.

Standard caveat Applicable: This is for discussion purpose, whoever buys they need to do their own analysis. It is their money and their returns. This is not stock or financial advice.

I really see two scenarios for rest of the year.

- Slow grind all the way to $SPX 3800~4000

- A good dip and a big ramp

Market expecting stimulus  What happen if stimulus is less than expected? Or worse, no

What happen if stimulus is less than expected? Or worse, no