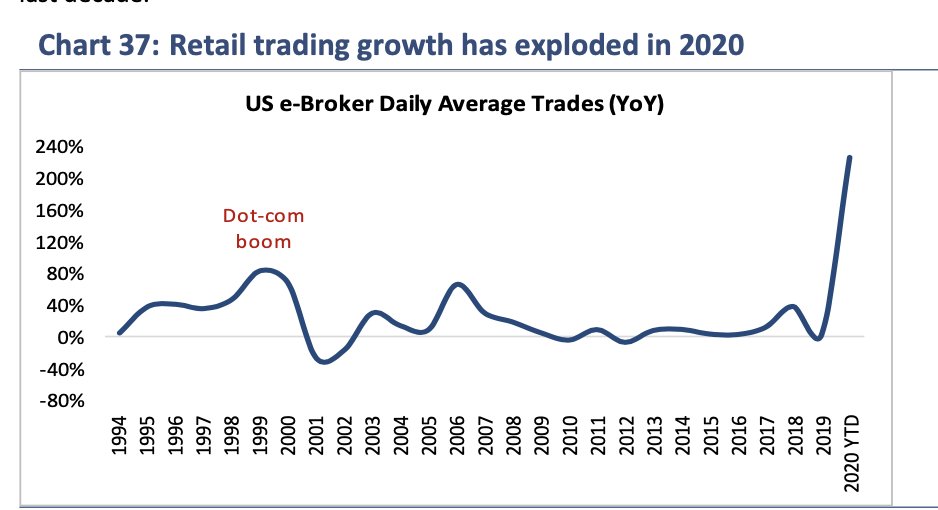

Bearish breath divergence:

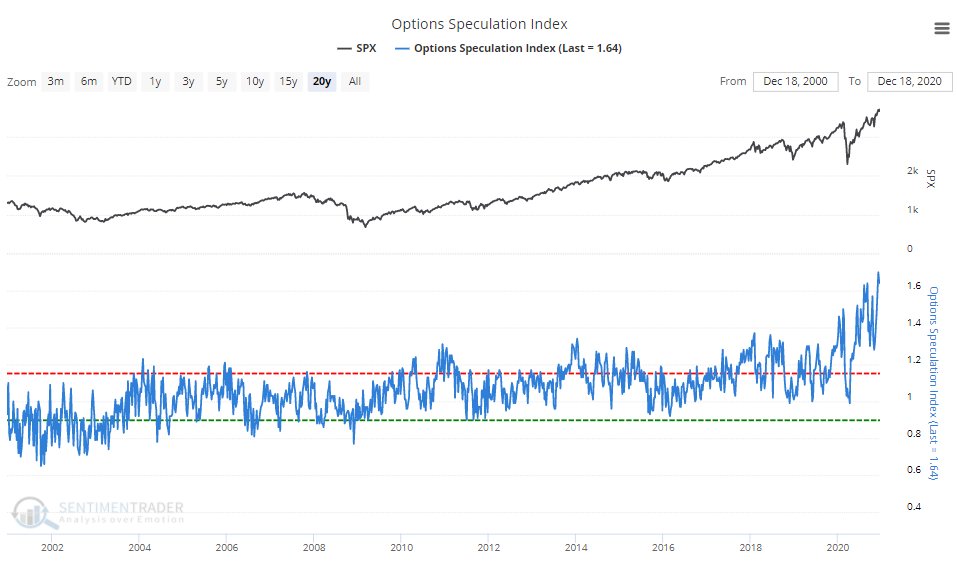

Options speculation gone thru the roof.

Warren Buffett: “derivatives are financial weapons of mass destruction, carrying dangers that, while now latent, are potentially lethal.”

![]()

Somehow some people don’t seem to realize valuation of stocks are relative to near risk-free Treasury. Valuations using DCF quite often use Treasury rate as the “risk-free” rate for discounting.

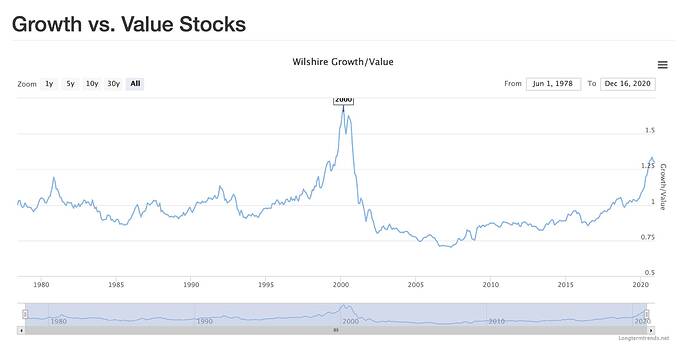

JC said yes post-pandemic. Are we there yet? Frankly, I prefer tech ![]() should do well even in post-pandemic. Whatever happen, tech will do well

should do well even in post-pandemic. Whatever happen, tech will do well ![]() Anyhoo, semi would do as well (I opine is better) than financials post-pandemic.

Anyhoo, semi would do as well (I opine is better) than financials post-pandemic.

So Finance + Tech = Fintech…

Even though it is post fact, market may likely be killed for next few days continuously.

Disaster started today, do not believe the market anymore until end of the year !!

Year end profit taking started now.

How come you’re always so sure? Market is recovering ![]() Anyhoo, you love to choose the alternative count

Anyhoo, you love to choose the alternative count ![]() I just bear it in mind while betting for preferred count. So my position is much reduced just in case alternative count is correct. Win a little is better than lose a lot

I just bear it in mind while betting for preferred count. So my position is much reduced just in case alternative count is correct. Win a little is better than lose a lot ![]()

Two ways.

- Because market is in potential peak. Banks make money with fluctuation and they have bring down the market for healthy ride.

Market recovery is giving me breath to release some more cash so that I can buy at dip. Market is recovering to make sure people have confidence to buy more !

If it ends positive today and even goes up tomorrow, I do not even wonder about that, but will finally show its real face.

- Or else, my program sends me false positive !

…market is in potential peak…

I know this. Is why I have reduced size.

Market recovery is giving me breath to release some more cash…

Now you make me wonder I should do likewise.

…my program sends me false positive…

False negative?