Just going through his tweets now. Trying to learn something new especially how to identify the bottom. This guy is very focussed, trade only call/put of SPY, sometimes VXX. Suspected I have too many counters (has reduced from 30+ to 5, apparently still too many) - confused often… trying my best to reduce to 1. There is no need to trade so many counters… I suspect so but can’t resist buying interesting names. Trading and buy n hold is the same in this respect, less is MORE. 1 is IDEAL.

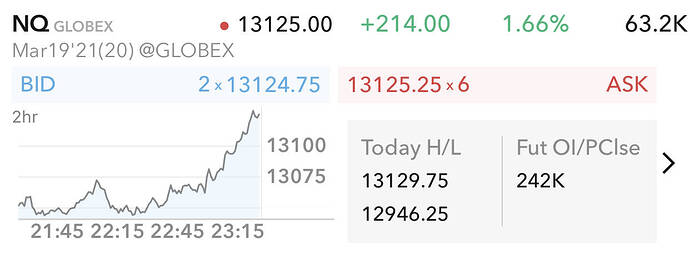

Looks like market turned up finally. Last Thursday seems to be the bottom (after the fact).

Let’s be real. The $15 min wage was dropped. It was determined it can’t be passed in the senate as part of reconciliation.

Oh and for those keeping track of the math.

That’s a cool $562k spent per person lifted out of poverty. That’s some pretty embarrassing efficiency and shows just how much wasteful spending there was that had nothing to do with the stated goals.

.

Enough for stonks boosting.

I just don’t get the federal minimum wage issue. Let states and local governments decide it based on cost of living there.

Seattle’s minimum wage hike didn’t work:

- Rents increased by the same percent as wages

- Employers cut hours so take home pay was actually lower

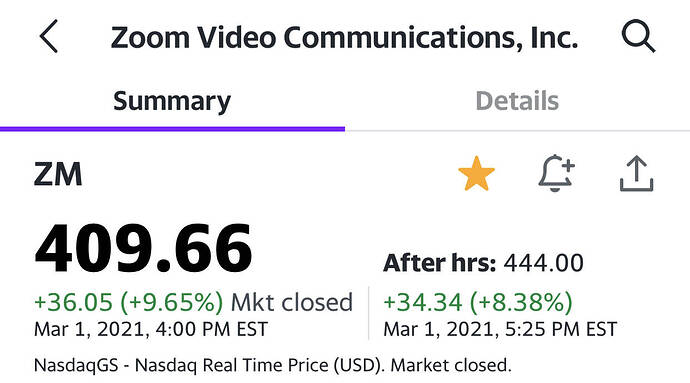

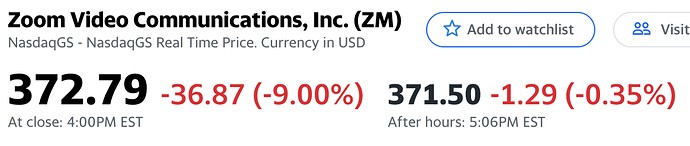

Guidance is more important as comps from last year was still pre-Covid. Too many bears on ZM and they got their heads sawed off.

Those margins are insane. So is net retention. Zoom is executing very very well.

The guidance vs covid quarters has been weak for a number of software companies. Their stocks got hammered for it. The real question is are they just being conservative or will revenue growth slow?

Most are running 130%+ net retention, so they can grow 30% without adding customers. Some company’s guidance seems to indicate they won’t be adding many or any new customers. That’s a bit scary, since it means the market is saturated and new customers aren’t out there.

I’m keenly watching net retention, customer count, and revenue forecast when I look at earnings reports.

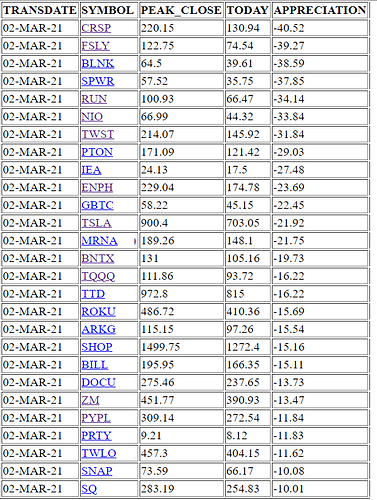

These are nicely corrected stocks, which exceeded TQQQ last year (2020) on appreciation, but at somewhat low prices.

Shares of Rocket Companies, a large short target of hedge funds, jump more than 70%

A number of popular posts on WallStreetBet chatroom featured Rocket on Tuesday. One says “I like RKT. $1.7M all-in, let’s gooo YOLO,” and it quickly drew more than 1,700 comments.

Aren’t the big players down – AAPL TSLA etc? They aren’t within reach of 52 week highs. The market wants to sell off? The stuff in play now doesn’t strike me as the type that would lead a bull market forward.

Can you share some examples of companies where net retention is starting to be a problem?

All good companies are getting corrected when every retailers expect to go up after a good run. Market makers, mainly big banks, funds, are selling them profitably now and rotating the cash to buy different companies at low prices in the market.

This they do every 3 months or 6 months. Read the financial reports of JPM, WFC, BAC, GS, MS…all these banks trading sectors are making excellent results every quarter after quarters last 4 qtrs.

How are they doing? They belong to market making deciding which companies to sell and which companies to buy…

Ultimately, they make money by making big waves in market…

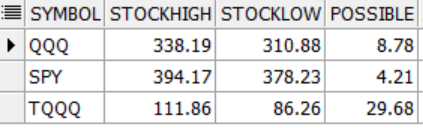

Where TQQQ wins? Based on previous peak of QQQ, SPY, TQQQ, current market goes up to old level (actually it is supposed to go higher), TQQQ always wins…the people , like hanera, got it at 86.26 will earn 30% return when TQQQ comes back to $111.86.

I haven’t seen net retention be a problem. It’s lack of new customers where all the growth is due to net retention. That’s the issue.