Broad-based indices are boring… nuance ![]() is ARKK

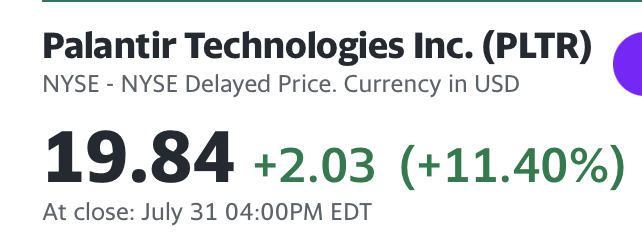

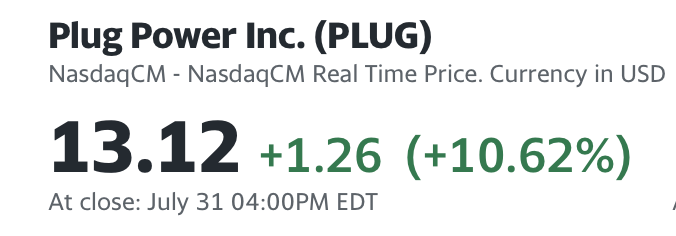

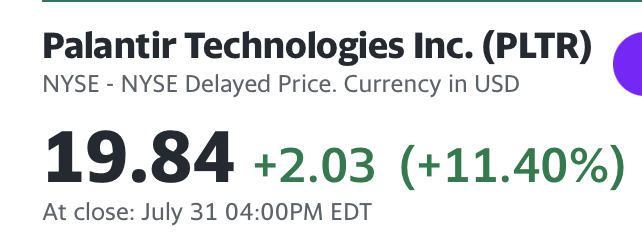

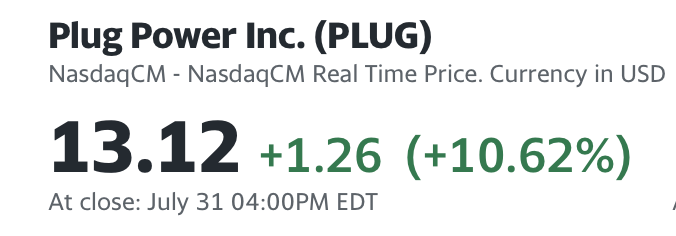

is ARKK ![]() growth stocks are hot e.g.

growth stocks are hot e.g.

Broadly FinTech, AI and data stocks are hot.

Broad-based indices are boring… nuance ![]() is ARKK

is ARKK ![]() growth stocks are hot e.g.

growth stocks are hot e.g.

Broadly FinTech, AI and data stocks are hot.

Looks like institutions finally realize they were wrong. FOMO is taking over. I have been scratching my head how come so many people are confidently short when market and economy data have been consistently telling them they were wrong.

Hedge funds’ short-covering this summer hasn’t been this aggressive since 2016.

Don’t know about next year, but the problem with being bearish short term is this:

Too many hedge funds missed the H1 rally by being stubbornly short. They need to catch up or else their return will look like garbage compared to peers, and that means their jobs are on the line. I think FOMO is still running high. Any dips could be fiercely bought.

When everyone are looking for a pullback, it will happen! Self-fulfilling prophecy.

Will it be BTFD? Bear in mind this is a downgrade of USA! not any Tom, Dick and Harry company.

Best stock in bad time… it will surprise you…

Aug 3

VIX crashes, market re-bounces, Finance Junkies’ stocks (ENPH, ENVX, DIS, PYPL, PLTR, SOFI) remain red (their days are over?)… Is downgrade an one-day affair or will continue tomorrow and next week? Anyhoo, S&P has already downgraded USA to AA+ decades ago, does Fitch downgrading mean much?

You don’t own AMZN and ABNB, why post their results. What happen to your NET!!!

AWS is the bellwether of all things cloud related. The most important stock to monitor for the cloud sector. Anyway here’s Amazon’s margin over the years. International still sucks.

.

FinTech stocks have been plunging after earning. Could be because as a sector has been overheated/ expectations are too high. Need some cooling off. Even SOFI which have triple beat (revenue beat, earning beat, guidance beat) also tumble after earning.

Fear returns.

VIX spikes to 17+

When…

Is time for…

After giving back more than 100% of the gain, the greatest option trader of the year is doing this… this guy has a structured process to option trading well suited for an early bull market… is too late to do that… nice to read about it and applies for the next early bull market if you can identify it after the scary bear market, that is ![]()

As usual, Puru justified his losses after the fact…

Aug 7:

Slaughtering of high growth stocks + 2 of the magnificent 7.

S&P is doing well ![]()

VIX remains elevated.

Looks like dip buying is already happening. I still think many funds missed the big rally since last Oct and are eager to make themselves look less bad.

The only risk Wall Street cares about is managers’ own career risks.