![]() Two greens

Two greens

Odd market. Strong labor report sends rates up but the dollar is down some and oil is flat.

Dollar down again today despite higher rates and a pretty good economic report.

Gold sharply higher.

Market is desperately looking for laggards that have yet to participate in this bull run + rapid increase in IPOs. Charts of these stocks either look like forming an iH&S or about to go into Stage 2. Sound like a ST top.

Laggards: PYPL, INTC, DIS, CSCO, DELL, …+ many laggard growth stocks (highly risky).

Disclosure: Don’t plan to buy any.

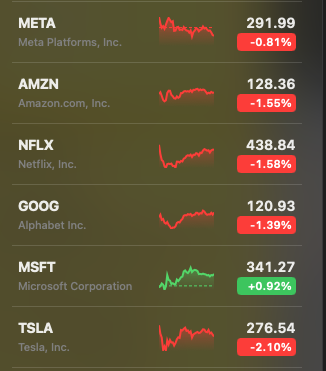

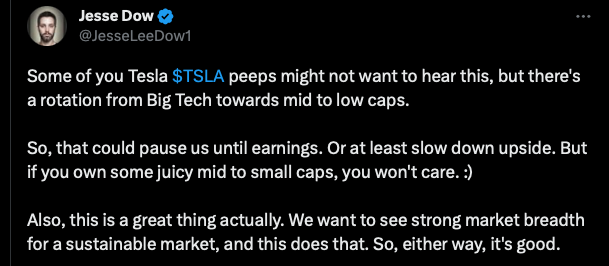

SPY down 0.25 Friday; RSP up by exactly the same. So some breadth.

A self-taught economist thinks his view is important ![]() Read for whatever reasons… is not an advocate for action.

Read for whatever reasons… is not an advocate for action.

The rotation is fairly obvious. Mega Techs should take a pause to let mid/ small cap stocks to catch up… rebalancing of Nasdaq 100 is a good trigger.

You must be kidding me? People are still bearish on US stocks? How’s that even possible?

Anyway, more fuel for our ![]()

We’re at the top of a trading range we’ve been in for almost two years and nowhere near the all time high. And there’s plenty to pressure corporate profits.

Internationals look tastier given the lower multiples and plunging dollar.

Media keeps talking the narrative that big techs led this rally. The truth is many SMCs have rallied over 100% Ytd, some a few folds. Many option traders investing in SMCs are making few hundred percent Ytd.

NVDA is a must hold. Still waiting for a pull back to add a lot… anyhoo, is my largest position in the growth portfolio. NVDA is a real thing. A certain stock starting with a T… is a lot of hot air.

Still waiting for AMD to get some of the Nvidia magic. Heard AMD’s drivers are total garbage compared to Nvidia’s. But big GPU users like Meta etc have a burning desire to not be hostages of Nvidia. So we will see.