Wait, does it not mean that 74% are fully invested and would be selling?

Tuesday CPI headlines

Wednesday FOMC

This is the huge week where we might finally get the rate pause. ![]()

Mega cap tech stocks that make new ATH in 2023: AAPL NVDA ORCL

Builders that make new ATH: D.R. Horton, Meritage Homes, Taylor Morrison, PultzGroup, TriPointe Homes, M/I Homes

Real estate is crashing. Haven’t you heard?

.

Now then you notice. Thought you would have noticed in the list of stocks doubling. Some of them are as sh?t as Peloton. Stocks that should have become zero and its business insolvent are now excellent turnaround plays.

The gamblers are back.

Perfect names for gambling with options, no? Put $10K on and watch it go to either $0 or $100K?

How come so many red in the market yet NVDA and U are mighty green?

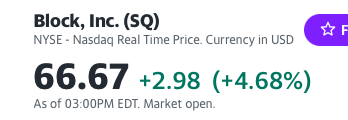

Gamblers looking for laggards, found SNOW and SQ today.

Truth be told, still underwater ![]() Averaging down over 1+ years… less than 10% down. Two more good days, would be green

Averaging down over 1+ years… less than 10% down. Two more good days, would be green ![]()

Rotation?

Metaverse stocks are ![]() e.g. NVDA, RBLX, U

e.g. NVDA, RBLX, U

Meme stocks are crashing e.g. SOFI, PLTR

Hmm… more like traders going into protecting funds (max profit, min losses) mode. SELL!

Final is over or two more finals ![]()

Many stocks are recovering from yesterday’s Pow’s talk shock (he merely repeated the same message uttered during FOMC CC).

PLTR is surprisingly weak. Thought won’t break below $14, LoD is $13.86. May have to examine my EW count carefully… may be omitted something.

There is no similarities. In any case, all zigzags are three waves (ABC). And it is not true that length of wave C has to be longer than length of wave A.

Many tickers are rising very fast… almost a double ytd.

YTD, NVDA and PLTR >> TSLA, and COIN is moving up extremely fast.