SVB issue

If during coming Mar FOMC, Fed announces no more rate hikes and may start rate cuts sooner than expected, what will happen to stock market and real estate market? Economy? Recession confirmed?

Did not you listen Powell vs Warren last week 5 mins video?

If not, re run the 5 mins video and your answer is there!

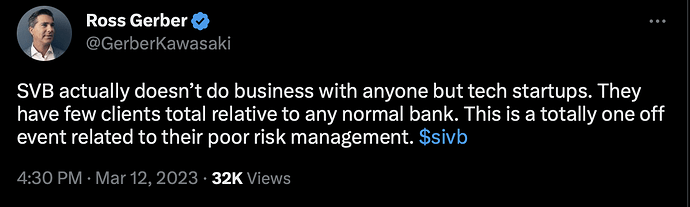

Tomorrow is going to be a total bloodbath for the smaller banks. I expect more will fail, because we will see bank runs.

They will be forced (?) to change their mind by the end of the week I think.

The word “bailout” is toxic. There won’t be one meaning the equity and bond holders will be wiped out. But making depositors whole with temporary government backstop is not a bailout.

How these things usually work in the past is that FDIC will find a buyer of the failed bank. The government may need to provide some temporary guarantee to tide things over but in the end not going to cost the Treasury much if at all. If people don’t think the sky is falling they won’t get money out all at once. It’s a confidence game.

People may not realize FDIC isn’t even government money. Money comes from fees charged on banks.

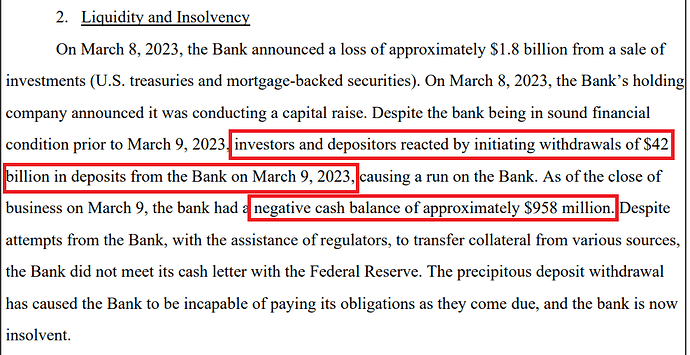

MARGARET BRENNAN: For those depositors, about 85% of SVBs accounts were uninsured. And, as you were saying, a lot of different tech firms relied on them. Do you believe that depositors should be paid back in full? Will they?

SECRETARY YELLEN: Look, I’m not going to comment on the details of the situation at this point. I simply want to say that we’re very aware of the problems that depositors will have, many of them are small businesses that employ people across the country. And of course, this is a significant concern, and working with regulators to try to address these concerns.

Although the FDIC insures bank deposits up to $250,000, a provision in federal banking law may give them the authority to protect the uninsured deposits as well if they conclude that failing to do so would pose a systemic risk to the broader financial system, the people said. In that event, uninsured deposits could be backstopped by an insurance fund, paid into regularly by U.S. banks.

That is need to identify more failed (about to fail) banks ![]() to justify there is a systemic risk.

to justify there is a systemic risk.

Note: Didn’t verify that there is indeed such a provision and not made out for this incident.

Under the new program, the Fed said it would provide loans of up to one year to banks, savings associations, credit unions, and other eligible depository institutions in return for collateral such as U.S. Treasuries, agency debt and mortgage-backed securities.

SVB must be cursing… program introduced after they have sold T for a big loss!

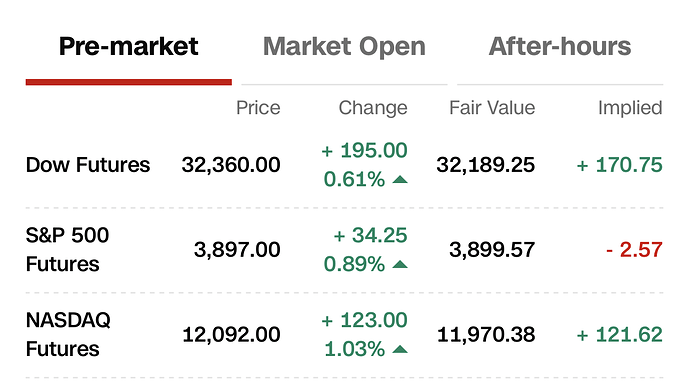

The morning star post was very helpful to review the banks.SVB gave me a good knowledge how to evaluate the banks and dipped nicely today…

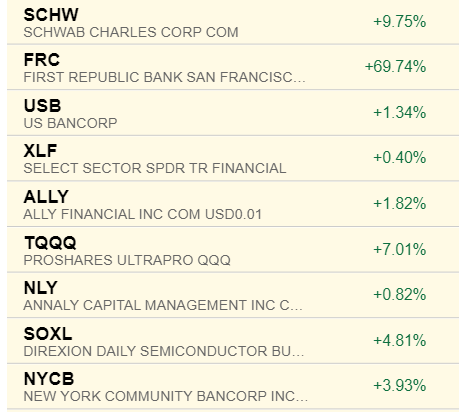

Who took a wild purchases today on bank stocks? I was madlly buying since 4 AM and completed by 8 AM. All bank stocks are buy & hold for nice dividends.

BTW: Few Head strong Junk people talking nonsense, without even basic knowledge, I actually wanted to stay away.

Good Luck!

.

A trader buying bank stocks for dividends?

Which bank did you get? Thanks!

Damn…you got FRC below 10$?. Serves me right for not waking up early. ![]()

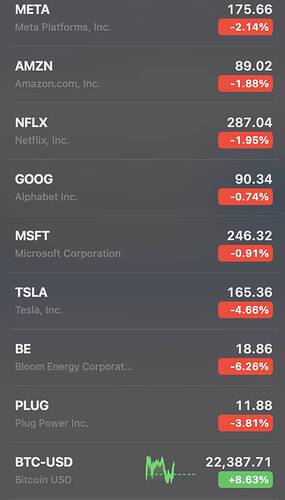

All those banks listed, SCHW,FRC,USB,ALLY,NYCB, NLY are my purchases

I try to allocate a portion of my investment dividend buy and hold so that I get cash like rental income and exceed returns over indexes. Still I may have some cash for trading.

Yes, I ran a check. If I buy these stocks now and hold, it will exceed SPY, QQQ return when market reaches ATH.

For example, current NYCB is lowest priced in the last 20 years, payout is 53% and they have nice income potential. Manch posted a link which gave me some idea how to calculate. Even with 5.5% interest rate, they will make good income (as they had YOY -0.11% on their margin). The dividend works out 10.5% at 53% payout ratio.

NLY has higher risky element, but again MBS related, but I know the company last 15 years and one of the biggest REITs and the price is too low. It can still drop further, I will DCA further.

It was DCA from $28, $25, $20, $19 and $18. I had $15 and $10, but did not reach that level. FRC did the right thing to have more liquidity, but panic selling was there.

If it dips again, below $20, I will buy more in next 7-10 days as I expect more volatility in the market until FED meeting.