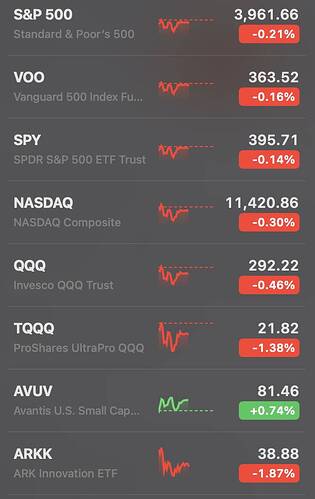

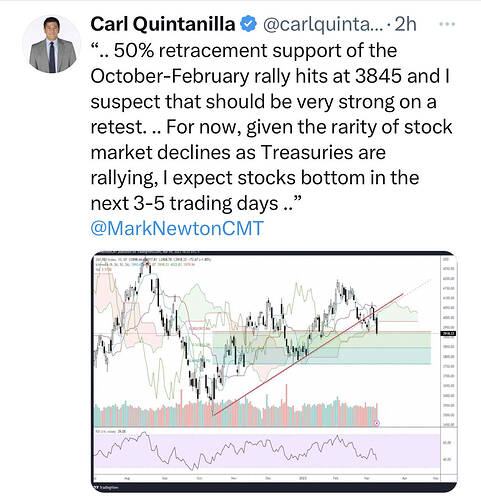

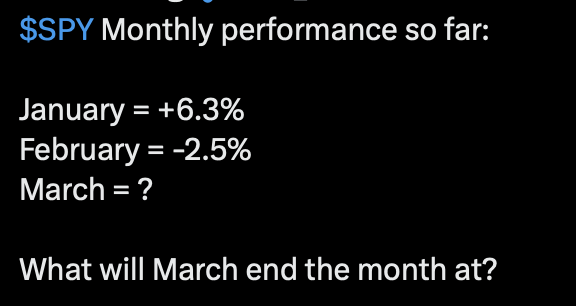

Permabull face ripper has been wrong for the past two years. Would he be right this year?

BTFD in Feb and loses money today.

Wish him and me good luck ![]()

Counter intuitively, ARK funds rally. Her stocks will do well in recession?

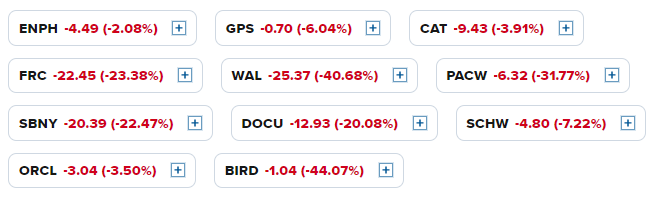

Market is telling us what stocks are likely to underperform during recession.

Hint: those that close negative today and Cathie stocks.

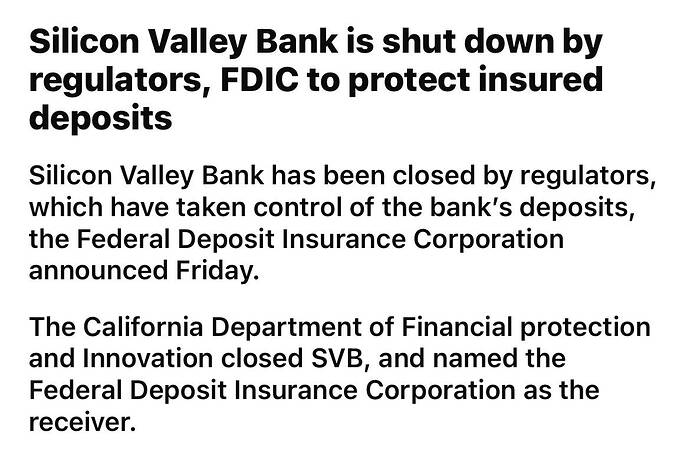

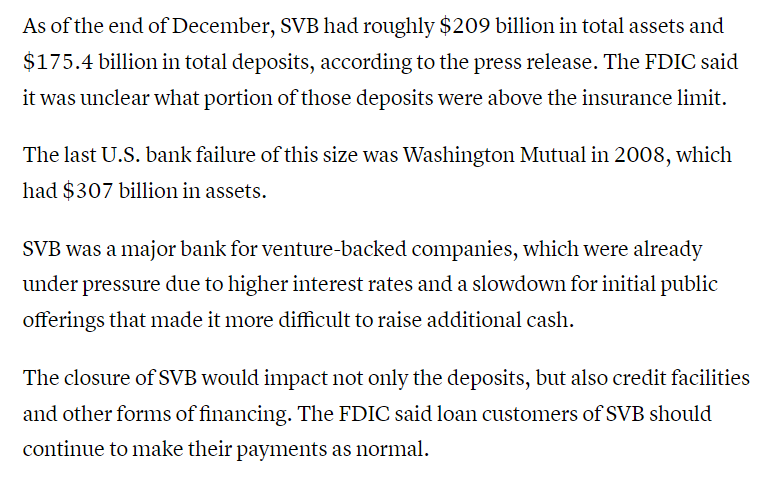

Bank run coming at Silicon Valley Bank?

Based on my past experience and with my algorithmic inferences, following may happen (no guarantee).

Market went down extremely with excessive shorting today, which will result a squeeze pull back.

However, lot of scared investor sell their holdings, but squeeze release (whoever shorted today) will abosorb all their stock, and very likely market ends positive tomorrow.

This will happen in first 2-3 hours.

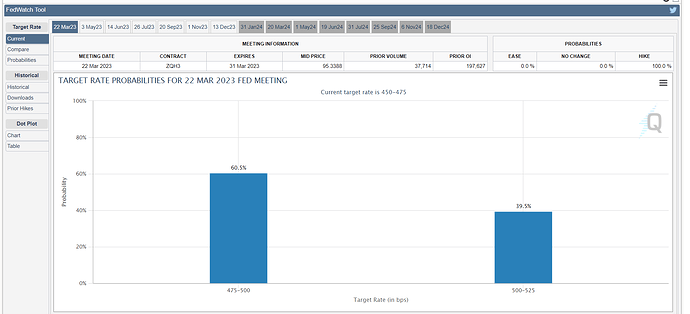

Regarding long term, market may not recover easily until end of this month (and also depends - may change based on what FED forecasting rates on Mar 22).

[edit] my guess was wrong!

Red ![]()

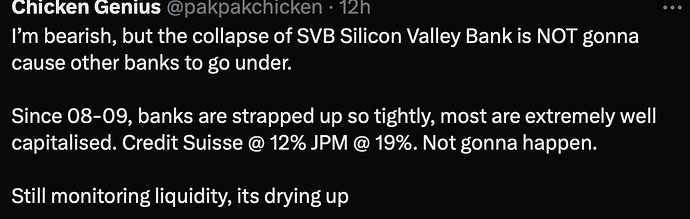

Market is looking SIVB issue like “Lehman Brothers”. Bank with 190B deposit unable to pay back money for depositors means their investments are negative and likely go bankrupt. They also failed to make share dilution and bond floating…etc.

Loss of confidence: No one really knows how many banks are like SIVB. Or It may be a reason for market to drop heavily.

These won’t happen if FED is not raising rates.

Businesses always have risk. Macro is always changing. Any businesses that can’t manage is their own incompetence.

Experts have been saying won’t be as bad as 2008 or dotcom bust, look increasing like those. So far cloud computing stocks bust 90% just like during dotcom bust. RE prices are declining fast just like in 2008 GFC.

Even during 2008, media predicted real estate drop of 0.7%, but eventually it went to 50% level. Most of the so called experts are mainly seekking publicity to improve their wealth by earning commission money. We can not trust any one, bullish or bearish ones.

No one really know what are all the future failures like FTX (30B), Silvergate and now SIVB(190B deposits)…and how much domino impacts to other companies.

In the end after 6 months or 1 year, we will hear nice stories about what went wrong.

$250k per depositor per bank per category. So if you have more, is ![]()

Whatever I heard is appx 2.73% deposits are less than 250k and rest above 250k as most of them VCs and startup people!

Crazy Sell off today !

Market will soon rollback one or two days after the FOMC forecast is changed from 0.5% to 0.25% suddenly (looks like FED may not increase 0.5% with issues like SIVB).

The above is guesswork.

yeah I think today is gift.

Im buying FAS, TQQQ and Schwab