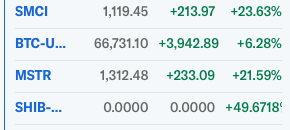

Theme: Sell all stocks, buy crypto and AI stocks

Really… would be smarter to sell everything to buy hookers and blow…lol

.

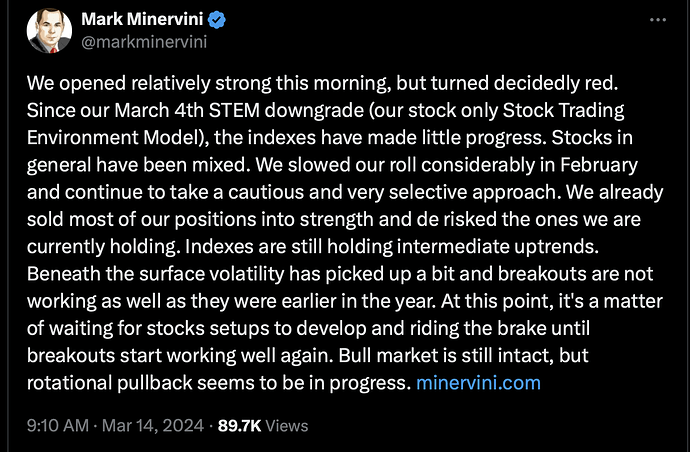

AAPL, which has led the bull rally before handing the baton to NVDA, is in correction. This could mean market would follow soonest even though Ruth might be early.

Btw, I have been trimming my super profitable COIN position too.

Gold is on a tear.

.

Correction might have started. Even crypto is declining. Experts predict that bitcoin would pull back once it hits $69000 to… before shooting to $100k-$300k.

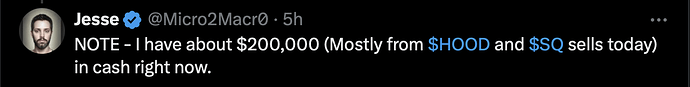

Jesse has started raising cash too (after Ruth Capital)…

Kevin Praffath puts up a video…

Me: Trim more COIN and SE holdings. Closed GBTC position. Holding ETHE.

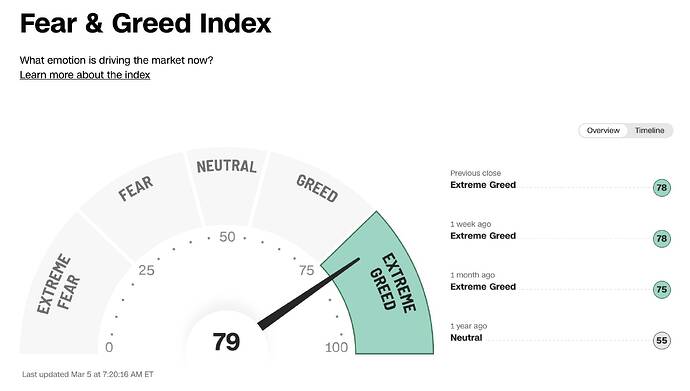

Adam said market is not in a bubble. Yes, traders are not using margin much but I heard they are selling stocks to pile into calls aggressively. So bubble or not? Anyhoo, I don’t think comparing with 2000s using those metrics are appropriate… just thinking aloud, no DD done.

Everything is booming. No need to overthink things. Just sit tight, don’t over leverage, don’t time the market, and everyone will do great this year.

.

Great is not enough with Jesse keeps bragging about insane gains. We love to compare but long ago, can’t. Now with social media, we love to compare with the best. Any1 below the best are losers. Social media is so wonderful, ban social media TikTok.

That’s why I said investing is mostly psychological. I now focus more on making myself mentally comfortable so I don’t make stupid mistakes, instead of chasing raw financial numbers.

I still make stupid mistakes though. Hopefully fewer than before.

Everything including gold. Which isn’t exactly bullish for everything else. Soaring gold prices presaged the '08-'09 collapse. And the late '87 crash.

Inflation remains sticky, investors rush back to cash rich Mag7 for safety. Risky assets like crypto and cash starved high growth stocks are slaughtered.

PPI is hot. Investors rush to FANGMANT for safety. Green are AAPL, AMZN, GOOG META, NFLX and MSFT. NVDA and TSLA are red.

Rotation back to safer stocks like Mag7 continues.

Mar 19, 2024

Flock to safest of the safest e.g. AAPL, AMZN, MSFT and BRK.

Anxiety over FOMC, Mar 19-20. Expectation: Non-zero probability of hiking rate. Non-zero probability of no rate reduction in 2024. Expected first rate cut is in Jun or Jul.

EWT: Many stocks are in multi-week wave ii (downtrend). Some are in multi-month wave 2 (downtrend).