It is not about holding AAPL, but the valuation of IEP is 535% over actual book value, way over priced by hype.

.

I didn’t do any DD so don’t know whether Hindenburg guy is correct or spreading FUD.

If Hindenburg is right, IEP won’t recover, otherwise it is buying opportunity which can give potential 50% on the investment !

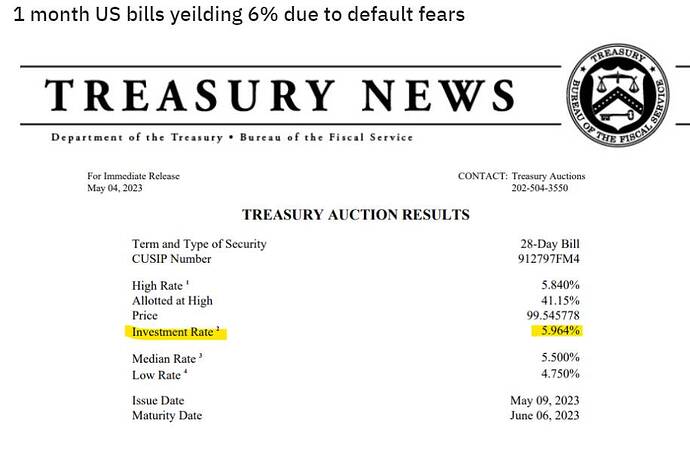

One hurdle is down. Now we just need to avoid debt ceiling drama.

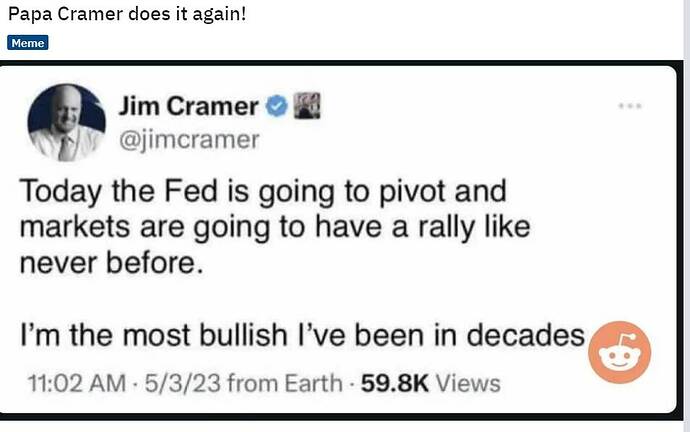

He said two important hints in conference.:

-

Staff report expects a Mild recession (you know how diplomatic he is!)

-

No rate reduction discussion until inflation comes down. He also said “Inflation is not coming down easily unlike the past. There are improvements, but not clearly coming down”. Data dependent in future meetings.

Having a debt ceiling is unconstitutional in the first place. The 14th Amendment states the federal government MUST honor its debt.

Section Four of 14th Amendment, adopted after the 1861-1865 Civil War, states that the “validity of the public debt of the United States … shall not be questioned.”

The debt ceiling doesn’t question validity of existing debt. It allows us to borrow more and add to the debt. It’s honestly embarrassing we can’t balance the budget.

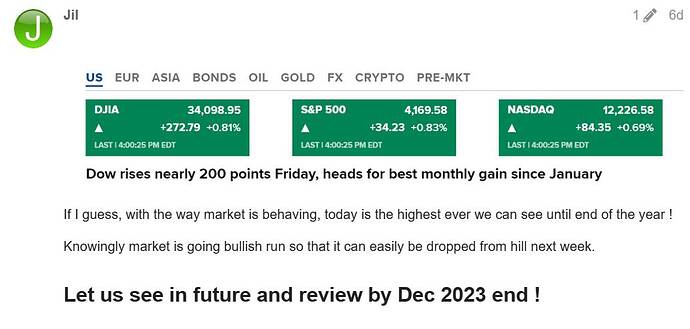

Let us see whether this is correct !

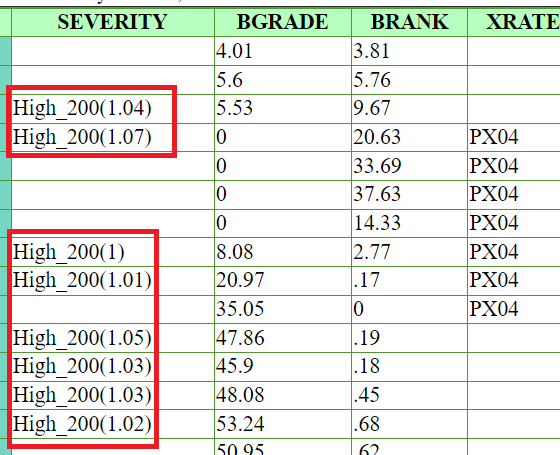

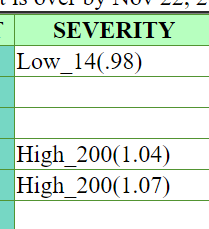

As I said previosuly, this Severity somehow predicts!

BTW: Sold all my SQQQs/Puts ! Next 10-15 days off the market trading !

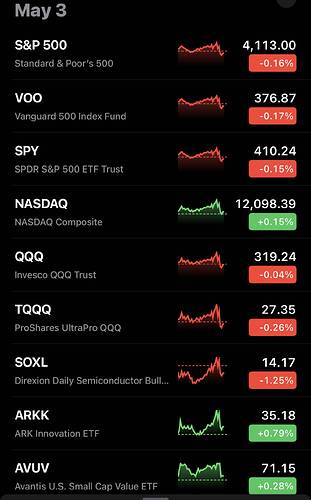

See here, it is matched. Next one or two days likely market turns positive after sometime today

But, long term next 15-45 days downtrend.

Good Luck and Good bye for next 10-15 days !

Guess work: In 1 or 2 days, SPX may touch appx 4120 or more!

Today is a good day. Need more good days ![]()

Do not pray for it, reverse will also be like this, you are going to see the same in next 30-45 days.

Market May be positive Monday, but not long last further.

What market is doing creating FOMO, it may be volatile from next week.

Remember my prediction =>

Guess work: In 1 or 2 days, SPX may touch appx 4120 or more!

The debt ceiling drama will pass. Once it does ![]()

Weak earning scare didn’t materialize. Many companies are announcing good earnings.

As I said too much bearishishness and the market still didn’t die. That’s a significant signal all by itself.

Nvidia just quietly made another 52w high today.

Move faster. Since market bottoms on Oct 12, 2022, SHOP is catching up with NVDA. Whichever is first doesn’t matter, NVDA and SHOP are my top 2 position in the speculative high growth stock portfolio. RBLX, third largest position, is a disappointment, performs worse than the matured stock, AAPL and the two major index ETFs.