From Thursday:

During the recent CCP congress, two messages are sent.

-

Welcome new policies, bye old policies.

Symbolizes by removing Hu Jintao. -

Zero Covid will be ending soon.

Symbolizes by all the attending elderly didn’t wear a mask.

Can you tell what is the impact of ending zero Covid?

Some says hyperinflation for the world because of revenge spending by coop-up Chinese.

Some says lower prices of many things because of improved supply chain.

Your view?

What stocks would benefit ![]()

![]()

If it takes 12 months, we have time to think about it and raise cash to cash in this end of zero Covid ![]()

I don’t think China will end Covid zero outright. Remember, the full name of their policy is “Dynamic Zero”. Now what the heck does dynamic mean? It means they can move the goalpost in whatever way they like to suit their own political needs.

I guess the most optimistic scenario is that they would like to make things more targeted and less disruptive. Like closing off a few city blocks instead of the whole cities. But that depends on the incentives and leeway the central government gives to the local officials. Currently if outbreaks happen the local officials’ political careers are shitcanned. No promotions and sometimes even outright fired. So local governments are incentivized to overreact. Will that change? Nobody knows.

Ultimately the whole thing is a black box that depends on one guy’s whim. In China the most important consideration is safety for the Xi regime. Everything else like the economy and welfare of Chinese people are very distant seconds. I won’t even try to guess how things will play out. There are so many beaten down stocks right here in the US. I’d rather look at those.

.

I am not talking about China stocks ![]() I am wondering impact on US stocks. If hyperinflation then Fed has to continue hiking longer than expected.

I am wondering impact on US stocks. If hyperinflation then Fed has to continue hiking longer than expected.

I guess you don’t remember the articles being shared at the time. ![]()

If China reopens it will be inflationary. But most likely it will be a gradual process and our own inflationary pressure is easing, I don’t think it will be a very big deal.

Now if Chinese economy gets better, their consumers will have more money to spend on western imports. Mass market premium brands like Apple, Lululemon, Starbucks and Nike should benefit. A huge wildcard is whether China will ease foreign travel restrictions. If it does Macau casino stocks will soar. Probably cruise ship stocks too.

Big “if” of course.

.

![]()

Strongly believe China is planning to end zero Covid.

Hope so.

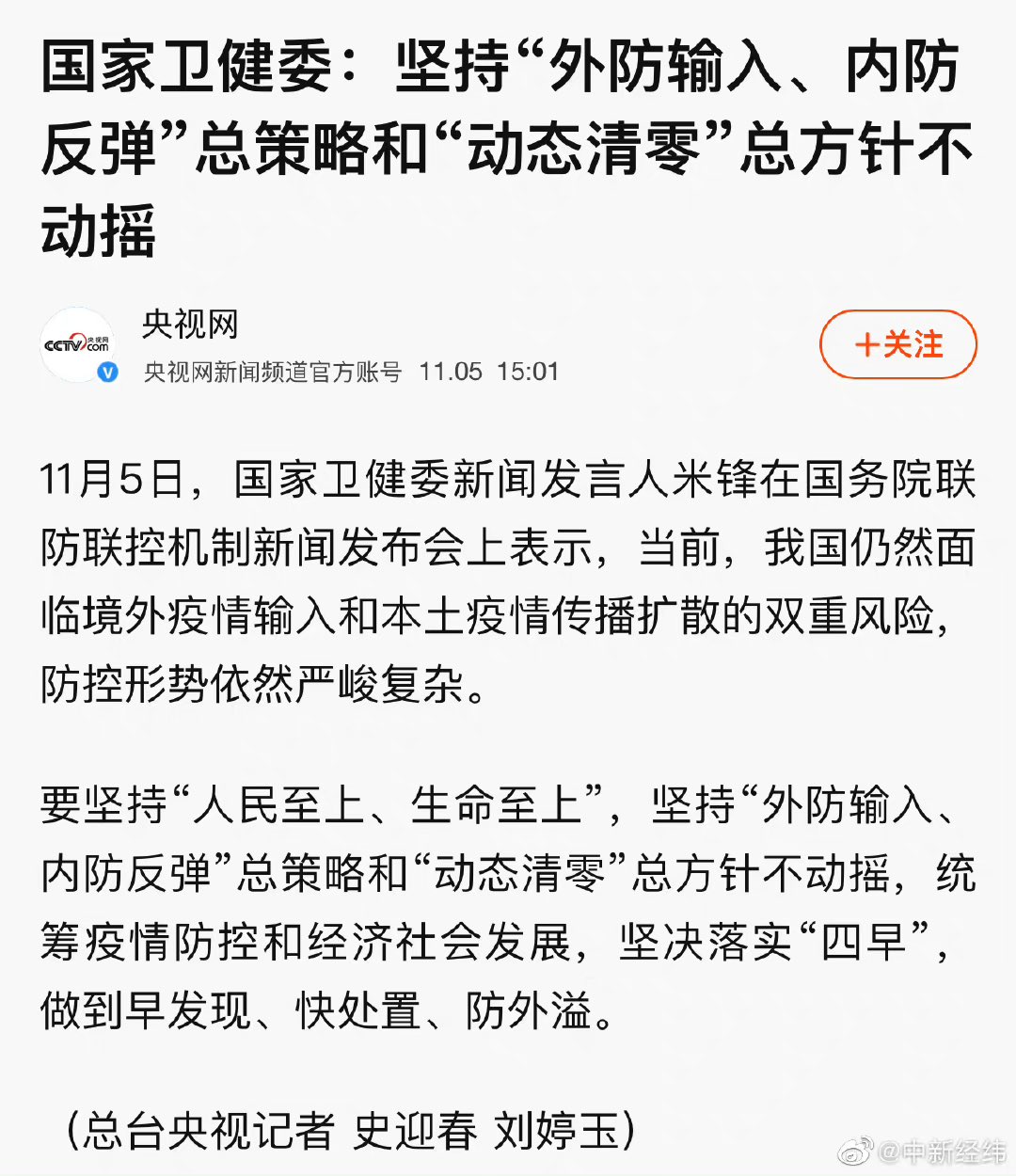

Well they just had a big press conference on Saturday. Since you can read Chinese, read for yourself.

They are reconfirming commitment to Covid Zero.

In fact there is a big outbreak (big for China) in Guangzhou right now. A big district is under lockdown.

Officially not ending, unofficially has started ending in stages.

Indices are behaving like what Mauro is thinking, in a bear market rally. If follow Mauro, SPX should not go above 3912.

If FTX is Bear Stearns, which company is Lehman Brothers.

Any change in sentiments?

Because every crisis has to unfold in exactly the same way?

I’d just say it’s easy to mock. Boos always come from the cheap seats. But things tend to bottom when everyone is despondent and bearish.

.

So you think stock market has bottomed? Many stocks didn’t make new low since Jun. But broad-based index might not have bottomed yet. By stock market, most people refer to S&P.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

Coinbase…

They reached out to me last week or the week before about a job opportunity. I thought it was odd given the amount of layoffs and financial instability there.

Reading about FTX is just insane. They didn’t correctly calculate how much margin their customers had. They claim they have enough assets to be solvent, but they lack liquidity. That likely means they are delusional about the value of their assets.

Heard a lot about FTX before this, their business practice is outrageously aggressive, I was wondering where they get their money to fund those practices. Now I suspect they didn’t bother to do any cash flow management, they are banking on their hyper growth status can get funding from angels easily.

Now we have to assess whether bull market has returned. From Volcker era, market does jump 40% in a week and hit previous ATH within three months.

Bear market rally or start of a new bull market?

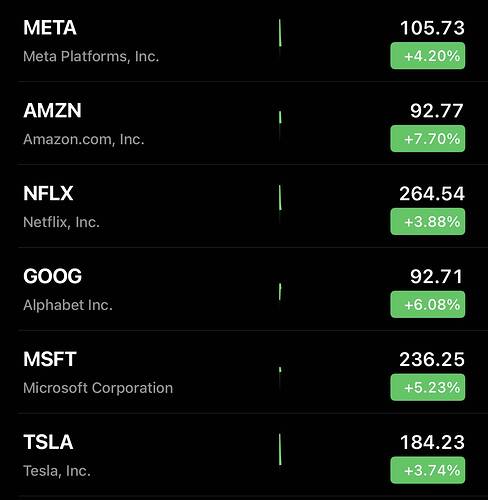

Gain is huge. If bull market, don’t be surprised these stocks would jump 40% from their low next week. Blink you miss the large jump. If bear rally, can get stuck for months to years. Take your med. Red or blue pill?

If 4-4.5% is the new terminal rate, that’s massively bullish. We’d also see mortgage rates drop quite a bit. They were pricing in more hikes than that.