I wonder if even algorithms have begun to anticipate a melt up. In the past month, the Redfin algorithm has increased the value of my home by $200k. Clearly, this is not based on recent comps - they stabilized over the summer. It must be in anticipation of price increase in the Fall

Cash-out refi and plunge the spoils into crypto?

.

Compete with you for large lot to be splitted into two houses.

Nice advice to trigger a crash…

Based on 2017 to 2019, you can expect low to modest increase till spring or summer next year, and then it will begin some corrections late next year when interest rates are up.

It is not a bad idea if you have a 1 acre lot in LAH, and can split it to your kids… ![]()

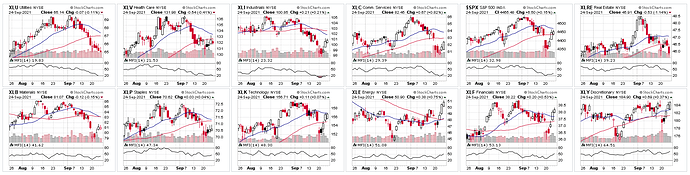

RE is too slow for folks here. Need to ride the

![]()

That reminds me Singapore’s Covid cases are ripping. 1400 cases a day now?

Failed government.

Too much negativity everywhere and most of it already priced in.

Wow, didn’t even notice we actually had a 5% mini-correction this month.

![]()

https://compoundadvisors.com/wp-content/uploads/2021/09/SP-2021.png

Fears of contagion from an Evergrande default helped push the S&P 500 down just over 5% from its high earlier in the month. This was just the second 5% pullback in what has been an atypically quiet year for U.S. equities. But after a sharp move lower on Monday, stocks shrugged off the Evergrande news and actually rallied to finish higher on the week (S&P 500 +0.5%).

The second 5% pullback this year.

https://compoundadvisors.com/wp-content/uploads/2021/09/correction-9-21-2.png

Regardless of what happens next, we are living today in one of the great uptrends of all time. The S&P 500 ETF ($SPY) has not closed below its 200-day moving average since May 2020. That’s the 5th longest streak since its inception in 1993.

https://compoundadvisors.com/wp-content/uploads/2021/09/spy-200-day-9-26.png

.

Slaughter.

I am busy with some work. But my question for veterans. How do we play next few months. All of the sudden things have started looking scary. Am I overreacting?

I don’t know. If you have a long term horizon and no need for an immediate cash, I think it’s fine to hold indexes or a basket of great companies. Depends on everyone’s situation. I’m sitting mostly cash and will stay nimble by trading in/out both ways until price action dictates otherwise. The charts does look scary imo. The rising wedge breakdown is usually not good. I’m looking to time the bounces but I won’t be holding long even if I catch it. Come to think of it, I’ll write some naked puts.

@hanera probably has a better opinion. My tactics don’t work for everyone.

Face ripper be like

According to theory of finance:

Expected return from stock market = Returns from bonds (like treasury with 0 default risk) + risk premium of investing in stocks

Therefore, rise in treasury yield raises the expectation from the stock markets, and prices of the stock drop if they are not expected to offer the higher expected return.

Another way to look at it the rising treasury yields raise the discount rate at which future cast flows can be discounted to calculated NPV (net present value).