These guys are always fun to watch.

Can they speak Singlish? Can’t understand them.

Up up and away.

AAPL

FB

AMZN

NFLX

GOOG

TSLA

If you just want to beat QQQ & SPY for the next 10 years, buy FANGMANT.

If you want more, need to put on your thinking cap. Outcome could be much more or way less than return of index. Are you good enough?

Is this call for action or in-action?

@manch favoriate says don’t overthink like a grad from University of Wisconsin. Just buy n hold FANGMAN.

That woman in the video is still looking for a correction, so is pretty much everybody on Twitter. That means any slight down shift would be relentlessly bought. Real correction can’t happen when everybody and their cousin are waiting for it.

If this is true, fall will be epic.

.

You mean Panda would be eventually right? Epic is the word I want to hear. Not interested in run of the mill correction and bear market.

All the permabears will be right at some point. I want see it pump a few hundred billion more.

Not talking about run of the mill bears. We’re talking about EPIC bear aka Panda. Sure he would be right eventually? I mean within our lifetime… just to be very clear.

Everybody is waiting and frankly wishing for a crash. Therefore crash probably won’t happen.

.

Please define a crash. Even Panda no longer use the word, crash. So who are the one talking about crash?

Don’t you have a definition for crash? I remember seeing it when you were pushing Panda voodoo.

Are you using Panda definition? I don’t know whether that is a generally accepted definition, didn’t bother to find out. Who else talk about crash? I need to check on them. Btw I don’t have a definition of crash, I prefer to do like everybody else do, talk vaguely.

Slightly dated article.

This bit caught my attention:

Of all the things that you should do during a melt-up, the most important is to get invested. Do not sit in cash. Why? Because even if the market does eventually return to its prior levels, sitting in cash will destroy you psychologically. Just imagine how hard it would have been to sit in cash during the DotCom bubble from 1995-2000. For five years you would have to watch everyone around you (even people dumber than you) get rich while you sat on the sidelines. It would be infuriating.

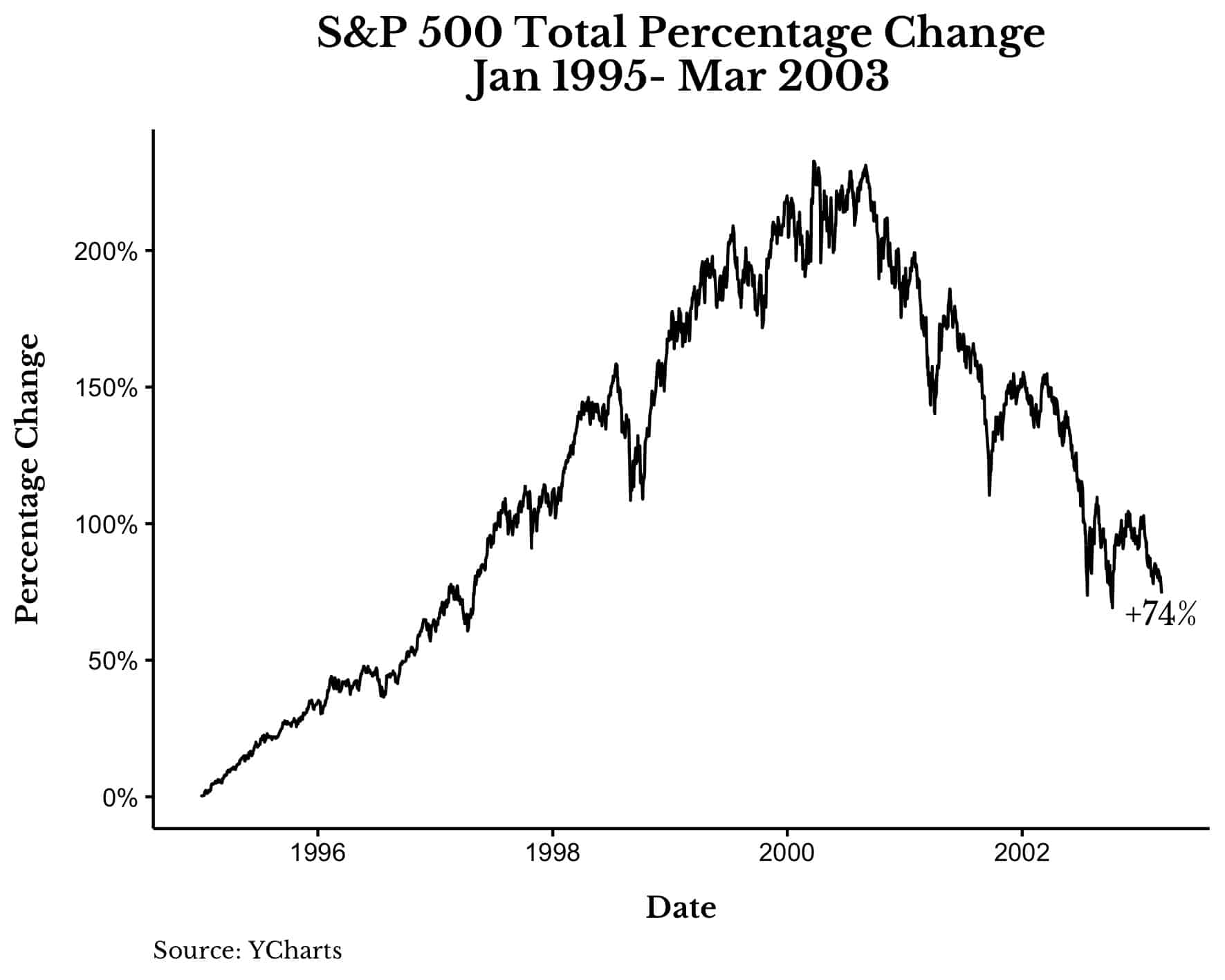

Of course, some of that wealth would disappear when the bubble eventually popped, but not all of it. For anyone who stayed invested from January 1995 to the bottom in March 2003, they still would have been up 74% when all was said and done:

Where are we in the bubble? 1995? 1999? Why do the author assume we’re in 1995?