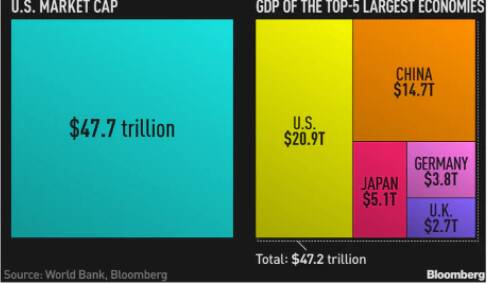

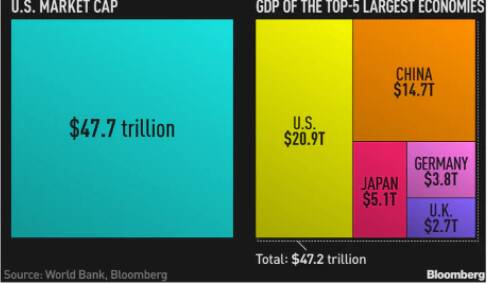

How to interpret?

Nothing because market cap and GDP is not equivalent?

How to interpret?

Nothing because market cap and GDP is not equivalent?

Comparison between Market cap and GDP is a false comparison.

GDP is sum total of value of actual transaction that happened in an economy in a year.

Market cap is stock price times number of stocks in circulation.

Taking example of a home to explain above. One can say GDP is rent generated, and Market Cap is appraised value of home.

Added Later: One more caveat. GDP may be counting transactions that are not assoicated with stock market or its participant in any way or shape. Leading such comparisons as above even more meaningless.

Why do many articles often do such comparison?

The big purpose of articles is to generated income by attracting readers. Some articles entertain, and some educate. The above one is an entertainment.

Warren Buffet uses that ratio as an indicator of if stocks are over or under valued. I think that it’s become dated though. A majority of S&P 500 company revenues are from outside the US. That makes the US market more a measure of the WW GDP than just US GDP.

On the flip side, one can argue that much of the valuation of US stock market comes from stocks owned by Foreign Direct and Portfolio investors.