Maybe top performers are white and/or Asian and there’s a lot of wokeness involved? It could also be based on social criteria of who eats lunch together and goes to happy hour together. Some were people who were very recently promoted which is beyond irrational.

It appears that in several Google product areas not even the VPs were aware of what was going to happen on Friday and definitely not Sr.Directors and below. The SVPs and Sundar held this one close to their chests. It’s then not surprising to see what happened - random culling without truly looking at who was low performing. (funnily enough they’d started a process of identifying low performers 2 months ago but didn’t use the data in this exercise).

This has to be one of the most un-Googley things that google has ever done.

That’s literally insane. I wonder if they did it at random then because of fear of lawsuits over criteria.

.

Do you mean VPs and below were fired?

Not an Elon fan but he’s not wrong. Twitter org was terribly bloated. Wonder how many tech co bosses will be bolder in wielding the ax.

I meant in terms of orchestrating the layoffs. Not all VPs were involved weeks in advance.

From polling folks I know, there were definitely VPs, directors, staff or senior staff engineers affected.

.

I interpret the answer to the question below is yes… VPs and below were fired.

I think a lot of it was they culled some highly paid employees - cutting the fat on the top

That could also mean Apple is not taking enough risks.

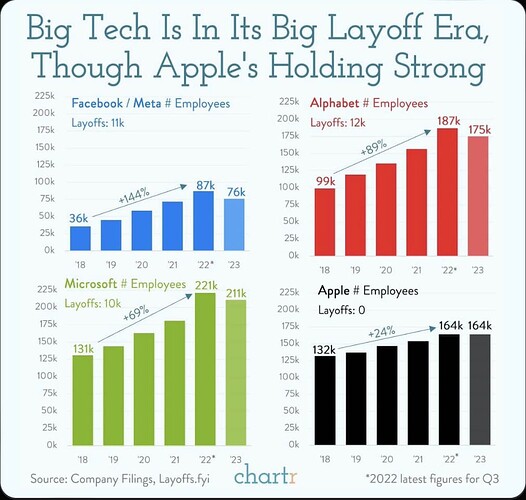

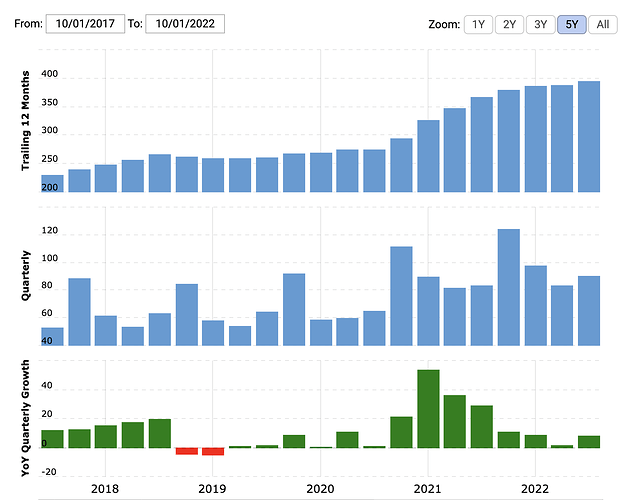

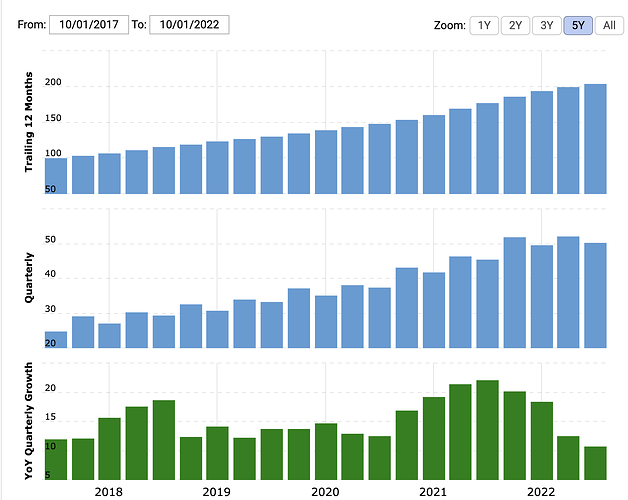

Apple revenue in last 5 years, from 229B to 394B, 72% growth in 5 years:

Microsoft revenue in last 5 years, from 99B to 203B, 100% growth.

High growth in revenue is big deal? Can’t believe people still believe that after the massacre of high growth stocks in 2022. Shall I call this anchoring? Fossilized belief regardless of new evidence.

High revenue growth is always important. Don’t let temporary stock market fluctuations knock you off the true path.

Liquidity is finally returning after the dovish signals the Fed has been making. This year high growth names could shine again, at the expense of value traps.

You are brainwashed by financial literature. Revenue growth is necessary for the same margin in order to grow earning. Another way is to grow margin.

High revenue growth with high revenue acquisition expenses and/ or high SBC is not good. One more thing, organic revenue growth is better than revenue growth through acquisitions.

Only those that didn’t have too high cost of revenue acquisition and/ or excessive SBC.

Like which companies?

The current fuss over SBC is just a fad in the current environment. People are expecting recession and companies are in defense mode. But if we don’t have a recession, or if recession proves to be mild, aka if we achieve a soft landing, mood will change on a dime. Wall Street will again evaluate companies on their offense positions.

Besides, recessions take up only a small percentage of years. In most years economies expand. So in vast majority of years high revenue growth matters.

You are not wrong but not exactly right. This thread is about layoffs ![]() I am in Las Vegas now

I am in Las Vegas now ![]() and enjoying myself. Next trip would be to Singapore, after that Europe or China, depending on Covid and other

and enjoying myself. Next trip would be to Singapore, after that Europe or China, depending on Covid and other ![]() situation.

situation.

Good to see you not wasting your golden years in Texas. You should talk your wife into moving back to SG.

Track tech companies layoffs on this website: https://layoffs.fyi/

My portfolio companies Cloudfare, Snowflake and Nvidia don’t have any layoffs, yet.

Nice what game do you play? I was there 1 week back

.

I came here to eat ![]() , see … shows, and see houses.

, see … shows, and see houses.