What Happens to the Real Estate Market When Supply Falls for 25 Straight Months?

(NASDAQ: RDFN) — Home price growth was strong in October, up 7.6 percent compared to a year ago, according to Redfin (www.redfin.com), the next-genera

That’s surprising giving how much talk there is about a shortage of construction workers.

Go to Santa Cruz, a Realtor told me many houses are “sitting” on the market.

Edited: Get out of your cave. Lots of new construction everywhere.

Are you sure? May be I should buy a house there. Affirmative?

I sent you a PM.

(NASDAQ: RDFN) — Home price growth was strong in October, up 7.6 percent compared to a year ago, according to Redfin (www.redfin.com), the next-genera

But upward pressure on prices remains

10% decrease in home values because of no deductions for home owners?

Will Massachusetts residents lose tens of thousands of dollars in home value if Republicans succeed in ramming their tax overhaul bill through Congress? The National Association of Realtors says yes. It has estimated that homeowners in the state could lose an average of anywhere from $21,050 to $44,130 in home value, depending on the congressional district they live in. Nationwide, homeowners are facing a 10 percent drop in values because of the bill, with potentially steeper decreases in higher-cost areas, the group argues. “Make no mistake, middle-class homeowners will see their home values fall if this proposal moves forward, while large corporations walk away with the bulk of the tax cuts,”

U.S. homebuilding unexpectedly rose in November, with the construction of single-family housing units surging to a 10-year high.

The total value of all homes in the U.S. reached a record $31.8 trillion in 2017, or more than one-and-a-half times the nation's gross domestic product.

The National Association of Realtors reported as housing inventory sank to its all-time low during the fourth quarter, home prices increased, creating all-new highs in many U.S. markets. A majority of the country saw an upswing in buyer interest at...

Est. reading time: 2 minutes

Denver and Seattle both have a shorter supply of available homes than San Francisco, according to the latest report from RE/MAX.

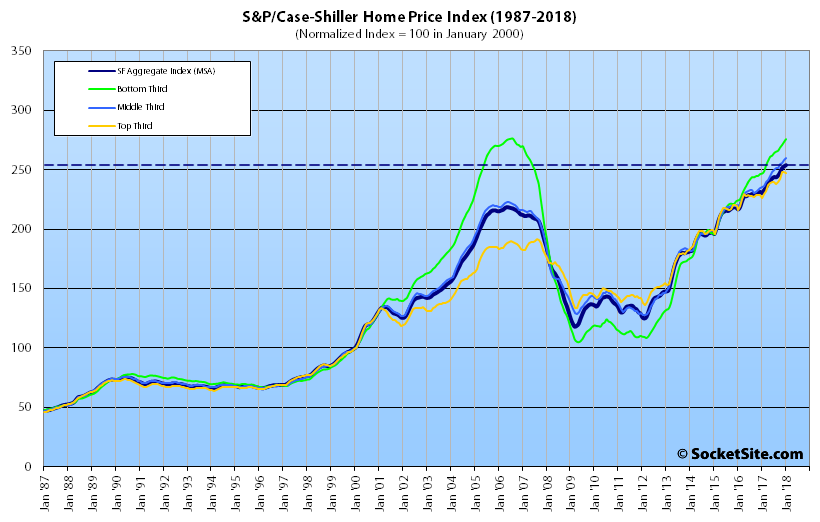

Having ended 2017 at an all-time high, the S&P CoreLogic Case-Shiller Index for single-family home values within the San Francisco Metropolitan Area – which includes the East Bay, North Bay and Peninsula – inched up another 0.4 percent in January...

Pilot offers mile high view of Mile High City real estate. Pilot John Tennyson traded high rent in San Francisco for a relative bargain in Denver.

U.S. homebuilding rose more than expected in March amid a rebound in the construction of multi-family housing units, but weakness in the single-family segment suggested an acute shortage of homes for sale will likely persist.

Oh, the often repeated phrase that when interest rates go up, then home prices must decrease due to payment affordability.

A critical shortage of houses for sale caused home prices in March to take the biggest leap in four years.

It’s just not true. Rates go higher and home price appreciation accelerates.