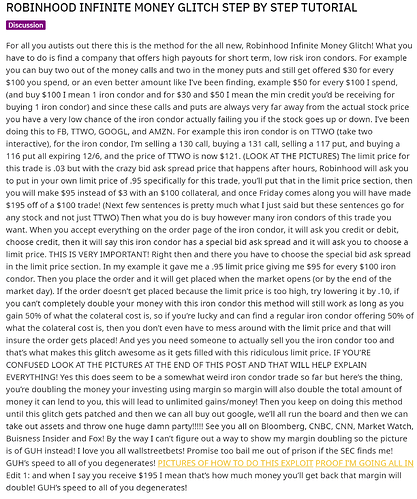

Robinhood is in trouble now, functional issue on leverage, someone posted an hour ago

Consequence of cost competition. Founders should know. Only the company go insolvent. Founders should have divested a huge chuck and billionaires now. Is legal swindling.

Short FB, AMZN, GOOG and TTWO.

Made is not what you have made, is what Robinhood system think you have made. This glitch is dumb. Only Robinhood has it. The offer of $30 trading credit for every $100 trade itself would create a larger leverage than what other brokerage firms offer. Another bad leverage scheme allowed is portfolio margin. These brokerage firms are asking for trouble.

Did something come out of this infinite leverage issue with Robinhood? I wasn’t keeping tabs and discovered this post and issue today.

Called it!

Who is left to buy ?

GS merges with MS?

AAPL acquires GS?

GOOGL acquires MS?

GS merges with MS?

Unless MS blows up.

AAPL acquires GS?

GOOGL acquires MS?

Regulatory nightmare. Won’t happen.

I see more deals with investment managers. Recently Franklin Templeton took out Legg Mason. The active to passive trend is putting huge pressure on active managers. They need to scale up and take out costs. Invesco should be hunting.

Also T Rowe Price has been quiet. I think they will be in play soon (if not already).

Wow. I wouldn’t have guessed their market cap is that much bigger than Etrade.

Me2. Market cap of eTrade is down the drain after the financial crisis. It was a hot stock that could one day become industry titan like GS.

Talk about oversight

That is an edge case, only once every 4 years!

And doesn’t happen in the 100s. Tricky.

Robinhood has ushered in 10 million — mostly millennial — traders by offering free equity, options and cryptocurrency trading.

Mostly millennials and day traders with less than $5k accounts relying on margin.

He refers to Thomas Peterfly.

Well documented is not dangerous to 18-49 who doesn’t have any bad habits. Is highly dangerous to old folks like me, wondering whether I should hide in my home till Summer.