https://www.citylab.com/life/2017/10/venture-capital-concentration/539775/

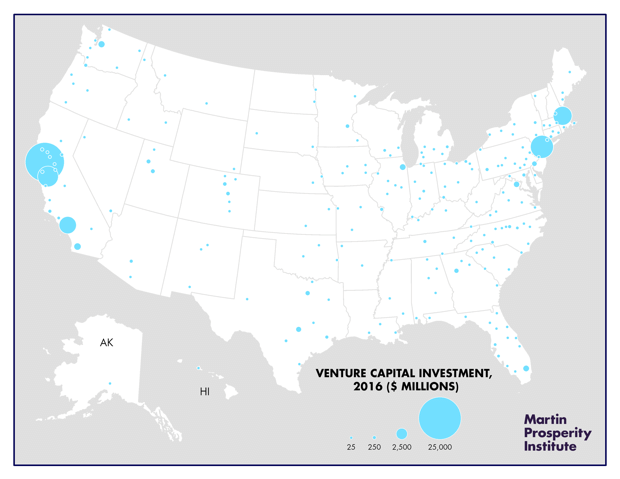

The geography of high-tech startups remains extremely concentrated and unequal, with the Bay Area and the Boston-New York-Washington Corridor accounting for roughly two thirds of all venture capital-backed investment across the United States.

The table below lists the top twenty metros for investment in venture capital-backed startups. San Francisco tops the list with $23 billion, more than a third of the national total. New York is second with $7.5 billion or 11 percent. Three additional metros took in more than $5 billion: San Jose, in the heart of Silicon Valley, with $6.7 billion or nearly 10 percent; Boston-Cambridge with $6 billion, also right around 10 percent; and LA with $5.5 billion or 8 percent. San Diego netted $1.5 billion and there are four additional metros with a billion or more in venture capital investment: Seattle, Miami, Chicago and DC; Austin is close with $977 million.